In today’s uncertain financial climate, individuals are increasingly concerned about rising inflation, the devaluation of local currencies, and extremely low bank interest rates. As these economic pressures mount, more people are looking for ways to preserve and grow their wealth in a world where traditional financial systems seem inadequate. One such solution that has emerged as a safe haven is USDT (Tether), a stablecoin pegged 1:1 to the U.S. Dollar.

USDT offers stability in volatile market conditions, making it an appealing tool for financial protection, especially when local fiat currencies are experiencing rapid depreciation. With its ability to provide a hedge against inflationary pressures, USDT has become a go-to asset for those looking to secure their savings from the turbulence of local currencies. But, as with any investment or store of value, a key question remains: Is USDT truly safe as an inflation hedge?

The Short Answer: Yes, But With Some Important Nuances

The short answer is yes, USDT can offer a significant degree of safety and stability, particularly for those living in economies where local currencies are losing value. However, it’s crucial to recognize that, like any financial instrument, USDT carries its own risks. To fully understand its effectiveness as an inflation hedge, we must examine the two layers of protection and risk involved in using USDT as a financial tool: the local currency shield and the US Dollar inflation exposure.

This article will provide an in-depth exploration of how USDT works as a financial shield, the potential risks associated with its use, and how platforms like MEXC can provide users with safe and profitable growth opportunities through their Earn products, offering stable returns even during uncertain economic times.

What is USDT and How Does it Work as an Inflation Hedge?

USDT (Tether) is a fiat-collateralized stablecoin, which means it is pegged 1:1 to the value of the U.S. Dollar. This fixed peg ensures that one USDT is always worth one U.S. Dollar, offering a high degree of stability compared to most other cryptocurrencies. As a stablecoin, USDT aims to maintain the stability of the U.S. Dollar, providing an accessible and reliable alternative for individuals and institutions looking to protect their wealth, particularly during times of economic uncertainty or financial market volatility.

Stablecoins, such as USDT, are specifically designed to mimic the stability of traditional fiat currencies like the U.S. Dollar. This makes them an ideal solution for those seeking a safe haven from the wild fluctuations commonly associated with other cryptocurrencies like Bitcoin or Ethereum, whose values can change drastically within short periods. In contrast, USDT offers a consistent value, making it a trusted asset for wealth preservation.

USDT as an Inflation Hedge

In regions where local fiat currencies face rapid devaluation, USDT can serve as an essential tool for protecting purchasing power and mitigating inflation risks. Inflation occurs when the purchasing power of a currency decreases over time, often as a result of increasing prices of goods and services. In many economies, hyperinflation or high inflation rates erode the value of local currencies quickly, forcing individuals to seek alternatives for preserving their wealth. In such cases, USDT provides a safe alternative, as it is pegged to the U.S. Dollar, a globally accepted and more stable currency.

The US Dollar, being the global reserve currency, has generally been more stable than most local currencies, which can be affected by economic crises, political instability, and currency policies. USDT’s peg to the U.S. Dollar allows it to offer stability and avoid the erosion of wealth that occurs when holding local currencies in economies facing devaluation. This makes USDT an effective hedge against the inflationary pressures that many individuals face in countries where their local currencies lose value quickly.

For example, in countries like Argentina, Nigeria, Venezuela, and Kenya, local fiat currencies have faced severe depreciation due to high inflation or political instability. In these countries, USDT has emerged as a popular choice for individuals who wish to preserve their wealth by converting their rapidly devaluing local currency into a more stable asset. By exchanging their local currency for USDT, citizens in these regions can “dollarize” their savings and protect them from the collapse of the local currency’s purchasing power.

Global Examples of USDT’s Use as an Inflation Hedge

- Argentina: In recent years, Argentina has faced extreme inflation, with inflation rates surpassing 200%. As the Argentine Peso has lost much of its value, citizens have increasingly turned to USDT to preserve their savings. By converting pesos into USDT through P2P platforms like MEXC, Argentinians are able to dollarize their savings and protect themselves from the effects of hyperinflation. USDT offers a stable store of value, helping individuals maintain purchasing power even as the peso continues to devalue.

- Nigeria: In Nigeria, the Naira has been severely impacted by inflation and currency devaluation. In 2024, Nigeria’s inflation rate was estimated at 22%, which significantly erodes the value of savings held in Naira. Many Nigerians have turned to USDT as a way to bypass capital controls and preserve their wealth. USDT offers them the ability to convert their Naira into a stable asset and avoid the high premiums imposed by the black-market exchange rate for foreign currencies. By using P2P trading platforms like MEXC, Nigerians can easily convert their Naira into USDT, securing their wealth in a globally accepted currency.

- Venezuela: Venezuela has been one of the most extreme examples of hyperinflation. With inflation reaching levels over 1,000,000% in recent years, the Venezuelan Bolívar lost almost all of its value. In response, Venezuelans have increasingly turned to USDT as a means of protecting their savings. With P2P platforms like MEXC, individuals can exchange their Bolívars for USDT, enabling them to protect their wealth from the collapsing local currency. The adoption of USDT has provided Venezuelans with a way to preserve their savings and gain access to global financial markets.

- Kenya: In Kenya, the Kenyan Shilling has been struggling with inflationary pressures, which have led many citizens to search for more stable assets. In the Republic of Kenya, interest rates went as high as 15% in 2024, something that did not go so well with the locals. By converting Kenyan Shillings into USDT through platforms like MEXC, Kenyans can effectively hedge against inflation and preserve their purchasing power. The adoption of USDT in Kenya is particularly significant as it enables individuals to access stable financial assets without relying on the local banking system, which may be affected by inflation and devaluation.

The inflation in Venezuela led to massive increase in prices.

How USDT Helps Users in High-Inflation Economies

- Protecting Savings from Currency Devaluation: By converting local fiat currencies into USDT, individuals can shield their savings from the devastating effects of inflation and currency devaluation. This allows them to maintain their purchasing power and avoid the erosion of wealth that is typically associated with holding local fiat currencies in high-inflation economies.

- Access to a Stable Store of Value: USDT provides a stable store of value, as it is backed 1:1 by the U.S. Dollar. As a result, it mirrors the value of the dollar, making it a safe alternative to holding unstable local currencies. In countries where the local currency is prone to volatility, USDT offers individuals a reliable way to preserve their wealth.

- Decentralized Finance (DeFi): USDT is widely used in decentralized finance (DeFi) platforms, which allow individuals to participate in lending, staking, and yield farming without relying on traditional banks. These DeFi platforms allow users to earn interest or rewards on their USDT holdings, providing an opportunity to generate passive income while maintaining a stable asset.

- Global Accessibility: As a global stablecoin, USDT allows individuals in high-inflation countries to participate in the global economy without relying on their local banking systems. By using P2P platforms like MEXC, users can trade USDT and access global crypto markets, where they can diversify their portfolios and hedge against the risks posed by local currency devaluation.

Step-by-Step: Buying Crypto Safely on MEXC

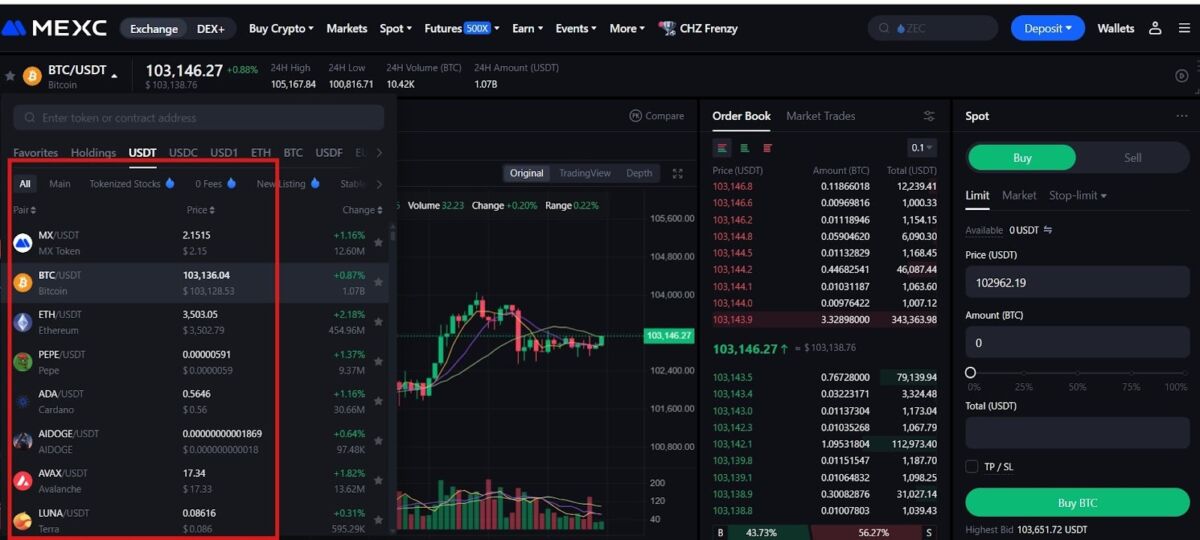

In the world of digital assets, security is paramount when purchasing cryptocurrencies. MEXC, a popular crypto exchange platform, provides a user-friendly interface to buy, trade, and store digital assets securely. Here’s a step-by-step guide on how to safely buy crypto on MEXC:

- Create and Secure Your MEXC Account

- Sign up: Visit the official MEXC website and sign up using a valid email address or phone number.

- Enable Two-Factor Authentication (2FA): To add an extra layer of security to your account, enable 2FA using Google Authenticator or SMS.

- Complete KYC (Know Your Customer): To comply with international regulations and enhance security, MEXC requires you to verify your identity by submitting documents like a government-issued ID.

- Deposit Funds Into Your Account

- Choose Your Deposit Method: MEXC supports multiple deposit options, including bank transfers, credit/debit cards, and other cryptocurrencies.

- Deposit Crypto or Fiat: If you want to buy crypto directly with fiat, deposit funds in USD, EUR, or any other supported currency. Alternatively, you can deposit another cryptocurrency like USDT or Bitcoin (BTC).

MEXC supports multiple deposit options, including bank transfers, credit/debit cards, and other cryptocurrencies.

- Select the Cryptocurrency You Want to Buy

- Navigate to the Markets: Once funds are deposited, go to the “Markets” tab on MEXC to explore the list of available cryptocurrencies.

- Choose Your Desired Coin: Whether you want to buy Bitcoin, Ethereum, or other altcoins, select the one you wish to purchase. For stable returns, consider using USDT, especially in uncertain markets.

- Choose the Right Trading Pair

- Fiat-to-Crypto or Crypto-to-Crypto Pair: Depending on your deposit, select the appropriate trading pair (e.g., BTC/USD or ETH/USDT).

- Check the Latest Market Prices: Ensure you’re buying at a favorable price by checking the latest market trends. MEXC provides real-time price charts for reference.

- Place Your Order

- Limit or Market Order: Choose between a market order (immediate execution at the current price) or a limit order (set your own price for the crypto). For safety, consider setting a limit order to avoid the risks of market fluctuations.

- Confirm Transaction: Double-check all details (e.g., amount and price) before confirming the order.

- Complete the Purchase

- Secure Your Crypto: Once the order is filled, your crypto will appear in your MEXC wallet. MEXC uses cold storage and advanced encryption methods to protect your assets, but for added security, consider transferring your crypto to a personal hardware wallet if you’re not actively trading.

- Withdraw or Stake Your Crypto

- Withdraw to a Private Wallet: If you’re not planning to trade your crypto immediately, withdraw your assets to a private wallet. This reduces the risk of losing funds in the event of exchange hacks.

- Stake for Passive Income: For users looking to earn passive income, MEXC offers staking and DeFi options. You can stake your USDT or other coins and earn rewards through the platform’s Earn products.

- Monitor Your Investment

- Track Your Holdings: MEXC provides tools to monitor the performance of your crypto investments in real-time. Stay updated with market changes and adjust your strategy accordingly.

By following these steps, you can safely buy and manage your crypto on MEXC. Always remember to use security best practices, including enabling 2FA and withdrawing your assets to a secure wallet if you’re holding for the long term.

Conclusion: USDT as a Reliable Inflation Hedge and Passive Income Source

USDT remains a powerful tool for preserving wealth in inflationary environments and offers a stable store of value, especially when compared to local fiat currencies facing rapid devaluation. It serves as an effective hedge against local currency depreciation in high-inflation economies, providing users with a stable asset in a globalized financial system.

However, while USDT is a reliable solution for wealth protection, its value is still tied to the U.S. Dollar, and it is subject to U.S. inflation. USDT is not a perfect hedge against global inflation, but it remains an excellent tool for safeguarding assets in high-risk regions.

By leveraging platforms like MEXC, USDT holders can not only protect their wealth but also generate passive income through staking and DeFi platforms, turning idle assets into working wealth.

Explore how USDT can help you preserve wealth and generate passive income:

- Discover MEXC Earn Products: https://www.mexc.com/staking

- Learn more about Futures Earn: https://www.mexc.com/learn/article/what-is-mexc-futures-earn-/1

- Generate passive income by holding MX Tokens: https://www.mexc.com/learn/article/how-to-earn-passive-income-by-holding-mx/1

Verify MEXC’s reserves: Proof of Reserves

Join MEXC and Get up to $10,000 Bonus!

Sign Up