Summary

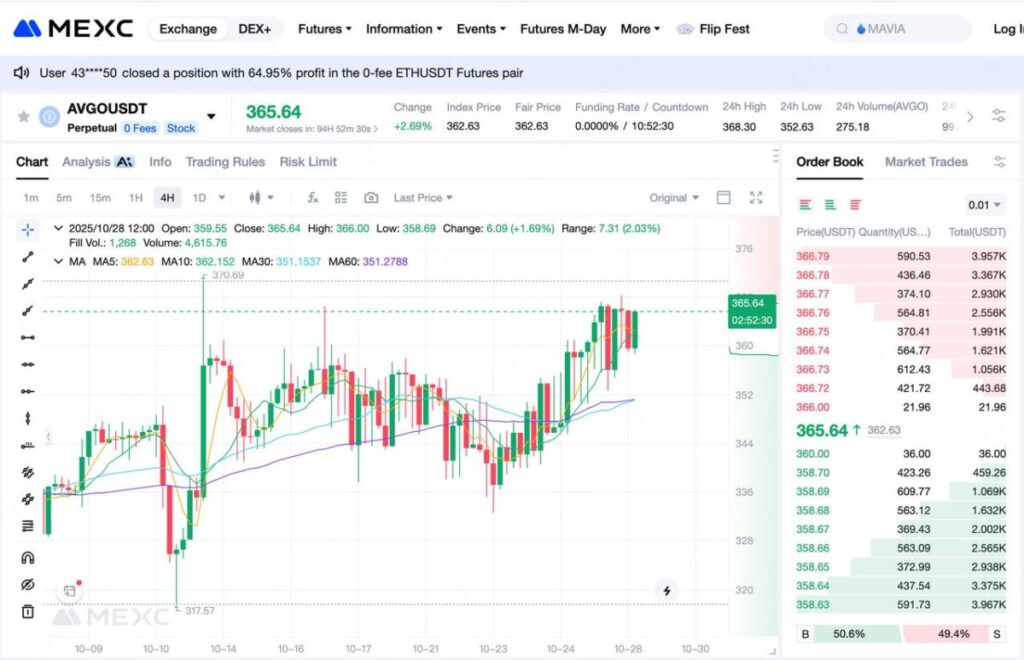

As demand for AI infrastructure surges, semiconductor and software convergence giant Broadcom Inc. (NASDAQ: AVGO) has become a major focus of global tech investors. With MEXC’s Broadcom USDT perpetual contract, traders can flexibly participate in AVGO price movements using USDT, capturing long-term growth opportunities driven by AI and cloud infrastructure expansion.

TL;DR

- Broadcom has entered the trillion-dollar market cap club, powered by dual growth engines: AI accelerator chips and the VMware software ecosystem.

- The AVGOUSDT perpetual contract allows investors to trade Broadcom’s price movements in USDT—without the need for a U.S. brokerage account.

- MEXC offers a low-barrier, high-liquidity trading environment with flexible leverage and comprehensive risk management tools.

- Analysts maintain a “Buy” outlook on Broadcom, highlighting its long-term potential in AI and cloud infrastructure.

1.Company Overview

1.1 Company Introduction

Broadcom Inc. (NASDAQ: AVGO) is a global leader in semiconductor and infrastructure software solutions headquartered in California, USA. The company designs and supplies essential chips across data centers, network communications, wireless connectivity, storage control, and industrial solutions. With continuous expansion in AI accelerators and enterprise software ecosystems, Broadcom’s market capitalization has surpassed $1 trillion, placing it among the world’s top technology companies.

1.2 Business Structure

- Semiconductor Solutions: Covers core segments such as networking chips, custom AI accelerators, storage controllers, and wireless connectivity.

- Infrastructure Software: Through the acquisition of VMware, Broadcom entered the virtualization and cloud management sector, forming an integrated “hardware + software” business model.

- Client Base: Includes top cloud providers, telecom operators, and large enterprise IT customers. Recently, Broadcom announced a strategic collaboration with Walmart to modernize its infrastructure.

2. AVGOUSDT Perpetual Contract Explained

2.1 What Is a USDT Perpetual Contract?

A USDT perpetual contract is a derivative instrument denominated in USDT, without an expiration date. Traders can go long (buy) or short (sell) to speculate on AVGO price movements without owning the actual stock. Its price is pegged to the AVGO spot index and maintained through a funding rate mechanism that balances the contract and spot market.

MEXC currently supports various tokenized U.S. stock perpetual pairs, such as AMZNUSDT and COINUSDT, provide a flexible, crypto-native way to access traditional equity markets.

2.2 Key Differences from Traditional Stock Trading

- No Brokerage Account Needed: Trade directly using USDT with no geographic or regulatory restrictions.

- Two-Way Market Access: Go long or short to capture both bullish and bearish opportunities.

- Leverage Options: Enhance capital efficiency—but manage risk carefully.

- High Liquidity: Contract prices track spot market trends, suitable for both short-term and strategic trading.

2.3 Why Trade AVGOUSDT on MEXC

- Low Entry Barrier: Trade directly with USDT—no complex setup or account approval required.

- Real-Time Market Sync: AVGO contract prices update in line with U.S. market hours, ensuring transparency.

- Comprehensive Risk Controls: MEXC offers limit/market orders, stop-loss/take-profit functions, isolated margin, and multi-level leverage options for all risk profiles.

3. How to Trade AVGOUSDT on MEXC

- Register a MEXC account and complete KYC verification.

- Transfer USDT to your Futures Account.

- Search AVGOUSDT in the trading section. Choose your trade direction (long/short), set leverage, and select order type (market/limit).

- Set stop-loss/take-profit orders. Be mindful of liquidation risks if market moves against your position.

4.Valuation and Analyst Insights

4.1 Market Valuation

According to StockAnalysis, Broadcom currently trades at a P/E ratio (TTM) of ~90x and a forward P/E of ~42x, reflecting strong market expectations for its AI and software-driven growth.

4.2 Analyst Ratings

- Major research firms including TheStreet and Zacks maintain “Buy” ratings with price targets ranging from $290–$345.

- Analysts highlight Broadcom’s transformation from a traditional chip maker into a hardware + software + services platform, unlocking new valuation potential.

4.3 Core Valuation Logic

- Dual Growth Drivers: Parallel expansion of AI accelerator and VMware software revenues.

- Business Model Upgrade: Transitioning from hardware supply to a full-stack systems platform.

- High Customer Stickiness: Long-term contracts securing stable cash flows.

These structural advantages support Broadcom’s premium valuation thesis.

5.Risk Factors & Strategy Recommendations

5.1 Key Risks

- Rising Competition: NVIDIA and AMD are major rivals in AI chip development.

- Valuation Pressure: High P/E ratios demand consistent performance—any slowdown may trigger corrections.

- Macro Uncertainty: Tech cycles, supply chain volatility, and geopolitics could drive short-term swings.

- Derivative Risks: Leverage, liquidity, and funding rates add layers of complexity for perpetual contracts.

5.2 Strategy Suggestions

- Event-Driven Trading: Focus on earnings releases, AI server demand updates, and VMware integration progress.

- Strict Position Management: Scale entries and define stop-loss limits to avoid over-leverage exposure.

- Mid-to-Long-Term Allocation: For investors bullish on “AI + Software Integration,” consider phased exposure.

- Macro Awareness: Monitor semiconductor cycles and U.S. tech liquidity conditions.

6.FAQ

Q1: What is Broadcom USDT?

A: It refers to the USDT-denominated perpetual derivative of Broadcom stock available on MEXC. Before trading, review the platform’s margin, leverage, and settlement terms.

Q2: Why is Broadcom in the spotlight recently?

A: Broadcom is gaining attention to breakthroughs in AI infrastructure (custom AI accelerators and servers) and infrastructure software (VMware integration), leading analysts to raise their forecasts.

Q3: Does MEXC’s AVGO price fully match the NASDAQ spot price?

A: MEXC’s perpetual price closely tracks NASDAQ spot prices but may show slight deviations (basis) due to market supply, demand, and funding rates.

Q4: Who is this contract suitable for?

A: It’s ideal for investors experienced in crypto derivatives with moderate-to-high risk tolerance. Conservative traders should limit leverage use.

Q5: Does the contract expire?

A: No. MEXC’s perpetual contracts have no expiry date, allowing indefinite holding. However, a funding rate is periodically charged to maintain price alignment.

7.Conclusion

Broadcom stands at a pivotal point in the global tech cycle. Its fusion of AI infrastructure and enterprise software positions it not merely as a chip manufacturer, but as a central enabler of next-generation digital compute power. Through MEXC’s AVGOUSDT perpetual contract, global investors can gain crypto-native exposure to Broadcom’s growth momentum—bridging the traditional U.S. equity market with the digital asset economy.

Join MEXC and Get up to $10,000 Bonus!

Sign Up