The prediction market is receiving increasing attention in the cryptocurrency field. They not only provide investors with new trading tools, but also raise some issues related to transparency and regulation. This article will analyze the operation of the prediction market, the information asymmetry issues it faces, and how they affect the cryptocurrency market.

TL;DR:

- The Rise of Prediction Markets : Prediction markets allow investors to bet on events that have not yet happened, predict future trends by aggregating collective intelligence, but also expose information asymmetry and insider trading problems.

- Risk of information asymmetry : Some insiders profit by obtaining information in advance, putting ordinary investors at a disadvantage and questioning market accuracy.

- Implications for the cryptocurrency market : As the prediction market matures, more and more traditional financial capital is paying attention, despite regulatory compliance and transparency issues.

- Future challenges and developments : Experts point out that future prediction markets need to face technical challenges of compliance, information transparency, and decentralization in order to maintain fairness and transparency.

Predicting the rise of the market: the challenge of information asymmetry

In recent years, prediction markets have emerged as a new type of investment in the cryptocurrency field. Through these markets, investors can place bets on events that have not yet happened, and if the predictions are correct, they can profit. Traditionally, prediction markets have been considered a tool for aggregating information and revealing future trends, but as the market has developed, we are increasingly seeing the problem of information asymmetry hidden behind it.

For example, before the 2025 US presidential election, the data from the prediction market platform Polymarket quickly reflected the trend of the election results. However, recent events have revealed that the operation of the prediction market is not entirely about “predicting the future”, but more often it is like arbitrage through information asymmetry. Especially regarding the incident of Venezuelan President Nicolas Maduro, the prediction market accurately predicted the news of Maduro’s arrest, but all of this was not just market predictions, but some “insiders” obtained information in advance and profited from it.

The Mechanism and Limitations of Forecasting Markets

Prediction markets are essentially financial instruments that aggregate a wealth of information to form the “collective wisdom” of the market by allowing investors to bet on certain future events. These markets rely on information asymmetry : investors invest based on their own views on the likelihood of an event occurring. Over time, market prices will gradually reflect these views.

However, this information aggregation method is not perfect. For example, insider trading often occurs in the market, especially when it comes to political events, military operations, or corporate secrets. Some insiders can make more accurate trading decisions based on the information obtained in advance and profit from it. This puts ordinary investors at a significant disadvantage.

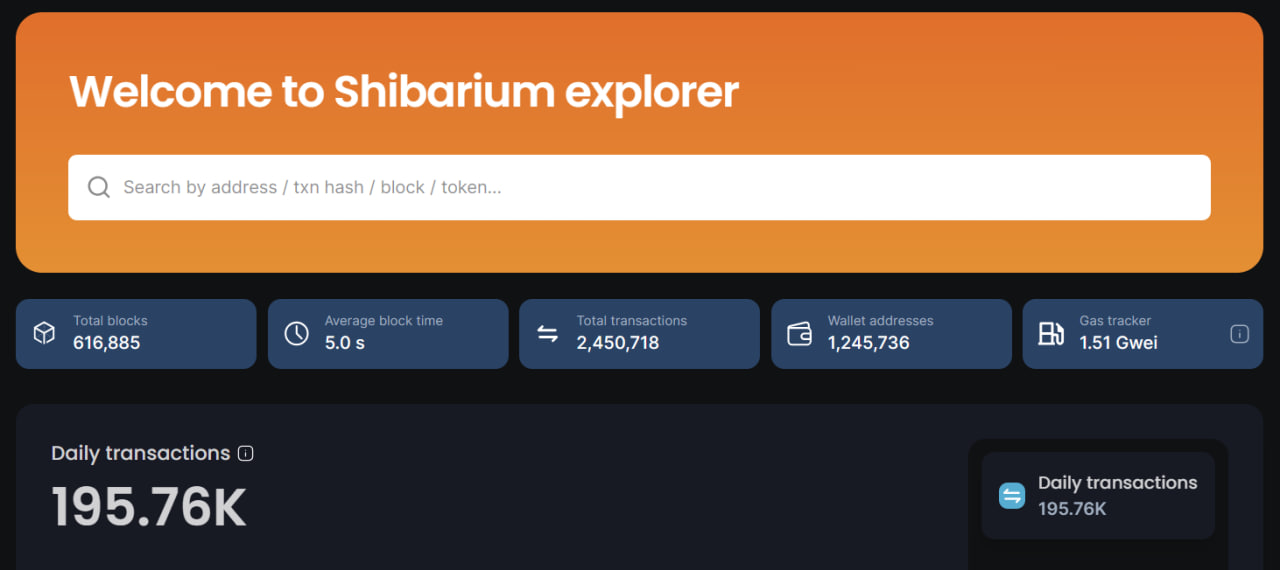

With the rapid development of the cryptocurrency market, crypto-native prediction markets (such as Polymarket) have attracted a lot of interest from traditional financial capital. Although these platforms use blockchain technology to ensure transaction transparency, the problem of information asymmetry has not been fundamentally solved.

Information Asymmetry: The Core Problem Facing Forecasting Markets

Internal trading and market accuracy

The reason why prediction markets can react quickly is because they are built on information asymmetry . This is particularly evident in the cryptocurrency field. For example, the prediction market for the Maduro incident quickly achieved significant profits within a few hours, which proves the speed of the market’s reaction. However, the reality is that some people profit from betting on the market by obtaining confidential information related to political decisions in advance. This phenomenon exposes the moral and legal risks hidden in prediction markets: they do not directly reveal the “truth”, but use information asymmetry for arbitrage.

The diversity of investor motivations

Investors participating in the prediction market include traditional investors, hedge funds, and a large number of retail investors. These investors are not only for predicting future events , but their purpose is usually to earn short-term profits through market fluctuations. For example, the Zelensky suit incident shows that the settlement results of the market are not entirely based on reasonable reasoning, but are deeply influenced by the flow of funds and information transmission. In some cases, the settlement results of the market are more like the interests of certain specific participants, rather than the true reflection of the event itself.

Market reaction: Attitudes of investors and platforms

Despite the controversy over information asymmetry and insider trading in the prediction market, their market position continues to rise. According to data from Bloomberg Markets, in 2025, more and more traditional Financial Institutions began to pay attention to and participate in these markets, believing that they have considerable potential. Platforms such as Kalshi and Polymarket continue to break records in trading volume, indicating that the market demand for these tools is gradually increasing.

However, regulatory issues remain one of the major challenges facing the prediction market. Although cryptocurrency platforms provide a decentralized trading environment, regulatory agencies in many countries are still figuring out how to define the legality of these markets. For example, the US CFTC (Commodity Futures Trading Commission) once punished Polymarket, requiring it to pay fines and comply with relevant regulations. This shows that although these markets are developing, their legality and transparency issues have not been completely resolved.

Industry Opinion: The Future Forecast Market

Industry experts generally believe that the future development of the prediction market will face several key issues:

- Compliance and Regulation : With the continuous expansion of the market size, how to ensure compliance and legal operation of the prediction market has become an urgent problem to be solved. Experts suggest that establishing a reasonable regulatory framework can help the healthy development of the prediction market and avoid the abuse of internal transactions.

- Market Transparency : Although blockchain technology provides transparent and tamper-proof records for the prediction market, how to ensure the fairness and impartiality of information flow is still an unresolved issue. Experts believe that future prediction markets may require more innovative technologies to solve these problems and improve market credibility.

- Decentralization Trend : With the advancement of blockchain technology, decentralized prediction markets may become mainstream. Such platforms allow users to participate more fairly without being controlled by central authorities. However, this also brings some new technical and regulatory challenges.

FAQ

What is a prediction market?

Prediction markets are markets that allow investors to bet on the probability of future events. Investors can participate in these markets to predict events that have not yet occurred and profit from them.

Why is there information asymmetry in the prediction market?

The core mechanism of the prediction market is investors’ predictions, which are often influenced by internal information flow. Some insiders profit from obtaining information in advance, which puts ordinary investors in an unfair position.

How is the legal regulation of the prediction market?

The legal regulation of prediction markets is still unclear globally. Some countries require prediction markets to comply with strict financial regulations, while markets in other regions are still in a gray area and lack a clear regulatory framework.

Conclusion: Predicting the future of the market

The prediction market has evolved from an emerging financial instrument to an important component of cryptocurrency and traditional Financial Marekt. Although they perform well in providing rapid market response and helping investors make predictions, information asymmetry, internal trading, and regulatory issues remain major challenges facing the industry. As the market develops, we may see a more mature regulatory framework and a more fair market environment.

As a cryptocurrency investor, it is crucial to understand the operation mechanism of the prediction market, grasp the market dynamics, and make wise investment decisions. In the future cryptocurrency market, the prediction market will undoubtedly continue to play an important role, but their innovation and improvement are still the key to ensuring fair and transparent transactions.

Disclaimer: This information does not provide advice on investment, taxation, legal, financial, accounting, consulting or any other related services, nor is it advice to buy, sell or hold any assets. MEXC Novice Academy is for reference only and does not constitute any investment advice. Please ensure that you fully understand the risks involved and invest cautiously. All investment behaviors of users are not related to this site.

Join MEXC and Get up to $10,000 Bonus!

Sign Up