Summary

In today’s volatile macroeconomic landscape, where confidence in traditional monetary systems continues to erode, both conventional safe-haven assets and emerging digital alternatives are being redefined. Since early 2025, gold prices have repeatedly smashed historical records—briefly exceeding $4,000 per ounce—becoming the centerpiece of global financial markets. At the same time, a new investment narrative is emerging: as physical gold shows signs of momentum exhaustion, capital is gradually rotating toward tokenized gold and more liquid crypto assets such as Bitcoin.

TL;DR

- Through Q4 2025, international gold prices have surged from $2,600 to $4,147, a 54.5% year-to-date increase.

- Gold’s total market capitalization surpassed $27.3 trillion, maintaining its dominance as the world’s largest asset.

- MEXC now offers multiple tokenized gold products, allowing seamless global access for retail and institutional investors alike.

1.Gold Goes Parabolic: Capital Seeks Shelter in a Risk-Off World

Amid persistent macro turbulence and weakening trust in fiat currencies, investors are once again turning to hard assets. Since the start of 2025, gold has entered an unprecedented bull phase, climbing past $4,000 per ounce and drawing massive institutional flows. Simultaneously, Bitcoin has reclaimed multi-month highs, signaling a structural shift toward dual safe-haven allocation—a, a balanced approach to hedging risk between gold and digital assets.

By Q4 2025, gold price today stands near $4,147, marking a 54.5% gain since January. The rally reflects a mix of inflation fears, geopolitical tensions, and a broader retreat from sovereign credit risk. After renewed tariff threats from the U.S. administration in early October, gold surged to new intraday highs, pushing investor sentiment to multi-year extremes.

From a valuation standpoint, gold remains the undisputed heavyweight among global safe-haven assets. Its market cap now exceeds $27.3 trillion, dwarfing all competitors. Meanwhile, Bitcoin’s market capitalization—around $2.3 trillion—has risen to eighth place worldwide, surpassing Tesla and Meta while trailing silver, Apple, and Microsoft.

2.Gold’s Triple Catalyst: Inflation, Central Banks, and Liquidity

The 2025 gold bull run isn’t a fluke—it’s driven by a perfect storm of macro catalysts.

- Inflation Hangover and the Dollar Trust Deficit:Persistent inflation, escalating global debt, and continuous monetary easing have eroded confidence in the dollar’s long-term purchasing power. Investors are, therefore, reallocating into hard assets—gold foremost among them—for long-term value preservation. Its scarcity and proven durability make it an anchor against both inflation and currency debasement.

- Central Bank Accumulation and the De-dollarization Wave:From 2024 through 2025, central banks—especially in emerging markets—have accelerated gold reserve accumulation to reduce dollar exposure. According to the World Gold Council, this official sector demand has been a structural driver of gold’s ascent. As de-dollarization trends strengthen, sovereign buying continues to lend powerful, non-speculative support to prices.

- Technical Breakouts and Sentiment Feedback Loops:After breaching the $3,000 level, gold triggered massive inflows from momentum funds and ETFs. The subsequent breakout above $4,000 pushed the metal into what some analysts call “bubble-watch territory.” As certain institutions began trimming positions, capital started rotating toward tokenized gold and Bitcoin, setting up the next leg in the evolving safe-haven cycle.

3.Tokenized Gold: Where Tradition Meets Blockchain

As physical gold becomes increasingly expensive and illiquid, a new generation of assets—Tokenized Gold—is bridging the gap between traditional finance and blockchain. These assets represent direct ownership of gold stored in regulated vaults, combining the stability of physical gold with the efficiency and transparency of crypto networks.

Two main categories define the landscape:

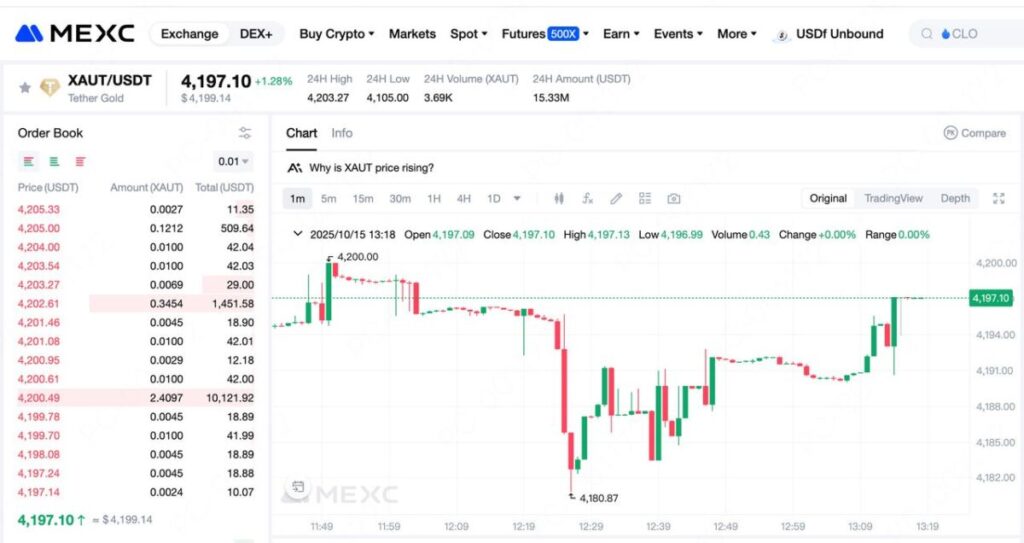

- Tokenized Physical Gold: Assets such as TetherGold(XAUT)and PAXGold(PAXG) represent ownership of LBMA-certified bars. Each token corresponds to one troy ounce of physical gold. Investors can verify serial numbers, purity, and storage locations on-chain, ensuring full auditability.

- On-Chain Gold Derivatives: Trading pairs like XAUT/USDT and PAXG/USDT allow investors to speculate, hedge, or arbitrage gold exposure within the crypto ecosystem—without touching traditional settlement systems.

Compared to gold ETFs or bullion accounts, tokenized gold delivers four core advantages:

- Lower Barriers: Fractional ownership enables micro-investing—no need to purchase a full ounce.

- Superior Liquidity: 24/7 trading on global exchanges like MEXC ; no clearing delays.

- Lower Costs: No custody or management fees; near-zero transaction costs.

- Transparent Verification: On-chain validation eliminates “paper gold” opacity.

By digitizing gold ownership, tokenized products like TetherGold(XAUT) are redefining how investors access and trade the world’s oldest store of value.

4.How to Trade Tokenized Gold on MEXC?

With gold price today hovering near record highs, investors looking to diversify into the next generation of safe-haven assets can easily access tokenized gold through MEXC.

How to start trading:

1)Log in to the MEXC App or official website.

2)Search for “XAUT” ,choose spot trading or future trading.

3)Enter the amount and price, then confirm the trade.

5.From Gold to Bitcoin: The Digital Evolution of Safe-Haven Assets

As gold’s rally matures, market capital is rotating toward Bitcoin and tokenized assets that embody “digital scarcity.” Initially viewed as a speculative tool, Bitcoin has evolved—backed by institutional adoption, ETF listings, and macro diversification use cases.

Historical data increasingly shows a positive correlation between Bitcoin price and gold price during global risk-off events. Both assets serve as hedges against fiat debasement, but Bitcoin’s programmability, portability, and capped supply give it an additional edge in a digitized economy.This convergence suggests the next safe-haven paradigm may not be “gold versus Bitcoin,” but rather a complementary portfolio of physical gold + tokenized gold + Bitcoin, merging tradition with technology.

6.Conclusion: The Dawn of a Digital Safe-Haven Era

The 2025 macro cycle marks a structural rebalancing of global capital. Gold remains the cornerstone of wealth preservation, yet its digital counterparts—tokenized gold and Bitcoin—are redefining what it means to own a safe-haven asset.

In this new era, gold will no longer exist solely as physical bars or ETF shares, but as verifiable digital certificates on-chain. As decentralized finance evolves, the boundaries between traditional and digital stores of value will continue to blur.

For investors, the opportunity lies in understanding these dynamics, leveraging secure platforms like MEXC, and building balanced, risk-adjusted exposure to both tangible and digital gold. The narrative of safe-haven investing has entered its next chapter—and it’s happening on-chain.

7.FAQ

Q1: Which tokenized gold assets can I trade on MEXC? MEXC currently lists two major gold-backed tokens: Tether Gold (XAUT) and PAX Gold (PAXG).

Q2: What are the trading rules for MEXC’s gold pairs? Tokenized gold trades like any spot pair on MEXC. Minimum orders start at 0.0001 tokens (≈0.0001 oz of gold), lowering barriers for retail investors. Trading is available 24/7, with low fees and USDT settlement, ensuring fast, transparent execution.

Q3: Is tokenized gold a secure investment? Yes. Both XAUT and PAXG are issued by regulated entities (Tether and Paxos), fully backed by physical gold held in professional vaults. MEXC provides institutional-grade security, multi-signature custody, and transparent reserves to safeguard user funds.

Join MEXC and Get up to $10,000 Bonus!

Sign Up