Summary

Recently, the cryptocurrency market has faced significant volatility and price corrections, leaving many spot holders struggling with depreciating asset values. In such conditions, panic selling is rarely the best option. Instead, using financial derivatives to hedge spot positions is a more professional and rational risk management approach.

This article provides a comprehensive guide on how to use MEXC’s futures trading products to hedge your spot holdings, offset downside risks, and protect your portfolio from devaluation.

TL;DR

Core Logic of Hedging:Open a short position in the futures market equivalent to your spot holdings. When the market drops, profits from the short position can offset spot losses.

Advantages of MEXC:MEXC offers deep market liquidity, ultra-low fees, and the broadest range of trading pairs—making it an ideal platform for executing hedging strategies.

USDT-Margined Futures Hedging:With BTCUSDT perpetual contracts, you can lock in the USDT value of your assets and neutralize downside risks. This method is intuitive and beginner-friendly.

Coin-Margined Futures Hedging:Using BTCUSD perpetual contracts, you can profit in BTC when prices fall—allowing long-term holders to accumulate more coins during market downturns.

1.What Is Hedging in the Crypto Market?

Hedging is a trading strategy designed to reduce investment risk. In crypto, it refers to opening a short futures position to offset potential losses from holding spot assets like Bitcoin.

If Bitcoin’s price drops, your spot holdings lose value—but your short futures position gains. Ideally, the profits from futures can fully or partially offset the spot loss, keeping your total portfolio value (in USD or stablecoins) relatively stable.

2.Why Use MEXC for Futures Hedging?

When executing a hedging strategy, the choice of platform is crucial. MEXC stands out as a global leader in futures trading due to several key advantages:

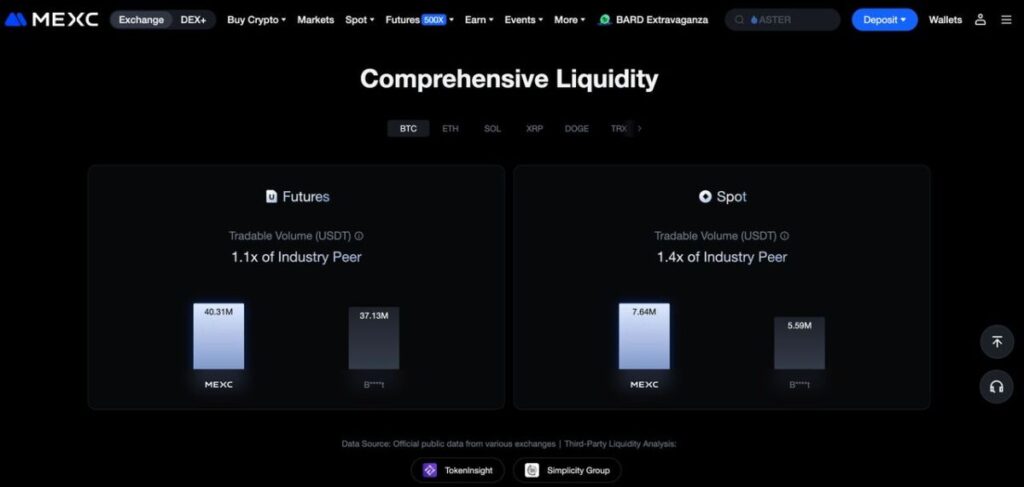

- Deep Liquidity & Tight Spreads:Whether you trade USDT-M or coin-M futures, MEXC offers top-tier market depth.This ensures minimal slippage when opening or closing large positions—essential for precise hedging execution.

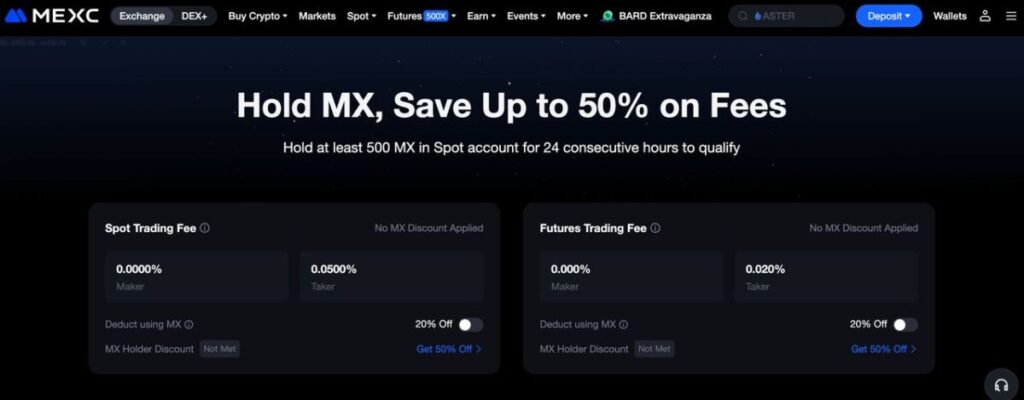

- Ultra-Low Fees:MEXC charges industry-leading low fees , significantly lower than most major exchanges. Lower fees reduce hedging costs—especially important for long-term positions.Holders with over 500 MX tokens can also enjoy additional trading discounts.

- Broadest Range of Futures Pairs:MEXC supports one of the widest selections of perpetual contracts in the market.Whether you’re holding BTC, ETH , or niche altcoins, you’ll likely find corresponding futures pairs to execute precise hedges.

3.Practical Guide: How to Hedge on MEXC

Let’s take a simple example. If you’re holding 1 BTC spot. Below are two popular hedging strategies depending on your investment goals.

3.1 Locking in Fiat Value — USDT-Margined Futures (BTCUSDT)

USDT-Margined futures use USDT as margin and settlement currency, making profit and loss straightforward.This strategy aims to lock in the USDT value of your holdings.

Scenario:

- Spot holding: 1 BTC

- Current BTC price: 112,000 USDT

- You expect the price to fall to 100,000 USDT

Steps:

1)Transfer Margin: Move enough USDT to your MEXC futures account.

2)Open a Short Position:Short an amount equal to your spot position,then use 1x–3x leverage (low leverage minimizes liquidation risk).

- Notional value = 1 BTC × 112,000 USDT = 112,000 USDT.

3)Outcome Analysis:

- When BTC falls to 100,000 USDT:

- Spot Loss: –12,000 USDT

- Futures Profit: +12,000 USDT

- Total Value: ~112,000 USDT

By using this strategy, your portfolio value in USDT remains stable despite the price dropping.

3.2 Accumulating More Coins — Coin-Margined Futures (BTCUSD)

Coin-Margined futures, or reverse contracts, use BTC as both margin and settlement currency.This strategy helps increase your BTC holdings when prices fall.

Scenario:

- Spot holding: 1 BTC

- Current price: 112,000 USD

- Expect a price drop

Steps:

1)Transfer Margin: Move a portion of BTC (e.g., 0.1 BTC) to your MEXC coin-M futures account.

2)Open a Short Position: BTCUSD contracts are quoted in USD, settled in BTC (1 contract = $100).

- To hedge 1 BTC: open 1,120 contracts (112,000 ÷ 100)

3)Outcome Analysis:

- When BTC drops to 100,000 USD:

- Spot Value Loss: in USD terms

- Futures Profit: ~0.107 BTC

- Total Holdings: 1 + 0.107 = 1.107 BTC

By using this strategy, you can take advantage of price declines to successfully increase the amount of BTC you hold. When the market eventually recovers, you’ll have more chips in hand to enjoy the rewards of the next rally.

4.FAQs on MEXC Hedging

Q1: Should I use USDT-M or Coin-M futures for hedging?

If your goal is to preserve USD (or stablecoin) value, choose USDT-M futures — simpler and more stable.If you’re a long-term holder aiming to accumulate more BTC, Coin-M futures are better suited.

Q2: What leverage should I use for hedging?

Hedging is risk management, not speculation.so,use 1x leverage to mirror your spot exposure and eliminate liquidation risk.If capital is limited, 2–3x is acceptable, but monitor margin closely.

Q3: Is hedging completely risk-free?

No. The main risks of hedging include: funding fees (perpetual futures positions require periodic payment or receipt of funding, which is the primary cost of hedging), basis risk (price discrepancies between futures and spot markets), and operational risk (such as forced liquidation due to improper leverage management). However, compared to being fully exposed during a market downturn, hedging remains an exceptionally effective risk management tool.

5.Conclusion

In a cyclical and volatile crypto market, spot investors need not panic during downturns.By leveraging MEXC ’s professional futures trading infrastructure—known for deep liquidity, low fees, and broad contract coverage—you can implement effective hedging strategies using either USDT-M or Coin-M futures.

This approach not only shields your portfolio from devaluation in bear markets, but also enables strategic accumulation of digital assets—positioning you strongly for the next bull cycle.

Join MEXC and Get up to $10,000 Bonus!

Sign Up