I. MEXC November Data Highlights: Utility Sectors Gain Momentum as Trading Volume and Price Performance Alignment Hits Annual Peak

MEXC has established “rapid listing + early-stage momentum capture” as its core strategy, maintaining industry-leading capabilities in identifying emerging opportunities and reducing the lag time between market narratives and tradeable assets—a key advantage for capitalizing on short-term price differences and thematic rotation opportunities.

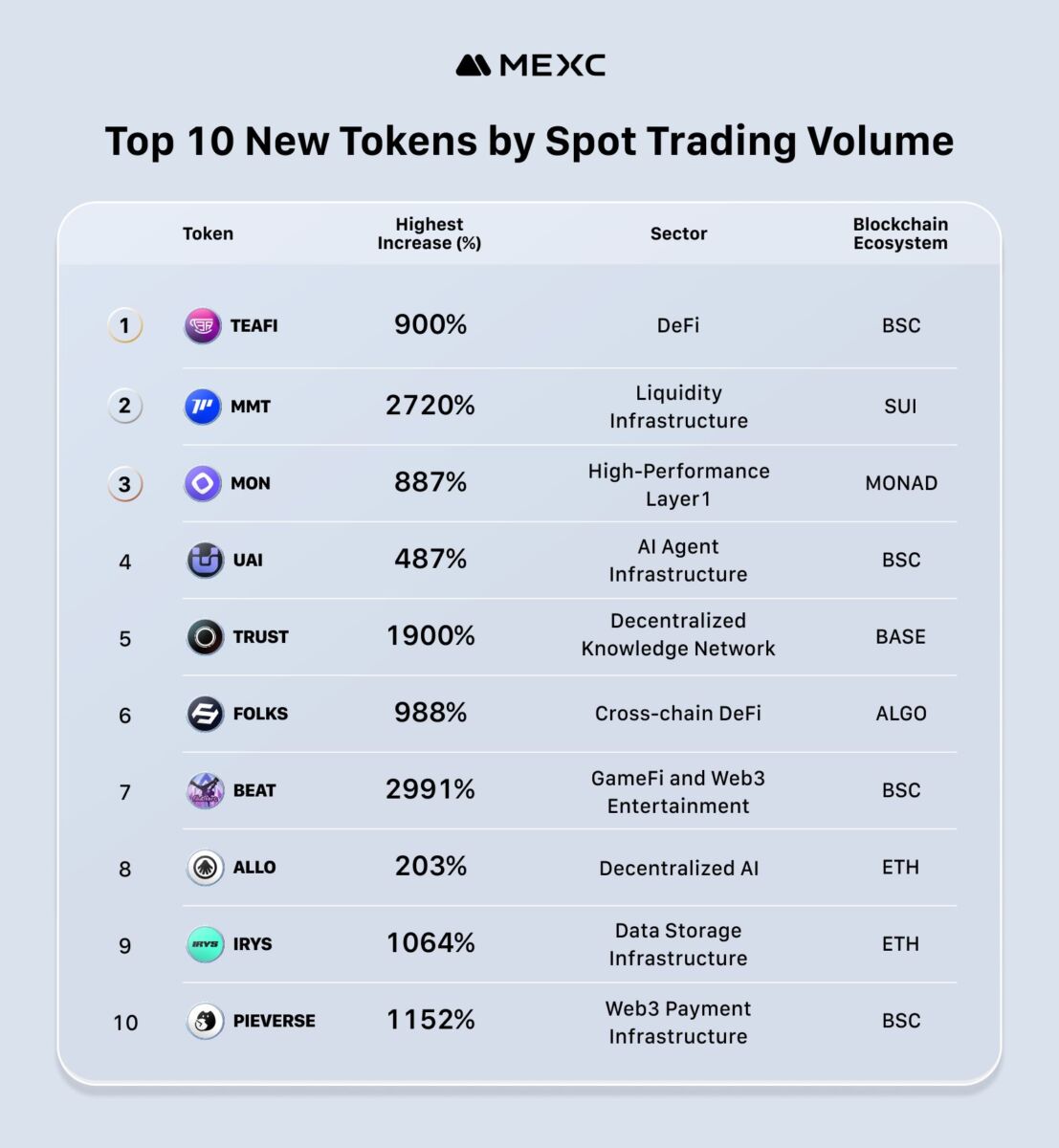

The top 10 tokens by spot trading volume delivered an average peak gain of 1,329%. Market attention concentrated primarily on DeFi, decentralized AI, and infrastructure sectors.

Among them, DeFi projects comprising 30% (TEAFI, MMT, FOLKS), infrastructure-related initiatives accounting for 40% (MON, TRUST, IRYS, PIEVERSE), decentralized AI representing 20% (UAI, ALLO), and entertainment applications making up 10% (BEAT). This distribution clearly indicates that November’s market narrative centered on projects solving actual pain points, such as improving liquidity, scalability, and payment compliance, reflecting investor preference for tokens with use cases and utility over purely sentiment-driven speculative plays.

The BSC ecosystem dominated with 40% representation and the broadest thematic diversity, spanning DeFi, AI, payment infrastructure, and entertainment applications. The ETH ecosystem captured 20%, concentrating on technical infrastructure including data storage (IRYS) and AI tooling (ALLO). SUI and BASE ecosystems made strategic advances through DeFi and InfoFi infrastructure, driving parallel development of practical applications and innovative narratives. Emerging ecosystems like MONAD and ALGO provided additional diversification, strengthening overall market resilience.

| Top 10 New Tokens by Spot Trading Volume | |||

| Token | Highest Increase (%) | Sector | Blockchain Ecosystem |

| TEAFI | 900% | DeFi | BSC |

| MMT | 2720% | Liquidity Infrastructure | SUI |

| MON | 887% | High-Performance Layer1 | MONAD |

| UAI | 487% | AI Agent Infrastructure | BSC |

| TRUST | 1900% | Decentralized Knowledge Network | BASE |

| FOLKS | 988% | Cross-chain DeFi | ALGO |

| BEAT | 2991% | GameFi and Web3 Entertainment | BSC |

| ALLO | 203% | Decentralized AI | ETH |

| IRYS | 1064% | Data Storage Infrastructure | ETH |

| PIEVERSE | 1152% | Web3 Payment Infrastructure | BSC |

II. Trading Depth Aligns with Price Performance as Market Matures Toward Rational Consensus

November’s top 10 new tokens by peak performance averaged gains of 1,644%, with BEAT leading at 2,991%. Notably, 8 tokens (BEAT, MMT, TRUST, PIEVERSE, IRYS, FOLKS, TEAFI, MON) appeared on both the top 10 trading volume and top 10 price performance lists—an 80% overlap rate representing the highest correlation of 2025. This convergence signals the market’s evolution from pure emotional speculation toward a more mature framework emphasizing “trading depth + fundamental backing.”

The two outliers, WOJAKONX and BAY—representing MEME and learn-to-earn platforms respectively—both exceeded 1,700% gains, demonstrating MEXC’s agility in capturing emerging themes like MEME tokens and educational entertainment, thereby diversifying beyond mainstream sectors.

| Top 10 New Tokens by Highest Increase | |||

| Token | Highest Increase (%) | Sector | Blockchain Ecosystem |

| BEAT | 2991% | GameFi and Web3 Entertainment | BSC |

| MMT | 2720% | Liquidity Infrastructure | SUI |

| WOJAKONX | 2076% | MEME | SOL |

| TRUST | 1900% | Decentralized Knowledge Network | BASE |

| BAY | 1758% | Learn-to-Earn Platform | BSC |

| PIEVERSE | 1152% | Web3 Payment Infrastructure | BSC |

| IRYS | 1064% | Data Storage Infrastructure | ETH |

| FOLKS | 988% | Cross-chain DeFi | ALGO |

| TEAFI | 900% | DeFi | BSC |

| MON | 887% | High-Performance Layer 1 | MONAD |

III. Multi-Layered Campaign Strategy Drives User Engagement and Amplifies Rewards

Launchpad

November featured two MEXC Launchpad campaigns for SOL and MON, offering users discounted access to high-potential tokens with substantial return opportunities.

MON’s debut launch enabled individual users to earn up to 262.5 USDT, achieving 125% returns. The token’s simultaneous appearance in both top 10 trading volume and price performance rankings allowed early participants to capitalize on explosive growth potential. The SOL campaign provided new users 50% discounted access to blue-chip assets, lowering entry barriers while offering cost-effective exposure to established digital assets.

These initiatives showcase MEXC Launchpad’s curated selection approach, precisely identifying high-potential projects and enabling users to secure early-stage value appreciation opportunities for optimal returns.

Spin & Win

MEXC deployed 5 Spin & Win events, targeting popular ETH ecosystem tokens and privacy-focused cryptocurrencies, featuring a combined prize pool of 250,000 USDT with individual rewards reaching 1,000 USDT. These low-barrier, simple mechanics enabled effortless user participation with prizes spanning new tokens, established cryptocurrencies, and premium physical goods. The ongoing CHZ All-Star Wheel campaign features a 300,000 USDT prize pool including premium items like iPhone Air and AirPods Max, further enhancing user engagement and reward potential.

Airdrop+

November launched 46 Airdrop+ campaigns, engaging 6,551 participants across a total prize pool of 2.3 million USDT. New users could earn up to 50 USDT in average rewards. These high-frequency, substantial prize pool initiatives combined with inclusive distribution mechanisms helped newcomers quickly access benefits while generating significant exposure and market momentum for newly listed tokens.

Join MEXC and Get up to $10,000 Bonus!

Sign Up