Summary

Coinbase Global Inc. (NASDAQ: COIN), the largest regulated cryptocurrency exchange in the United States and the first pure crypto company listed on Nasdaq, has become a key barometer for assessing the overall health of the digital asset market within traditional finance.

TL;DR

- Market Position: Coinbase is the largest regulated crypto exchange in the U.S., with over 110 million verified users and $130 billion in assets under custody. Its stock price maintains a strong correlation ( > 0.85 ) with Bitcoin’s price.

- Dual Identity: COIN functions both as a tech growth stock and a crypto proxy, benefiting from rising trading volumes and institutional adoption during bull markets.

- Multi-Revenue Model: Income streams include trading fees, staking, custody, and USDC-related earnings.

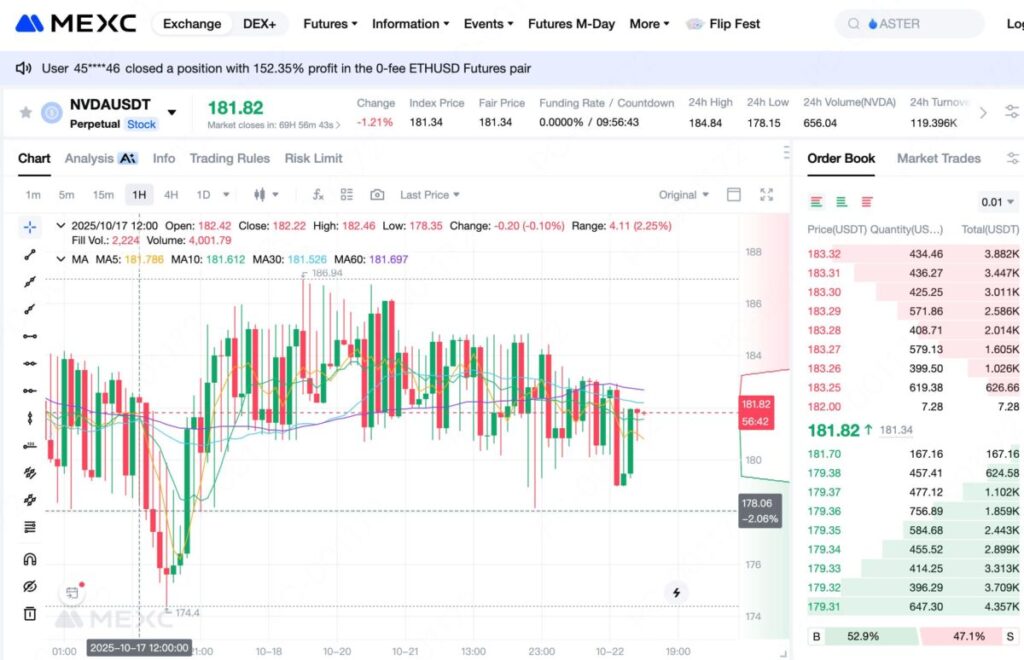

- Trade COINUSDT 24/7: On MEXC, you can trade COINUSDT perpetual futures — with 1–25× leverage — directly in USDT, no U.S. stock account required.

- Key Trading Catalysts: Bitcoin price breakouts, Fed policy shifts, regulatory updates, and quarterly earnings releases.

- Volatility Note: COIN’s volatility is 3–5 times higher than the S&P 500. Start with 2–3× leverage and use strict stop-loss discipline.

1.Company Overview

Founded in 2012 by Brian Armstrong and Fred Ehrsam, Coinbase Global, Inc. is headquartered in San Francisco, California. In 2021, it became the first crypto-native firm to list on Nasdaq under the ticker COIN.Its mission is to “create an open financial system for the world.” Coinbase offers a comprehensive ecosystem covering retail trading, institutional custody, developer tools, and stablecoin services.

2.Why Coinbase Deserves Attention

2.1 Regulatory Leadership and Institutional Trust

Coinbase’s heavy investment in compliance has built a formidable moat in the U.S. market. It holds money transmitter licenses in most states and actively collaborates with regulators to shape industry standards.

This “compliance-first” approach has earned trust from over 14,000 institutional clients, including Tesla, MicroStrategy, and Square. Institutions now account for the majority of the company’s $130 billion in custodied assets. As traditional financial institutions increase crypto allocations, Coinbase’s institutional business is expected to expand further.

2.2 Financial Performance and Growth Potential

Coinbase’s revenue is highly cyclical with the crypto market. During the 2021 bull run, it generated $7.7 billion in revenue and $3.2 billion in net profit. Although the 2022–2023 bear market caused a sharp decline, cost controls and revenue diversification allowed the firm to remain operationally sound.

In 2024, as Bitcoin ETFs launched and market activity rebounded, Coinbase re-entered a growth cycle.

2.3 Stock Drivers and Market Correlation

Historically, COIN shares move in lockstep with Bitcoin ( correlation > 0.85 ). When BTC rises 10%, COIN often rallies 15–20%, creating a natural leveraged exposure for traders.

However, regulatory developments can also trigger large swings:

- Positive news (e.g., Bitcoin ETF approvals) tend to boost the stock.

- Negative events (e.g., SEC lawsuits) may lead to sharp sell-offs.

Investors should monitor actions from the SEC, CFTC, and U.S. Treasury, as well as competition from both crypto exchanges and traditional financial entrants like Fidelity.

3.Investment Value Assessment

3.1 Bullish Case

The global trend toward crypto mainstream adoption is irreversible. Institutional adoption, payment integration, and the rise of CBDCs are all catalysts for growth.

Coinbase stands as the most trusted and regulated gateway to this new digital economy — validated by partnerships with legacy giants like BlackRock.

Notably, its Base, launched in 2023, has quickly become one of the fastest-growing Layer 2 networks, opening new revenue streams through gas fees and MEV while reinforcing network effects across the Coinbase ecosystem.

International expansion in Europe and Asia-Pacific is another key growth driver, particularly in crypto-friendly jurisdictions. Combined with ongoing Web3 integration (DeFi, NFTs, metaverse applications), Coinbase is well-positioned to capture long-term value.

3.2 Bearish Case

Nonetheless, risks remain significant:

- Regulatory uncertainty: The U.S. framework for crypto assets is still evolving; tightened regulation could raise costs or restrict product offerings.

- Revenue concentration: Trading volumes still dominate revenue; during bear markets, volumes can drop 70–80%, crushing profits.

- Security risks: As a custodian of hundreds of billions in assets, any major breach or fraud incident could be catastrophic.

- DeFi competition: The rise of self-custody and decentralized exchanges (DEXs) may gradually erode centralized market share among younger users.

4.How to Trade COINUSDT Perpetual Futures on MEXC

4.1 Quick Start Guide

MEXC offers COINUSDT perpetual contracts with a stable, liquid environment and competitive fees.

Steps to Trade COINUSDT:

1)Log in to MEXC App or website.

2)Search for “COIN” and select the COINUSDT Perpetual Contract.

3)Choose your order type, enter price and size, and execute the trade.

4.2 Entry Strategies

4.2.1 Long ( Bullish ) Setup

- Signal: Positive business outlook, user growth, institutional expansion.

- Entry: Buy pullbacks to support or breakouts above key resistance levels.

- Tip: Set a stop-loss 3–5% below support and consider scaling in gradually.

4.2.2 Short ( Bearish ) Setup

- Signal: Weak fundamentals, negative news, macro tightening.

- Entry: Sell after a confirmed breakdown below support or during market sell-offs.

- Tip: Use tight stop-losses and watch for reversal signals to avoid short squeezes.

4.3 Risk and Position Management

- Position Sizing: Risk only a small portion of capital per trade to diversify exposure.

- Leverage Discipline: Leverage amplifies both profits and losses — start with 2–3× for new traders.

- Adaptive Stops: Adjust stop-loss/take-profit levels as volatility changes.

- Emotional Control: Stay objective, avoid impulsive decisions, and review your trading performance regularly.

5.FAQ

Q1: Where can I check real-time COIN prices?

You can track live prices on the MEXC COINUSDT perpetual page, which mirrors Coinbase stock’s real-time movements.

Q2: What’s the difference between COIN stock and COINUSDT futures?

COINUSDT is a crypto-settled perpetual contract that tracks Coinbase stock price in USDT, tradable 24/7 with leverage. It does not grant dividends or voting rights, but offers flexibility and global access.

Q3: How risky is leverage trading? Highly.

A 10× position can be liquidated by a 10% adverse move. Start small (2–3×), set stop-loss levels, and use only risk-tolerable capital.

Q4: When is the best time to trade COINUSDT?

Liquidity peaks during U.S. market hours ( 9:30 AM – 4:00 PM ET ). Watch for volatility spikes around earnings releases, Fed announcements, and regulatory news.

Q5: What’s the minimum capital required?

MEXC allows micro-positions, but $500–$1,000 is recommended for effective risk management and margin buffer.

6.Conclusion

Coinbase acts as a bridge between traditional finance and the crypto economy, offering a unique investment gateway for both long-term investors and active traders.

Through MEXC’s COINUSDT perpetual contracts, investors can trade Coinbase’s market momentum around the clock with flexible leverage. Yet, higher returns come with heightened risk — volatility, regulatory uncertainty, and market cycles must be managed carefully.

Whether you trade for the short term or invest for the long run, discipline and risk control remain the core principles. In crypto and in trading alike, protecting capital always comes before chasing profits.、

Join MEXC and Get up to $10,000 Bonus!

Sign Up