Bullish sentiments dominated on social media in the middle of this week. Users of Telegram, X, Reddit, and X anticipated a decrease in the Federal Reserve’s rate.

Trader activity began to increase ahead of the publication of the American regulator’s decision. If last week the volatility of Bitcoin remained low, by the second half of September, the crypto managed to spike above $117,000.

On the MEXC exchange, a local peak was set the day before at the mark of 117,884 USDT. Moreover, ahead of the Federal Reserve’s interest rate decision, the leading digital currency was, on the contrary, in a correction phase.

However, the announcement of monetary policy easing became a driver for activating investors focused on a bullish scenario.

As a result, the BTC price quickly rose above $117,000, but at the same time, pressure increased in that area. Traders who took advantage of the influx of capital into the virtual assets market turned to profit-taking.

1. Euphoria on social media intensified to a two-month high.

The U.S. Federal Reserve unexpectedly lowered the discount rate by 25 basis points last Wednesday. Sentiments on social media turned positive even before the FOMC meeting. Euphoria intensified ahead of the release of the press release on monetary policy easing.

According to Santiment, sentiments on Telegram, X, Reddit, and 4Chat improved to the highest level since July 10. Approximately 64% of all posts were aimed at further Bitcoin growth. The ratio of negative to positive comments increased to 1/1.77.

- We remind you that a surge of positivity usually accelerates the achievement of a local peak. Conversely, if the majority of messages on social media are oriented towards a bearish scenario, then the digital currency has found its bottom or is approaching it. In this case, further decline is unlikely since traders scared by the correction have left the market.

This week we are witnessing an increase in positive emotions triggered by the decrease in the Federal Reserve’s rate. Against the backdrop of dominant bullish sentiments, the trading balance of Bitcoin has started to grow, creating the threat of a new wave of sell-offs.

According to Glassnode, about 48 hours before the Federal Reserve’s rate decision, three strong inflows of BTC were observed into exchange addresses. The volume of crypto exceeded $25 million for each block.

In our assessment, the increase in the number of Bitcoins on trading platforms signals an imminent activation of sellers looking to take profits after the coin’s jump above $117,000.

2. At what level are whales ready to support Bitcoin?

One of the most aggressive sellers has been miners. The volume of sales exceeded 2000 BTC. This week, in just 72 hours, due to a strong sell-off, the total Bitcoin reserves of miners decreased to 1.806 million coins (according to CryptoQuant).

On MEXC on September 18, the price of Bitcoin was at $117,070 after a surge resulting from the easing of the Federal Reserve’s policy. Analysts believe that the first strong support zone for the digital currency is at the level of $115,400.

If this zone triggers with the new activation of sellers, the coin could shoot up to $137,300. However, if the pressure is strong and BTC falls below $115,000, then fundamental support is expected only at the level of $93,600.

The level of $93,000 was indicated as early as March by the WhaleMap team, which tracks whale activity. According to their assessment, in the event of a significant retreat, bitcoin could secure support from addresses holding more than 1,000 coins.

A whale cluster has just formed at the level of $93,000, which means that at about this price, large investors previously acquired BTC. They will try to prevent a collapse to avoid going into the red.

- To determine the support level for BTC, one needs to analyze the behavior of large investors in the current cycle and see at what prices they purchased the cryptocurrency. This way, you will be able to operate with the obtained information and predict the asset’s trajectory in the market.

3. Accumulation as a factor for the long-term growth of BTC

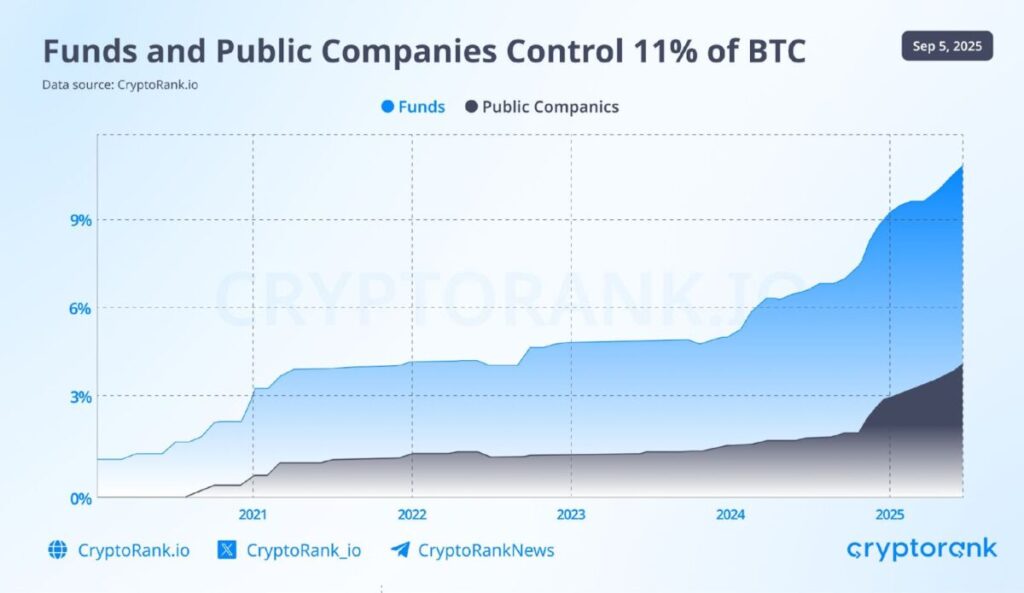

Companies and funds have accumulated about 11% of bitcoin’s circulation. More and more institutional investors are including digital currency in their reserves, and if this trend continues, the value of BTC will rise.

One of the indicators that reflect the influx of funds into the largest digital currency is the performance of the spot ETF market. Bitcoin ETF crypto funds record the inflow of funds, which also positively affects the value of BTC.

Companies whose stocks are traded on stock exchanges are also buying bitcoins. The software giant Strategy (MicroStrategy) is the most active.

At the beginning of the week, he reported the acquisition of digital currency amounting to $60.2 million during the period from September 8 to 14. The average purchase price was $114,562 per coin, according to the documentation, addressed to the Securities and Exchange Commission (SEC).

As of now, Strategy controls 638,985 coins worth about $73.4 billion. The founder and leader of the IT team, Michael Saylor, once again pointed to the enormous potential of Bitcoin. In his opinion, the value of the digital currency will increase in the long term.

The crypto accumulation model is followed by 171 companies in the world. Among the largest holders of BTC, besides Strategy, are Tether, Metaplanet, Riot Platforms, Trump Media & Technology Group, CleanSpark, and Coinbase.

Another important milestone in the acceptance of BTC was the decision of the Salvadoran government to recognize crypto as a means of payment. The relevant law in the Latin American state came into effect in September 2021.

The initiator of its adoption was President Nayib Bukele. Last weekend, he posted a message on the social network X, announcing that his country had acquired 21 BTC for $2.3 million.

As of September 15, 2025, El Salvador held 6,313 BTC worth $701.8 million. To protect its savings, the government decided to distribute the cryptocurrency among 14 addresses.

El Salvador’s Bitcoin reserves continue to grow, despite the fact that the Ministry of Finance had previously promised the International Monetary Fund to stop purchasing coins with budget funds.

Disclaimer: This information is not investment, tax, legal, financial, accounting, consulting, or any other advice related to these services, nor is it advice for the purchase, sale, or holding of any assets. MEXC Training provides information solely for reference purposes and does not constitute investment advice. Please ensure that you fully

Join MEXC and Get up to $10,000 Bonus!

Sign Up