Structural Research of Demand, Transaction Incentives, and Macroeconomic Drivers of Private Asset Growth

Privacy as a New Form of Financial Sovereignty

Amid a sharp pivot in market sentiment, 2025 is fast emerging as the year in which cryptocurrency investors reclaim privacy, challenging policymakers to rethink an era defined by transparency mandates, stringent KYC rules and exhaustive transaction-tracking regimes.

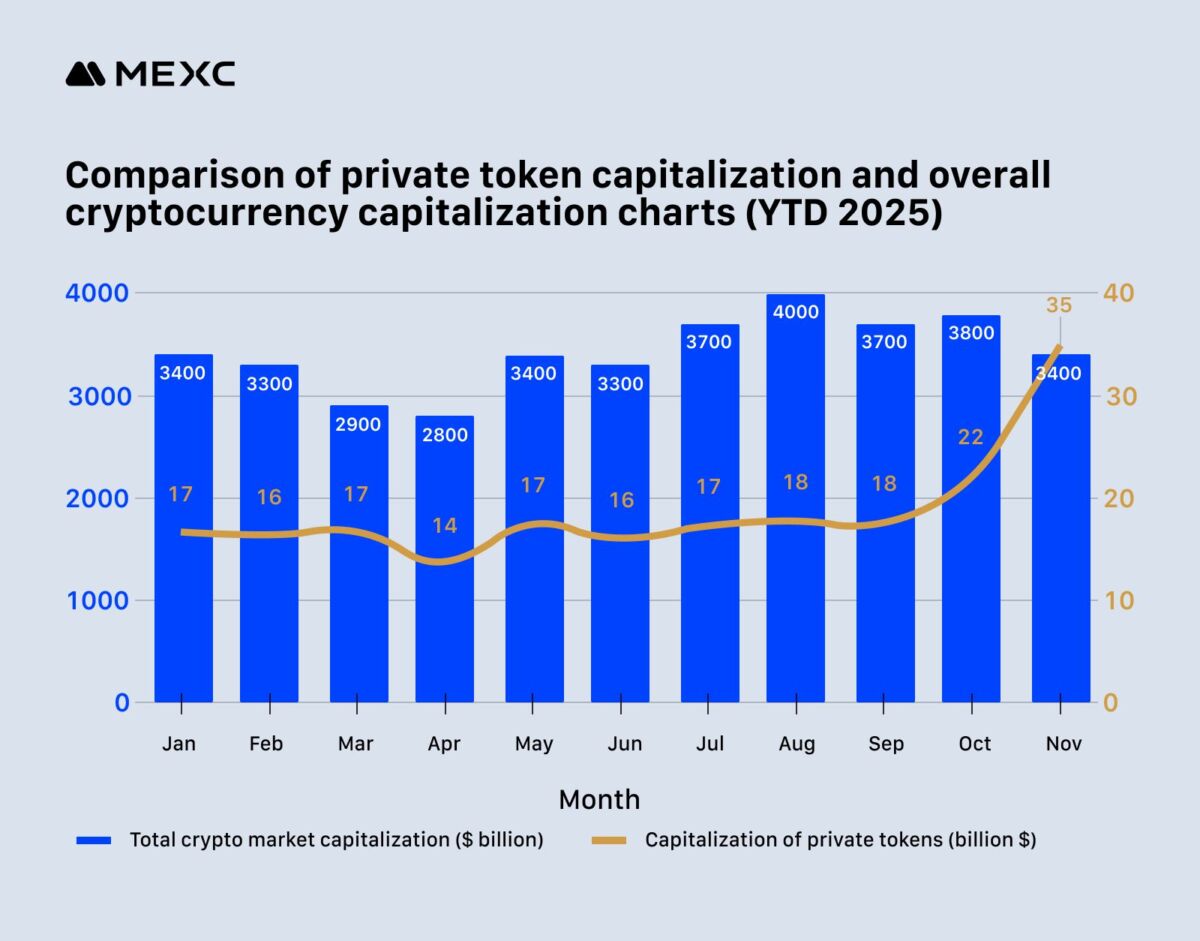

The shift is already visible in market data. The combined capitalisation of privacy-focused tokens such as Monero, ZCash and Dash has surged 335% since January, compared with the broader market’s modest 20% gain. While many analysts attribute this surge to rising global demand for financial privacy amid geopolitical uncertainty, MEXC Research cites robust transaction demand in the Middle East, North Africa, and the CIS as one of the most important drivers.

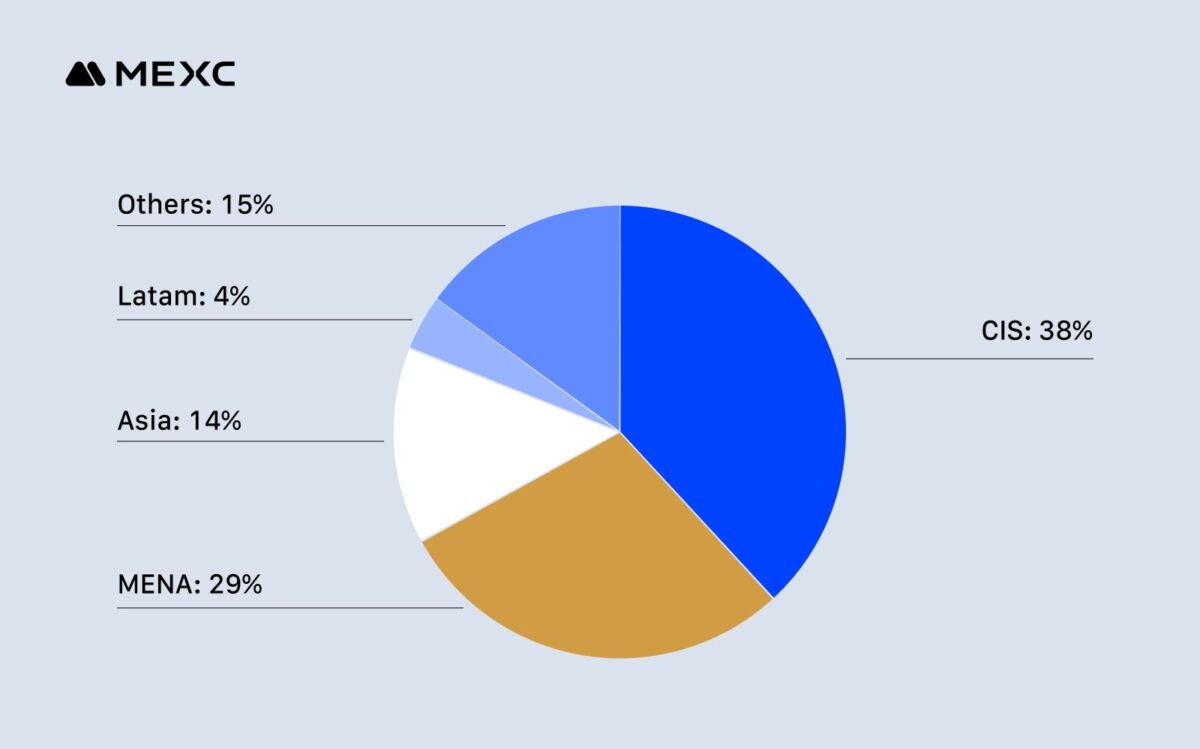

According to MEXC’s data, over 80% of global privacy coin trading volume currently comes from the MENA (Middle East and North Africa), CIS (Commonwealth of Independent States) and SEA (Southeast Asia) regions, where privacy is becoming a necessity.

Research Methodology

The research combines MEXC’s proprietary data with on-chain indicators sourced from Kaiko, Messari, Coingecko, Chainalysis, and Glassnode. All figures are presented as averages as of November 30, 2025.

Market Size and Current Status

Growth in the privacy-coin market has remained consistently firm in recent months.In November 2025, the sector’s total market capitalization exceeded $34 billion, representing 1.1% of the total market capitalization, demonstrating its growing role in cryptocurrency market liquidity. For comparison, two of the market’s most visible narrative sectors — memecoins and real-world assets (RWA) — currently account for 1.57% ($50.2 billion) and 1.74% ($55.6 billion) of total capitalization, respectively. Against this backdrop, privacy tokens are rapidly closing the gap, supported by growing demand for both hedging and cross-border payments amid broader market volatility, tighter economic scrutiny, and escalating geopolitical pressures.

Figure 1. Comparison of Privacy-Token Market Capitalization and Total Cryptocurrency Market Capitalization (YTD 2025)

Privacy Market Geography

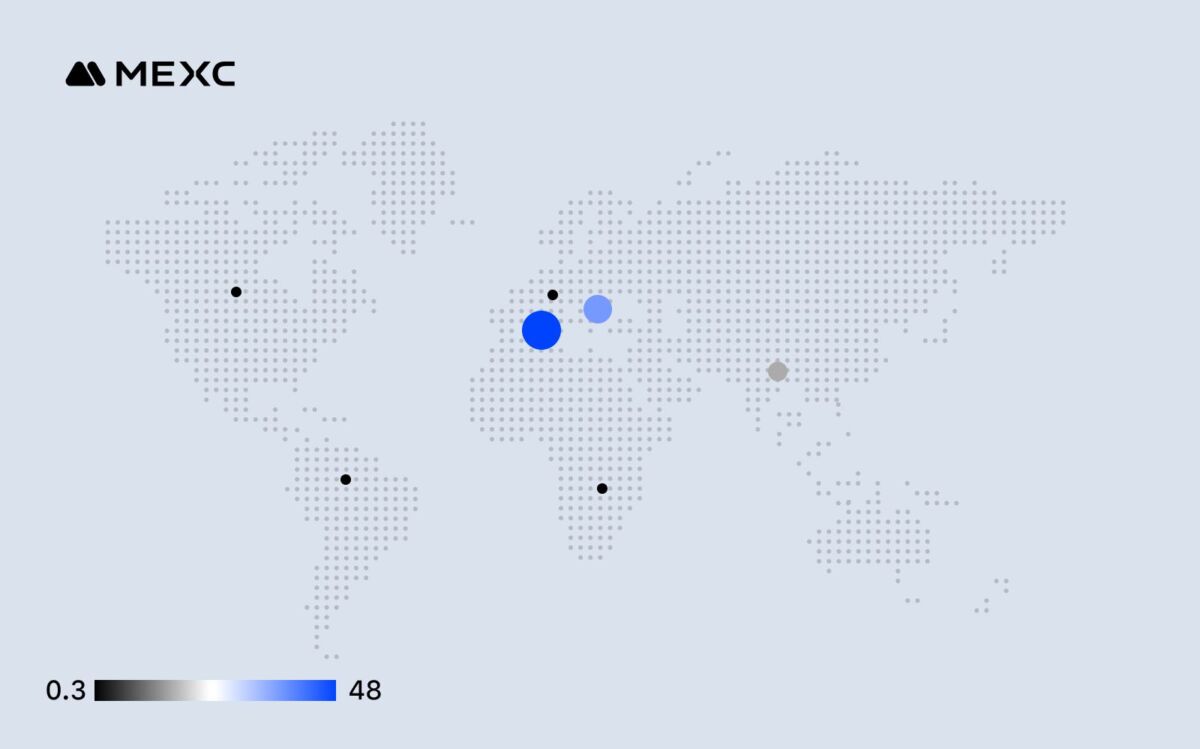

Private assets are no longer the domain of Western investors or early adopters. Before 2021, a significant share of privacy-focused cryptocurrency trading was concentrated in Europe, North America, and developed Asian markets. Today, however, countries across the Middle East, Southeast Asia and the CIS account for 81% of global privacy coin trading. These regions are also seeing the fastest growth in newly active wallets and on-chain transaction activity associated with these types of assets.

In particular, users in the CIS and MENA regions accounted for 38% and 29% of all privacy cryptocurrency transactions in Q3–Q4 2025, respectively, followed by SEA (14%) and Latin America (4%).

At the local level, private assets increasingly function as a buffer against prolonged inflation, depreciating currencies and the mounting barriers to international payments.

The data capture activity across exchange trading as well as user-to-user transfers, which can often be used to compensate contractors or substitute for digital cash where local banking options are prohibitively expensive or unavailable. In some cases, these assets now operate much like physical cash—evident in brief holding times, typical transaction values near $1,600 and consistently high turnover.

Figure 2. Global Distribution of Privacy-Token Trading Volumes (Q3-Q4 2025)

The growing interest in private assets reflects underlying processes in the global financial system. 2025 marked the beginning of tightened capital controls: Europe implemented MiCA, the US introduced new FinCEN reporting standards, and the FATF introduced the expanded Travel Rule 2.0. Trading platforms and payment systems are now required to disclose the personal data of senders and recipients, even for domestic transfers, and limits of $3,000–5,000 make microtransactions unsafe from an anonymity standpoint.

Figure 3. World map highlighting the regions with the highest privacy-coin activity

As a result, users in countries grappling with weak currencies or high inflation have begun to look beyond stablecoins for alternatives. USDT and USDC have long been the gold standard for hedging and cross-border transactions. Still, dollar-dependent currencies lacked the maximum privacy and independence from banks offered by such assets as Monero and ZCash. In Turkey, inflation exceeded 32.8% by October, and SWIFT transfers became more expensive and slower. Meanwhile, the UAE and Saudi Arabia have expanded their presence in the crypto market for several years, supported by favorable regulation and the migration of crypto companies from less welcoming jurisdictions.

Institutional Segment

MEXC data show a 210% jump in institutional transaction volume in the privacy-token segment during the Q4’25.

Investors in MENA showed particular interest, with ZEC and XMR accounting for 11% of total institutional transactions in the crypto segment in Q3-Q4 2025. In Latin America, the CIS, and Southeast Asia, these figures were significantly lower — 6%, 4%, and 2%, respectively. Institutional interest in private assets was strongest in the MENA region, where transactions with ZEC and XMR accounted for 11% of all institutional transactions in the cryptocurrency segment in Q3–Q4 2025. Local investors opted for XMR and ZEC for large transfers that require confidentiality, tolerance for latency, and minimal bank oversight.

In Latin America and the CIS, institutional demand for privacy coins is lower — 6% and 4%, respectively. Large local companies face greater regulatory uncertainty and less integration of such assets into corporate processes, limiting their participation in the segment. Meanwhile, such assets are primarily sought after by retail users, who use them to circumvent currency restrictions or hedge against inflation.

In Southeast Asia, the share of institutional transactions related to privacy coins is minimal (2%) due to the local market’s focus on high-frequency trading and the widespread use of stablecoins, which serve as the primary payment instrument. As a result, privacy tokens remain a niche product in the region, not integrated into the transaction infrastructure of regional institutions.

Private tokens for local investors in the regions mentioned above could serve as an additional tool alongside Bitcoin and stablecoins in the event of increased controls on dollar liquidity or stricter reporting requirements for traditional instruments. While their portfolio share averages just 4 per cent, these assets provide a crucial buffer, enabling swift restructuring of payment channels should regulatory conditions shift abruptly.

Amid growing global oversight of stablecoins, tightening requirements for funding sources, and expanding sanctions lists, large businesses and active capital holders are using private tokens as a safety net. Though unlikely to become foundational, such assets are increasingly serving as a significant secondary layer within the financial architecture. For cryptocurrency exchanges, this means the private segment is no longer a niche market for retail and is emerging as a distinct institutional market with its own demand logic, risks, and regulatory expectations.

Global Surge in Private Transactions in Q4

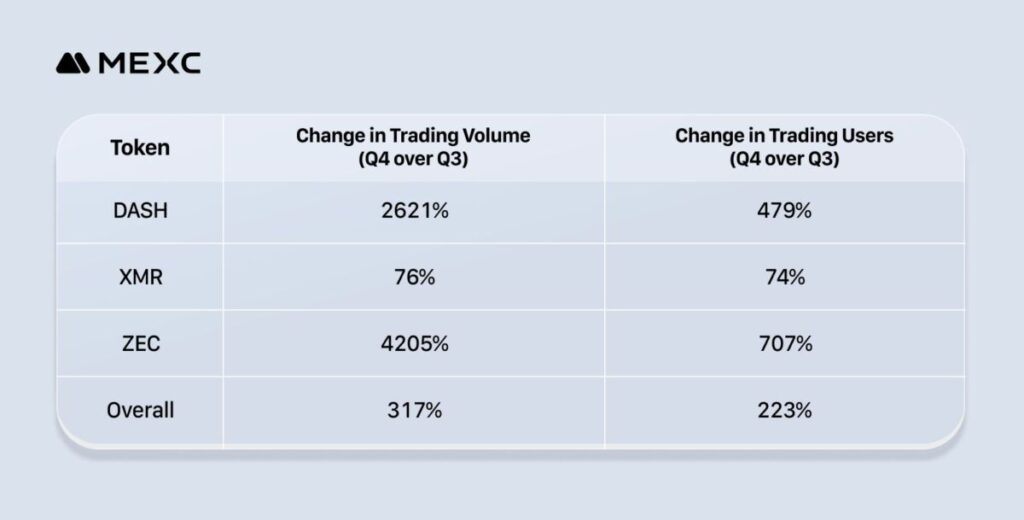

Despite the continued dominance of USDT and USDC in global markets, 1 in 5 privacy coin traders converted stablecoin holdings into privacy assets. In Q3-Q4 2025, 28% of all XMR transactions, 37% of all ZCash transactions, and 17% of DASH transactions involved conversion from USDT, which may indicate a gradual capital rotation and the growing demand for privacy.

These flows coincide with a sharp increase in volume and user activity in the privacy coin segment globally, especially in Q4. DASH trading volume grew by 2,621% and ZEC by 4,205% since October, while the number of active traders increased by 479% and 707%, respectively. XMR demonstrated more moderate but still significant growth: trading volume grew by 76% and the number of traders by 74%.

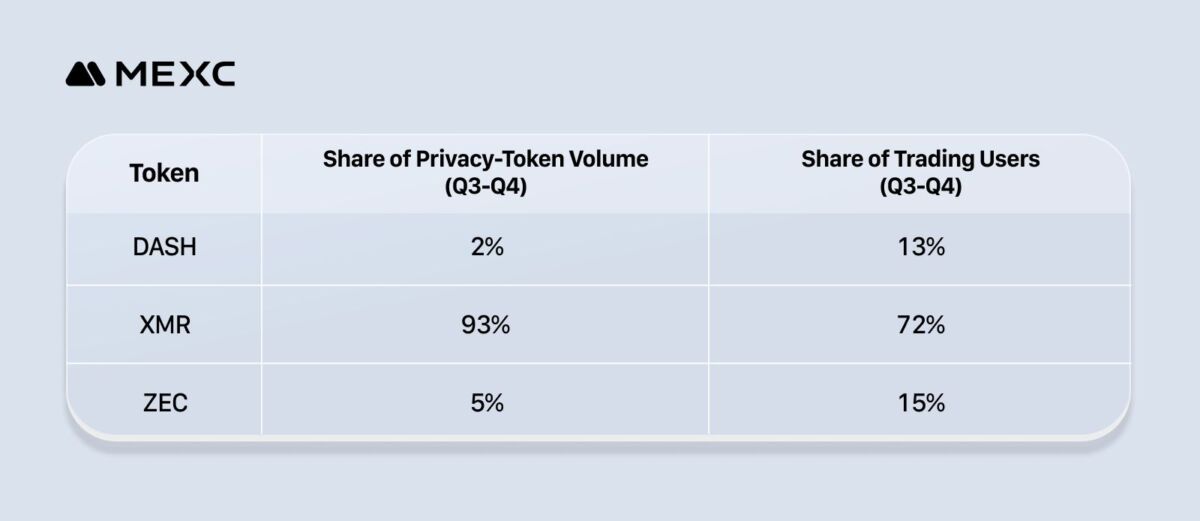

Despite ZEC and DASH posting record-high trading volumes, Monero remains an asset of choice among privacy coin traders, accounting for 93% of total trading volume in Q3–Q4 and 72% of users in this segment. ZEC and DASH hold smaller but stable shares, reflecting their functional use cases in more specific scenarios — from fast transfers to private settlements and local P2P transactions. Taken together, the data show that in regions with high sensitivity to monetary instability, privacy assets are becoming a critical parallel financial system rather than a secondary market segment.

Increasing Regional Segmentation and the Likelihood of Further Sector Growth

Although 2025 has seen a surge in demand for privacy-oriented cryptocurrencies, the market’s expansion is occurring alongside persistent systemic risks. Regulatory pressure and infrastructural constraints remain the most prominent, with private tokens facing intensified AML and KYC scrutiny.

In the EU, the MiCA II mechanism introduces additional requirements for assets offering enhanced anonymity. In the US, the list of so-called non-compliant assets is expanding, and several Asian countries periodically tighten targeted controls on Monero and ZCash.

These measures effectively limit the availability of privacy coins in Western jurisdictions but paradoxically increase their demand in countries with less integrated financial infrastructure aligned with Western reporting standards. In the Middle East, North Africa, Southeast Asia, and the CIS, private tokens are becoming not just an investment tool but a part of the everyday payment infrastructure. This is leading to accelerated geographic segmentation of the market: liquidity is concentrated around a few key regions, simultaneously strengthening robust transaction demand and increasing the sector’s dependence on a limited number of markets.

Current on-chain data dynamics, P2P payment volumes, and the regional distribution of trading activity hint at further growth potential in the private sector. The segment will likely continue to grow through the end of 2025 and may enter an accelerated expansion phase in the first half of 2026, driven by a combination of factors such as:

- accelerating de-dollarization in developing economies;

- strengthening currency and banking restrictions;

- growing demand for privacy as an element of financial security;

- active development of the Telegram/TON ecosystem and the emergence of new decentralized payment gateways;

- high institutional involvement in ZK technologies.

As privacy assets break from traditional market cycles and begin to move in step with deeper political and economic undercurrents, a clearer future is coming into view. The developments in MENA and the CIS point to where the industry is heading: toward a more self-reliant ecosystem, insulated from macro turbulence and driven above all by real-world transactional demand.

Join MEXC and Get up to $10,000 Bonus!

Sign Up