In early 2026, driven by global macroeconomic factors, the precious metals sector experienced a robust rally. Through its strategic deployment of Gold (XAUT, PAXG), and Silver (SILVER) contracts, MEXC precisely captured the trading demand triggered by this market surge. Leveraging a Zero-Fee strategy and superior liquidity, the platform significantly expanded its market share, establishing a dominant position in the GOLD and SILVER Futures market.

MEXC GOLD Futures Capture Nearly 50% Share, Showcasing Strong Leadership

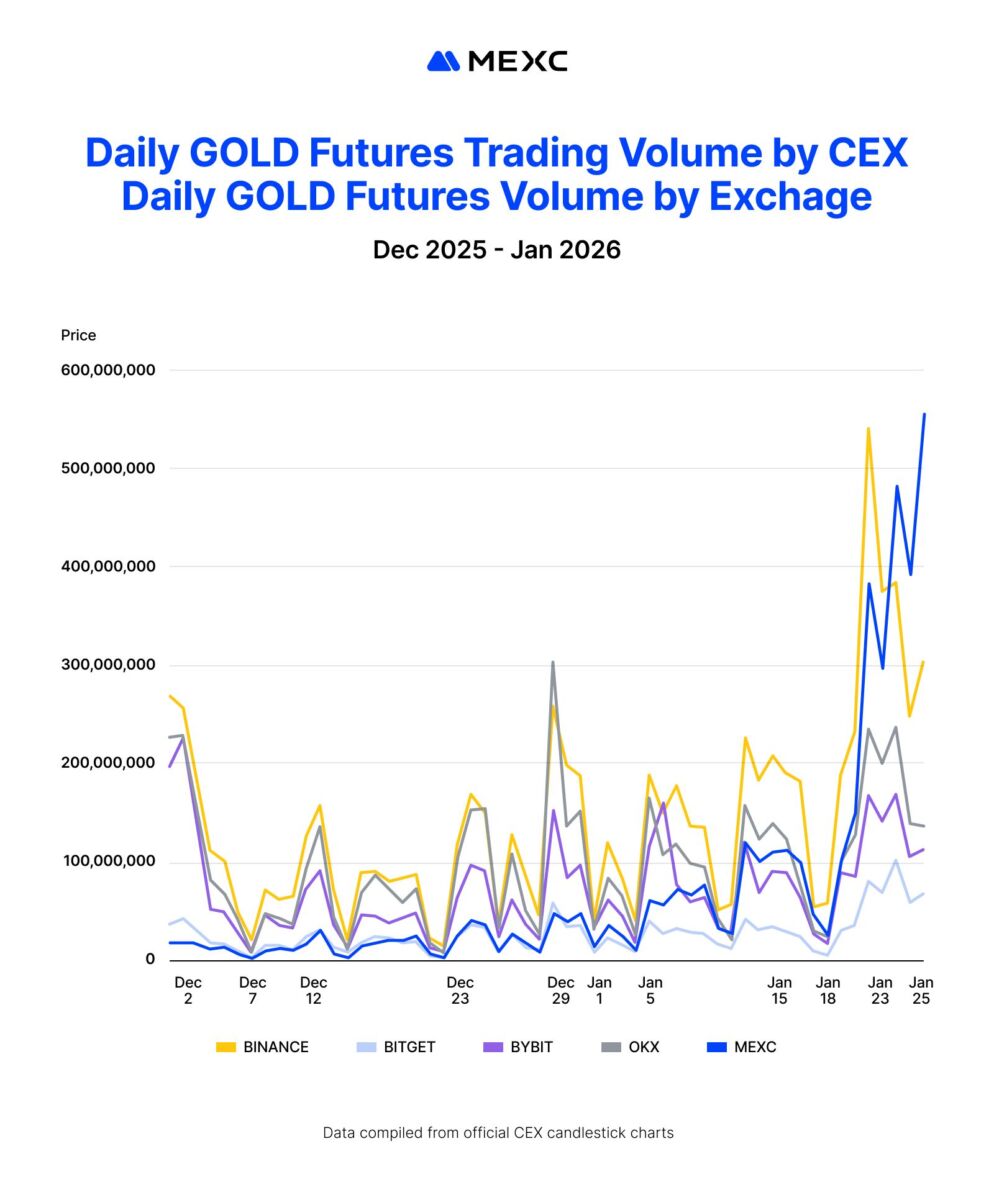

MEXC’s GOLD Futures market share surged from 2.4% in early December to stabilize around 20% by early January, a nearly 10-fold expansion in just over a month. Beginning January 15, the platform charted a steep “J-curve”: following a brief correlation with a broader market retracement, both trading volume and market share staged an explosive recovery.

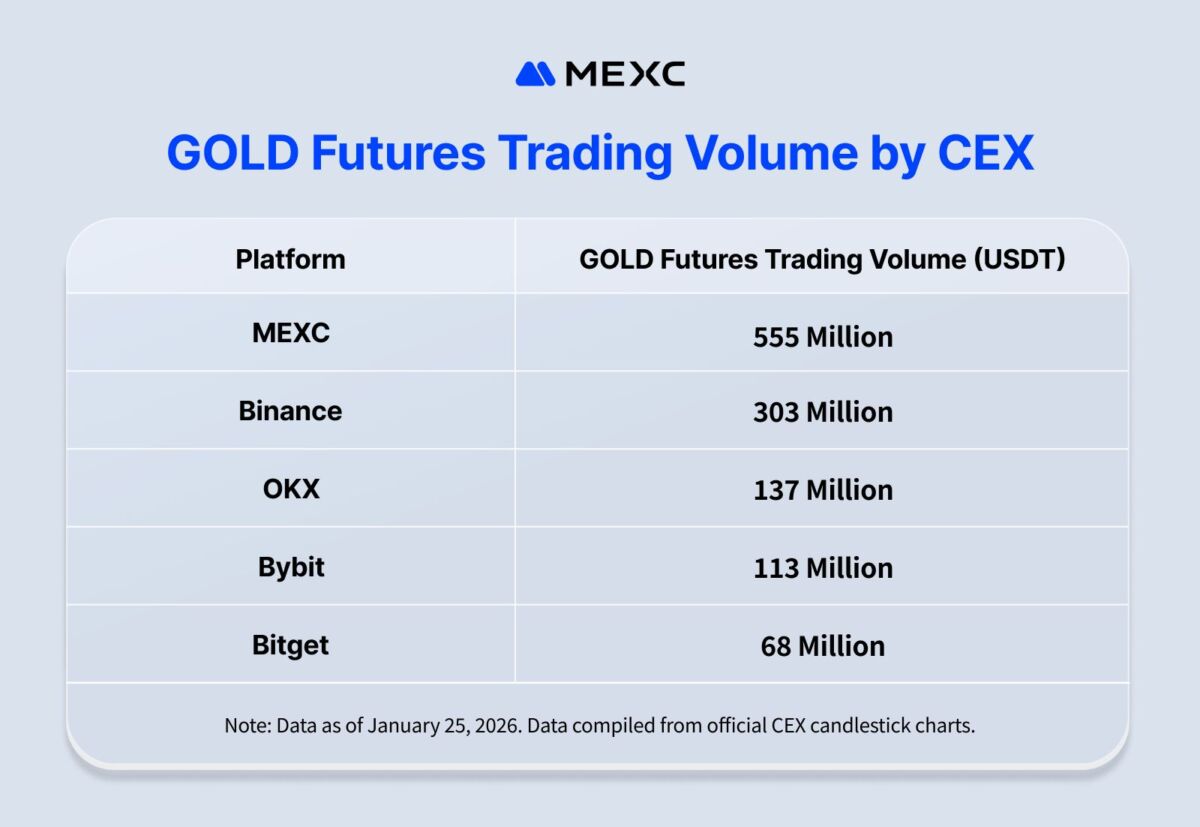

January 23 marked a critical watershed in the market landscape. As MEXC continued to widen the gap with industry peers, it surged to the top spot with a 35% market share. Over the subsequent days of January 24 and 25, this leading advantage was further consolidated, with market share breaking through 41% and 47%, respectively. Notably, on January 25 alone, MEXC captured nearly half of the total market share. In just two months, MEXC achieved a staggering 20-fold growth rate in market share.

This leadership can be attributed to MEXC’s unique ecosystem loop of “Zero-Fee + High Leverage + Top-Tier Depth,” which precisely addresses the core pain points of high-frequency and large-volume traders:

MEXC supports up to 100x leverage, satisfying demand for capital efficiency among aggressive investors. While high leverage on traditional platforms often entails high transaction costs that limit trading frequency, MEXC’s Zero-Fee strategy completely eliminates this friction, allowing users to trade without worrying about additional “wear and tear” on their capital. Crucially, leverage and low fees alone cannot support large-scale operations. Without sufficient depth, large orders face severe slippage risks. MEXC ensures the smooth entry and exit of large capital with world-leading market depth, providing a reliable safety net for high-leverage, large-volume trading.

It is the deep synergy of these three elements that has attracted and retained significant trading capital, propelling MEXC to occupy a dominant market position.

MEXC Trading Volume Resonates Highly with Gold Price Trends, Precisely Capturing Market Liquidity

The trading activity of GOLD Futures on MEXC shows a high positive correlation with spot gold price trends, highlighting the platform’s ability to capture macro trends and accommodate user demand. Data shows that the average daily trading volume in January 2026 achieved a635% month-on-month increasecompared to December 2025.

From December 1, 2025, to January 15, 2026, as gold prices trended upward with volatility, trading volumes for MEXC’s XAUTUSDT and PAXGUSDT Futures showed steady growth, keeping pace with the gold price rhythm.

Following the consecutive all-time highs in gold prices after January 18, MEXC launched a limited-time Zero-Fee strategy for relevant GOLD Futures. The synergy between this strategy and bullish market sentiment drove volume on a parabolic trajectory. The peak occurred on January 25, with a single-day trading volume reaching $555 million, ranking first among mainstream platforms.

MEXC SILVER Futures Achieve Rapid Liquidity Expansion in the Short Term

In the SILVER Futures market, MEXC also demonstrated exponential liquidity growth in mid-to-late January 2026. As silver prices began a new rally on January 16, trading volume for MEXC’s SILVER Futures SILVER(XAG)USDT simultaneously initiated explosive growth. Starting from a local low around January 18, volume peaked at $147.8 million on January 24, achieving nearly 20-fold growth in just 7 days. This vertical ascent fully demonstrates that MEXC’s SILVER Futures possess strong capital absorption capabilities and deep liquidity, enabling the instant accommodation of massive capital inflows during critical market windows.

Conclusion

MEXC’s explosive growth in early 2026 relies not merely on the traffic dividends of short-term market trends, but on the deep synergy between its long-term Zero-Fee strategy and world-class liquidity. From the precise handling of sudden market surges to independent recovery during volatile conditions, MEXC has successfully built a long-term competitive barrier. Moving forward, MEXC remains committed to arming traders with unrivaled cost efficiency and depth to capture every market opportunity.

Join MEXC and Get up to $10,000 Bonus!

Sign Up