Introduction

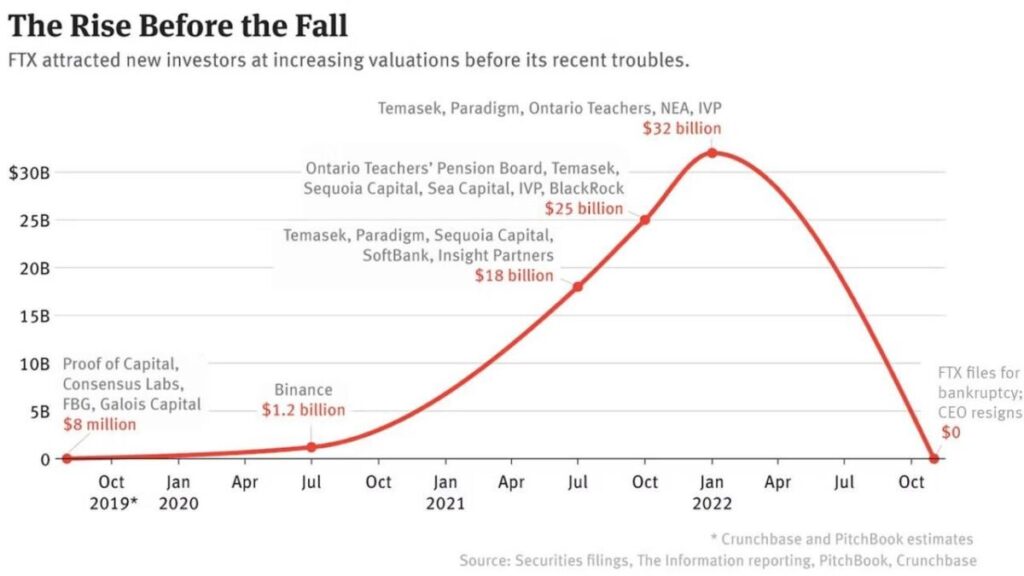

The collapse of FTX in November 2022 remains one of the most significant events in the history of cryptocurrency. What was once a leading global crypto exchange, with billions of dollars in customer deposits and a reputation for offering low fees, fast transactions, and a wide range of crypto assets, came crashing down within days. Following FTX’s bankruptcy filing, revelations emerged about its improper use of user funds, which were reportedly used to cover risky bets made by related trading entities.

For the average crypto user, especially newcomers, the FTX scandal raised serious questions: Can crypto exchanges be trusted? In 2025, these concerns are more relevant than ever. While the crypto market continues to evolve, choosing a safe exchange to store and trade assets is paramount. After FTX, exchanges need to provide clear, verifiable security measures that can withstand scrutiny from regulators and the public. This article will walk you through how to choose a truly safe crypto exchange in 2025. By understanding the key criteria that define a secure exchange, you can make more informed decisions about where to trade, store, and invest in digital assets.

The FTX Collapse: A Critical Turning Point in Crypto Security

Before its downfall, FTX was considered a major player in the crypto exchange space. Founded in 2019, it grew rapidly, offering a user-friendly platform that allowed trading of a wide variety of digital assets. But in the end, the exchange’s failure was due to a combination of structural flaws that made user funds vulnerable:

Sources:The Rise and Fall of FTX

- Lack of transparency: FTX failed to offer a clear view into its internal operations, particularly around how user funds were being used. Instead of fully segregating customer deposits, FTX allegedly mixed customer funds with its proprietary trading operations, which led to massive liquidity shortfalls when user withdrawals surged.

- Commingling of funds: The mismanagement of customer funds by the exchange was one of the key reasons for its downfall. User deposits should be treated as sacred, but FTX used those funds to cover losses incurred by its affiliated trading entities. This violated the basic principle of keeping user assets separate from corporate capital.

- Inadequate risk management: FTX lacked sufficient liquidity buffers, which would have helped it absorb a sudden surge in withdrawal requests. This left users exposed to the risk of losing their assets when the platform was unable to meet its obligations.

The FTX disaster has underscored the need for transparency, regulation, and the highest levels of financial prudence in the operation of crypto exchanges. For users, it is now clear that security cannot be left to chance – it must be built into the very DNA of the exchange you choose to trade on.

Takeaway: The FTX collapse highlighted the dangers of exchanges that fail to implement basic security measures. As a result, exchanges that prioritize user protection, transparency, and regulation are now the gold standard in crypto space.

What “Safe” Means in 2025: Key Criteria for Choosing an Exchange

In the aftermath of FTX, the crypto landscape has shifted toward greater security and regulatory scrutiny. With more eyes on the industry, exchanges are now expected to meet a higher bar in terms of transparency, security, and accountability. Here are the essential features that define a secure crypto exchange in 2025:

1. Proof-of-Reserves (PoR)

What it is: Proof-of-Reserves is a mechanism through which an exchange verifies that it holds enough assets to back all customer deposits. This is often done via cryptographic tools like Merkle trees, which allow third-party auditors to confirm the platform’s solvency. Why it matters: PoR prevents fractional-reserve practices, where exchanges only hold a fraction of user deposits while using the rest for trading or other activities. Having publicly verified PoR ensures that exchanges are not borrowing from users’ funds or taking excessive risks. What to check: Look for exchanges that publish their Proof-of-Reserves audits regularly and make these reports publicly accessible. Third-party audits, updated quarterly, offer the most reliable proof of solvency. MEXC offers transparent Proof-of-Reserves audits, ensuring that user funds are fully backed by assets on the platform.

2. Cold Storage & Asset Custody

What it is: Cold storage refers to storing cryptocurrency in offline wallets that are not connected to the internet. This helps protect the funds from hacking attempts or unauthorized access.

Why it matters: Cold storage is essential for securing the vast majority of user funds. Exchanges that keep most of their assets offline are far less vulnerable to hacking than those that store user funds in hot wallets (connected to the internet).

What to check: Ensure the exchange uses cold storage for at least 90% of user assets. The exchange should disclose their cold storage policy and provide transparency about the proportion of funds that are kept offline. MEXC follows a best practice of storing the majority of user funds in cold storage to minimize the risk of hacking.

3. Regulatory Compliance & Legal Transparency

What it is: Regulatory compliance means that the exchange follows the laws and regulations of the jurisdiction in which it operates. This typically involves Anti-Money Laundering (AML) and Know Your Customer (KYC) practices to verify user identities and prevent fraud.

Why it matters: An exchange that adheres to regulatory standards ensures that it is operating legally and has been vetted by authorities. Compliance with regulations helps reduce the risk of fraud or mismanagement and provides a legal framework for dispute resolution.

What to check: verify that the exchange is licensed and regulated in a jurisdiction with a robust regulatory framework for digital assets. Look for disclosures of compliance audits and financial reports to ensure transparency. MEXC is compliant with major regulations in the US, EU, and Asia, making it a reliable platform for users around the world.

4. Independent Security Audits

What it is: Independent security audits are conducted by third-party firms that assess the exchange’s security measures, including encryption, wallet security, fraud prevention, and internal controls. Why it matters: Independent audits provide an unbiased assessment of an exchange’s security, identifying any potential weaknesses before they can be exploited. Regular audits by reputable firms are a sign that the platform is serious about protecting user assets. What to check: Ensure that the exchange undergoes regular independent security audits, preferably from well-known cybersecurity firms. The audit reports should be publicly available for verification. MEXC publishes regular external security audits, ensuring that it adheres to high security standards and best practices.

5. Liquidity & Reserve Buffer

What it is: Liquidity refers to the exchange’s ability to facilitate trades without impacting the price of the asset. A liquidity buffer is the additional reserve an exchange keeps to absorb sudden market shocks or large withdrawals. Why it matters: Exchanges with inadequate liquidity are at risk of running out of funds when a large number of users attempt to withdraw at once. A solid liquidity buffer helps exchanges handle market fluctuations and ensures that users can withdraw their assets during times of high demand. What to check: Look for platforms that disclose their liquidity levels and maintain sufficient reserve buffers. Exchanges that are transparent about their liquidity practices are more reliable in times of market stress. MEXC has a robust liquidity reserve that can handle large withdrawal demands, providing confidence to its users.

How the Regulatory and Market Landscape Has Evolved by 2025

The regulatory landscape surrounding cryptocurrency exchanges has evolved dramatically since the FTX collapse. Governments around the world are now focused on tightening regulations and increasing oversight of crypto markets. This trend is driven by the need to protect investors and ensure that exchanges operate with high standards of security and transparency.

Global regulatory shift: According to a recent report, more than 60% of global jurisdictions have introduced new regulations for crypto markets, with an emphasis on transparency, AML/KYC practices, and Proof-of-Reserves disclosures. These regulations are designed to prevent fraud, ensure platform solvency, and increase accountability in the industry.

Integration with traditional finance: The increasing integration of cryptocurrencies with traditional financial markets has further prompted regulators to establish clearer rules. Platforms now have to demonstrate solid reserve backing and ensure the liquidity of their assets.

Adoption of stablecoins: As stablecoins gain traction, regulators are increasingly focused on their role in maintaining market stability. Exchanges that deal with stable coins must comply with stricter reserve and transparency rules.

In short, the regulatory environment is evolving toward greater transparency and stability, and exchanges that meet these new standards are the most trustworthy.

Recommended Exchanges for 2025-2026: Comparison of Leading Platforms

| Exchange | Last Verified Audit | User Self-Check | Coverage | Auditor / Partner |

| MEXC | Continuous | “My PoR” portal | Core assets (BTC, ETH, USDT, USDC) | Public wallet verification |

| Kraken | Sept 2024 | Merkle proof | 100 % assets/liabilities | Armanino LLP |

| OKX | Monthly | Yes | BTC / ETH / USDT / USDC | In-house + third-party review |

| Binance | Real-time (ZK pilot) | Beta | Top 10 assets | zk-SNARK prototype |

Choosing an exchange should go beyond a simple comparison of fees, trading pairs, or coins available. It’s about aligning your platform choice with a well-rounded financial plan that protects and safeguards your digital assets. A crypto exchange should be viewed in the same light as other investments — a secure, well-governed platform is an asset that can mitigate risk rather than expose you to unnecessary volatility. Fortunately, tools, standards, and best practices for evaluating exchange safety are available. Now is the time to do due diligence, verify, and ensure your assets are protected — not just for today, but for the long haul.

Conclusion

The collapse of FTX has fundamentally changed the way users approach crypto exchanges. Today, safety and transparency are paramount, and exchanges must meet higher standards to gain user trust. By focusing on Proof-of-Reserves, cold storage, regulatory compliance, and independent security audits, users can make informed choices and protect their assets.

The recommended exchanges listed above are not only compliant with industry standards but also prioritize user security, making them the ideal platforms for those looking to navigate crypto space safely. Remember, always prioritize exchanges that offer transparency and security over those that merely promise low fees or exotic token offerings.

By choosing a secure platform, practicing good risk management, and staying informed, you can safely participate in the growing cryptocurrency ecosystem without fear of falling victim to scams or mismanagement.

Further Readings

Below are the key resources used in this article — each provides evidence or documentation supporting the claims made about exchange safety, transparency, and security standards.

- MEXC — Proof of Reserves Guide: A public page explaining how MEXC cryptographically proves that user deposits are fully backed, allowing independent verification of reserve holdings.

- MEXC Security Best Practices: Details MEXC’s multi‑layer security infrastructure, including cold‑storage, multi‑sig withdrawal protocols, and routine audits to protect user assets.

- MEXC Cold Storage & Security: Describes how MEXC segregates most user funds into offline cold wallets, minimizing risk of hacks or unauthorized access.

- MEXC Futures Insurance Funds: Provides information on MEXC’s dedicated insurance fund and reserve buffers intended to cover extreme market events and protect users’ positions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up