As the crypto market continues its extraordinary rise into 2025, cryptocurrencies such as Bitcoin have surged past the $100,000 mark, Ethereum is scaling new heights with ongoing upgrades, and altcoins are propelling early investors to unprecedented wealth. However, this excitement also brings a crucial question: Is it truly safe to buy crypto in 2025?

The cryptocurrency market has undergone remarkable growth over the years. Some individuals have witnessed its explosive rise from early days when Bitcoin was priced under $10,000. While many have enjoyed the rewards, there have also been numerous stories of losses, scams, and hacking incidents that have wiped out entire portfolios. With increased involvement from both institutional investors and retail traders, the risk of falling victim to fraud or security breaches has only heightened.

This article delves into the risks that are still prevalent in the market today, shares essential lessons to ensure safety, and explores how platforms like MEXC are taking proactive steps to secure user funds and make cryptocurrency investments safer than ever in 2025.

The Reality of Crypto Risks in 2025: Why Safety Is a Top Concern

Cryptocurrencies have grown exponentially in popularity and value over the past decade. While this surge has created significant financial opportunities, it has also attracted malicious actors seeking to exploit newcomers. In 2025, cryptocurrencies like Bitcoin and Ethereum are no longer niche investments but mainstream assets that attract hackers, scammers, and fraudulent platforms aiming to take advantage of inexperienced users. With reports stating that over $3.1 billion has been lost to hacks and scams already this year, it’s clear that the dangers in crypto are not only real but escalating.

Security vulnerabilities such as access-control flaws, smart contract bugs, and more advanced social engineering scams are among the leading causes of these losses. Modern scammers are using sophisticated methods such as deepfake videos of influencers endorsing fraudulent crypto projects and phishing websites that closely resemble legitimate exchanges. For instance, one Reddit user shared how they lost $400,000 in an elaborate scam involving fake “guaranteed returns” promised by an influencer, ultimately leading to the disappearance of their funds. Similarly, AI-driven scams are becoming more common, with attackers draining users’ wallets using fake apps or impersonating actual traders.

Several common pain points among users, shared across platforms like Reddit, include:

- Phishing and Fake Platforms: Scammers create cloned websites or apps designed to steal user credentials. One large-scale phishing scam targeted $150 million from Coinbase users by using highly advanced social engineering tactics.

- AI-Enhanced Scams: AI technology allows for more personalized attacks. Scammers now use voice-cloned phone calls pretending to be support staff or bots that mimic real traders in an attempt to manipulate unsuspecting users into making mistakes.

- Exchange Reliability: Many users worry about exchanges freezing their accounts or disappearing overnight. There have been multiple instances of exchanges freezing profitable users’ accounts indefinitely, and other platforms have closed without warning, leaving users unable to access their crypto.

- Irreversible Losses: The irreversible nature of blockchain transactions means that once funds are lost, they cannot be recovered. Without proper precautions like hardware wallets and multi-factor authentication (MFA), victims often regret not securing their assets in the right way.

These stories are more than just anecdotal – they are cautionary tales that demonstrate how easily one can lose everything in crypto. However, with the right knowledge, security measures, and a trustworthy platform, buying crypto in 2025 can be far safer than many might think.

Turning Fear into Confidence: Key Lessons for Safe Crypto Buying

Based on the shared lessons of others in online forums, here are actionable strategies to help mitigate risks and protect investments:

- Spot Red Flags: Be cautious of any promise that sounds too good to be true, such as “guaranteed returns,” high-pressure sales tactics, or unsolicited advice on social media. Legitimate crypto investments rarely rush decisions or try to push users into immediate action. If something feels off, it’s worth investigating further.

- Verify Everything: Always ensure the legitimacy of any platform by checking official URLs, reading independent user reviews, and using blockchain explorers to trace wallet addresses. Fraudulent platforms are often new and lack any real transparency, so it is safer to choose exchanges with established reputations and positive feedback.

- Secure Your Setup: One of the most important measures to protect assets is to secure your crypto wallets and accounts. Enable 2FA (two-factor authentication) immediately (preferably through an authenticator app rather than SMS) and store crypto in hardware wallets like Ledger or Trezor for long-term storage. Never share your private keys or recovery phrases, as these are the keys to your funds.

- Choose Reputable Exchanges: Stick to platforms with proven track records and transparent operations. Look for exchanges with security certifications and features like Proof of Reserves (PoR), which ensures that the platform holds at least as much crypto as it claims to have. This provides peace of mind that your funds are being managed safely.

- Report Suspicious Activity: If you suspect you’ve been targeted by a scam or fraudulent activity, act quickly. Report suspicious activity to authorities like the Federal Trade Commission (FTC) or use scam-tracking websites. Taking swift action may limit the damage and help prevent others from falling victim to the same scam.

The most crucial lesson here is to never let hype cloud your judgment. As Redditors put it, “Crypto isn’t a scam, but scammers love crypto.“

Why MEXC Stands Out as a Safe Haven in 2025

Among the vast number of exchanges available, MEXC has continually demonstrated a strong commitment to user security and transparency. Established in 2018, MEXC has expanded its services to millions of users worldwide, consistently maintaining a solid reputation for reliability, fast withdrawals, and responsive customer support.

What truly sets MEXC apart, however, is its Proof of Reserves (PoR) system. This is not just a marketing gimmick – it’s a verifiable commitment to ensuring that MEXC holds at least 100% of user assets in reserve at all times. This system is crucial in eliminating the risk of insolvency, such as the one seen with FTX’s collapse in 2022. By providing users with transparency on reserves, MEXC ensures that funds are secure and readily available.

In the wake of hacks surpassing $3 billion in 2025, MEXC’s PoR system offers a significant layer of protection, reassuring users that the platform operates with their best interests in mind. Additionally, MEXC employs state-of-the-art security measures such as cold storage for most assets, advanced encryption technologies, mandatory 2FA, anti-phishing codes, and real-time monitoring for suspicious activity. For beginners, the platform also provides comprehensive educational resources to help users navigate crypto safely and securely.

How MEXC Protects Your Funds

- Proof of Reserves (PoR): MEXC maintains Proof of Reserves, ensuring that it holds at least 100% of user assets in reserve at all times. This eliminates the risk of platform collapse and provides transparency to all users.

- Cold Storage for Most Assets: The majority of user funds are stored offline in cold storage, which is not connected to the internet, making it secure from online threats and breaches.

- Encryption and Security Protocols: MEXC uses state-of-the-art encryption technologies to protect users’ data and transactions. This guarantees that personal and financial information remains secure from cyber threats.

- Mandatory Two-Factor Authentication (2FA): MEXC enforces mandatory 2FA, adding an extra layer of security to your account. This ensures that only authorized users can access and make transactions on your account.

- Anti-Phishing Codes: Anti-phishing codes help users identify legitimate communications from MEXC, reducing the likelihood of falling for phishing scams that try to steal personal data.

- Real-Time Monitoring for Suspicious Activity: MEXC continuously monitors user accounts for any suspicious behavior, providing real-time notifications if anything unusual occurs. This proactive approach helps to mitigate risks before they escalate.

- Educational Resources: MEXC offers comprehensive educational resources to help users understand how to secure their accounts and navigate the crypto market safely.

Step-by-Step: Buying Crypto Safely on MEXC

Ready to dip your toes in? Here’s a straightforward guide based on MEXC’s process:

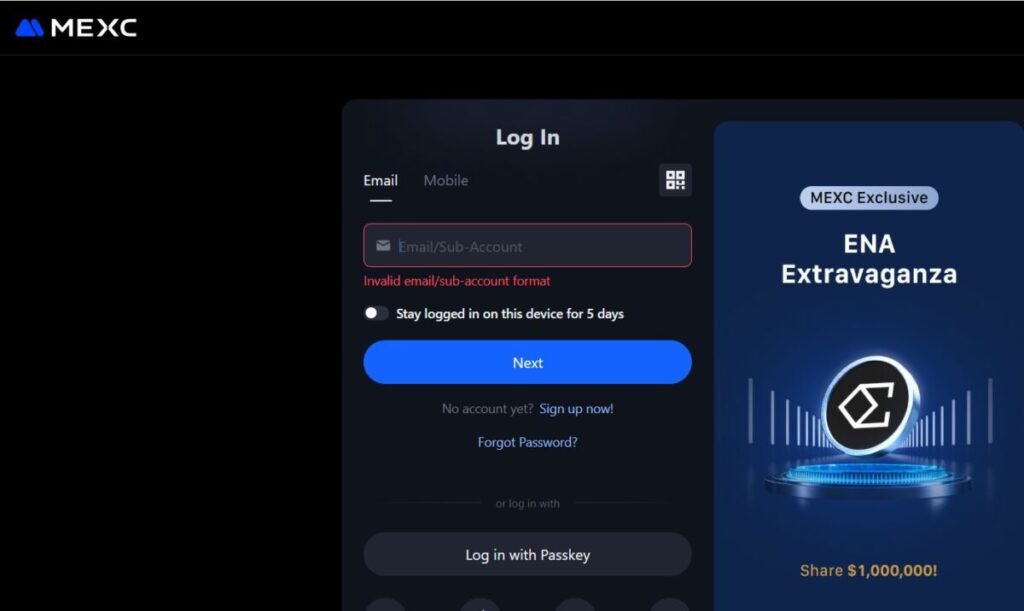

- Register and Verify: Go to mexc.com and click “Register” if you are new. If you already have an account, click login. Use your email or phone number, create a strong password (mix letters, numbers, and symbols), and enable 2FA via Google Authenticator right away. Complete KYC with ID and facial verification for added security and higher limits.

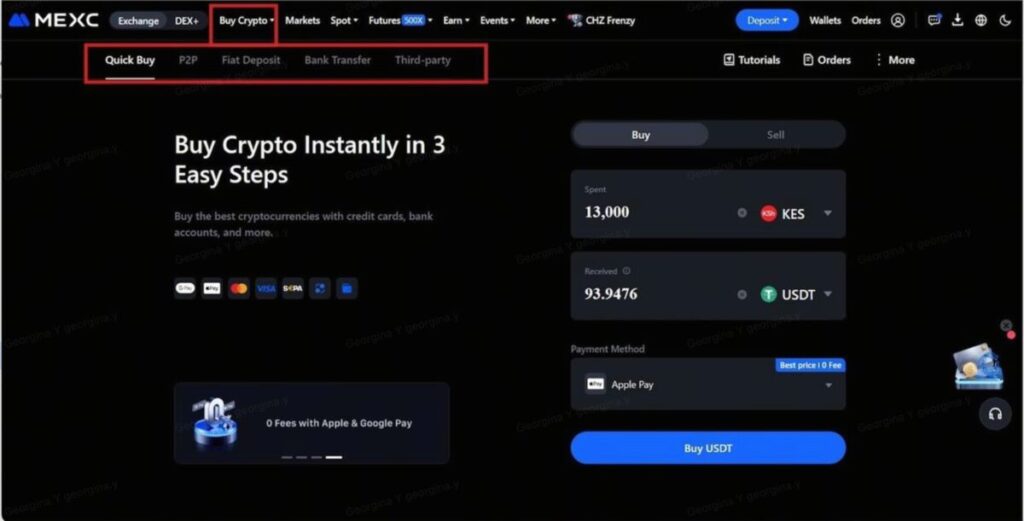

- Fund Your Account: Go to the “Buy Crypto” section. MEXC supports multiple payment methods, including credit/debit cards, bank transfers, third-party services, and zero-fee P2P trading. P2P connects you directly with verified sellers using local methods like mobile payments, ideal for global users who want to avoid high fees.

When you click Buy Crypto, you will find various ways to fund your account.

- Choose and Buy: Select the crypto you want to purchase (e.g., BTCUSDT, ETHUSDT, SOLNUSDT). You can buy directly through spot trading or place a limit order for better prices. MEXC supports a vast range of cryptocurrencies, featuring over 2,677 spot trading pairs and 799 futures trading pairs.

MEXC offers a wide range of tokens to choose from.

- Withdraw Securely: Once purchased, transfer to a hardware wallet. MEXC’s withdrawal process is fast and low-cost, with no hidden fees. Use stop-loss orders to manage market volatility.

For larger trades, MEXC’s OTC desk offers private, secure deals bypassing public markets, perfect for institutional investors or high-net-worth individuals.

Additional Tips for Long-Term Security in crypto trading.

- Diversify Wisely: Spread your investments across different assets and wallets to protect yourself from market crashes and hacks.

- Stay Updated: Keep an eye on MEXC’s blog and trusted sources like CoinDesk for news on emerging threats like AI scams or phishing waves.

- Use Tools: Use blockchain explorers like Etherscan and MEXC’s transaction monitoring tools to verify the legitimacy of transactions and spot scams early.

- Invest Responsibly: Never invest more than you can afford to lose – crypto is inherently volatile.

Conclusion: Yes, It’s Safe – If You Choose Wisely

Buying crypto in 2025 isn’t without risks, but with evolving scams and hacks, platforms like MEXC are making it safer through transparency like PoR and top-tier security features. Don’t let fear hold you back; learn from others’ mistakes and start smart.

- Ready to buy securely? Check MEXC’s How to Buy guide at https://www.mexc.com/how-to-buy.

- For account setup, visit https://www.mexc.com/learn/article/step-by-step-opening-an-account-and-trading-learn-on-mexc/1.

Trade wisely.

Join MEXC and Get up to $10,000 Bonus!

Sign Up