US Federal Reserve on the eve of expected reduced the discount rate by 0.25%.

Most American investment banks on the eve of the Fed meeting predicted easing of monetary policy against the background of moderate inflation.

In parallel, financial giants such as JPMorgan and Morgan Stanley announced that in December, most likely, the regulator will refrain from cutting the rate and keep it at its current level.

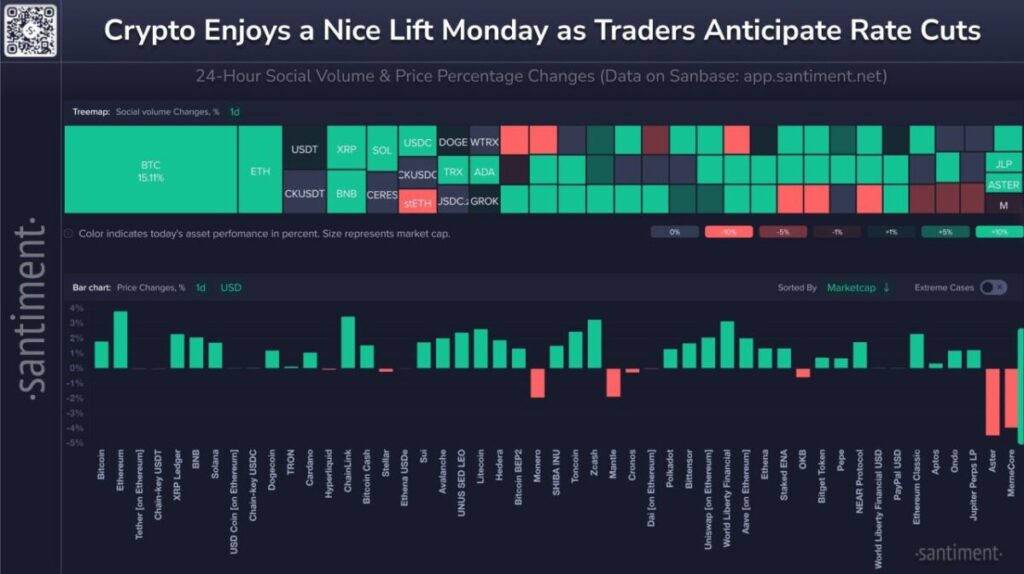

On the eve of the Fed meeting in the cryptocurrency market increased bullish sentiment increased. As a result, on Monday, bitcoin (BTC) jumped above $116,000 for a long time. At the same moment, the air (ETH) was trading at $4,240.

- The subsequent correction of BTC and ETH rates suggests that the leading digital currencies against the background of positive in social networks quickly reached a local peak.

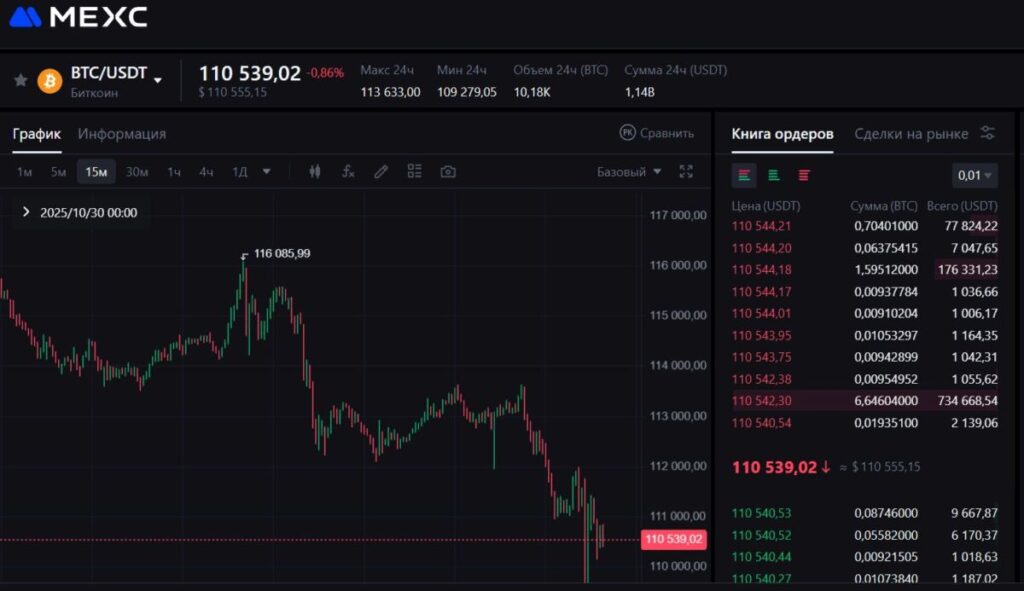

On the MEXC exchange MEXC bitcoin slipped below 110,000 USDT the day before the publication of the rate decision. At the same time, the US stock market, on the contrary, at the same time showed steady growth.

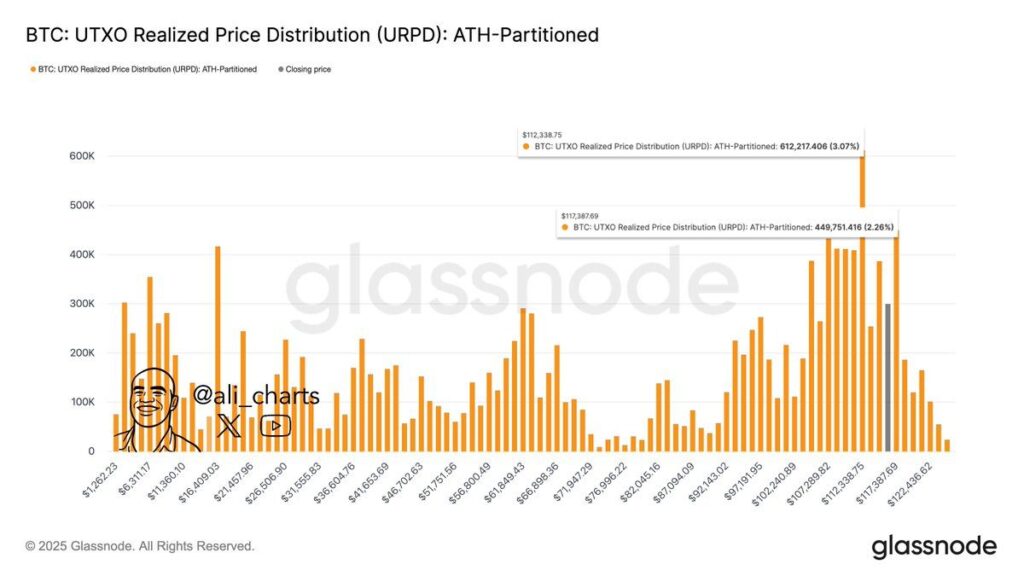

The BTC rate began to strengthen after the announcement of policy easing, the coin will try to approach the nearest resistance zone, formed at $117,387.

Bitcoin volatility escalated after the Fed statement

Targeted activity in the bitcoin network began to intensify after the announcement of the Federal Reserve to ease monetary policy.

The number of wallets regularly sending and receiving funds exceeded 700,000 the day before (according to Santiment).

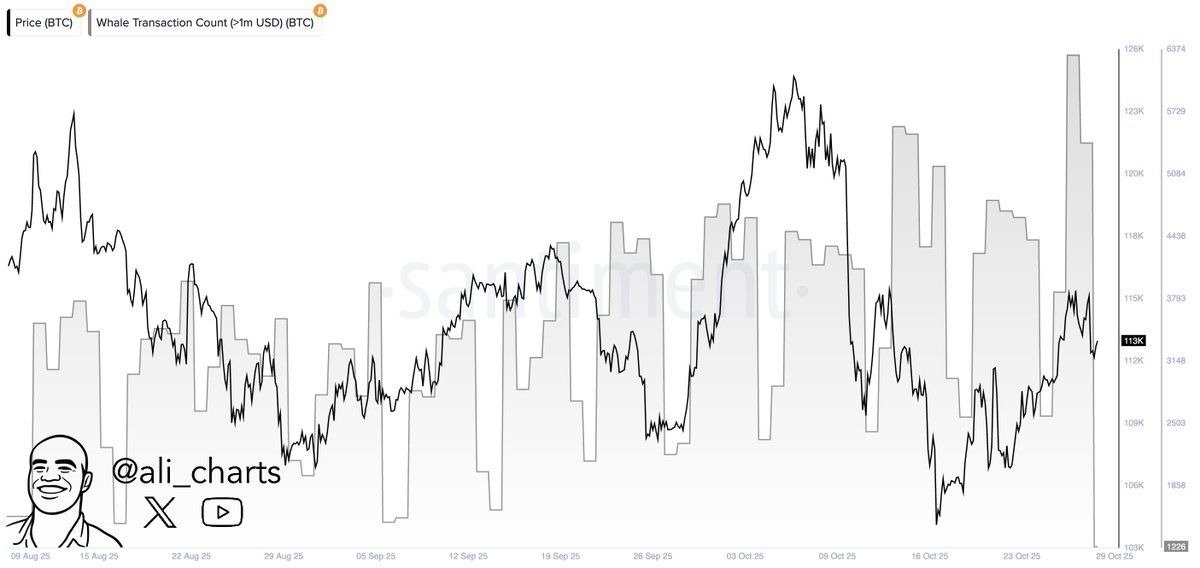

In parallel, analysts recorded the most powerful whale swim in the past two months. The number of transactions in the blockchain for amounts from $1 million reached 6,311. Support at $112,340 did not work on Wednesday evening, and BTC dropped below $110,000.

On the MEXC exchange, the local bottom formed at 109,279 USDT. On the night of Thursday, October 30, the BTC rate approached 111,000 USDT. Most likely, the whales recorded profits and returned to accumulation after the American regulator reduced the discount rate.

The amplitude of fluctuations of the largest digital currency has increased due to the activation of traders.

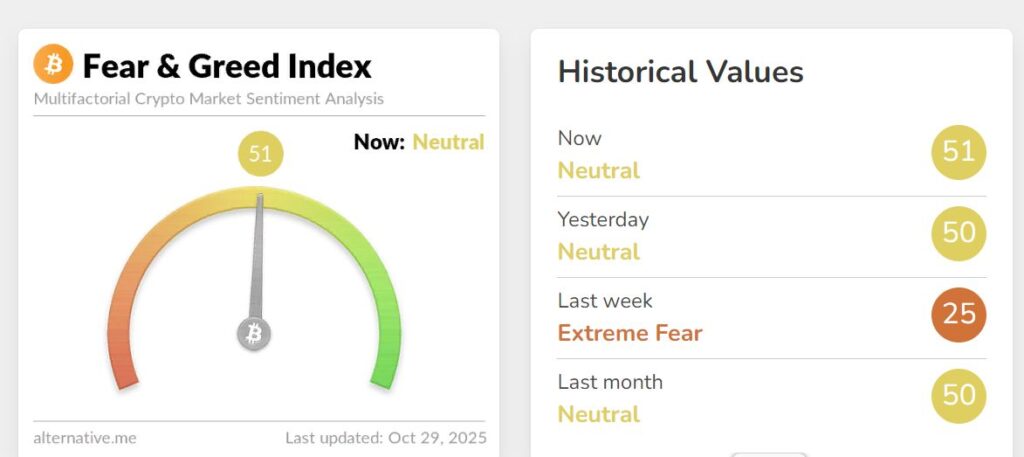

- index of fear and greed on the eve grew to the maximum level since the beginning of October, but is still in a neutral zone. That is, most investors focus on waiting tactics and are in no hurry to enter the asset. Usually at such moments, the market reaches fundamental values, and the risks of new sales are reduced.

The zone of strong resistance is at $117,390. To approach it, support should increase dramatically in the coming days.

First of all, investing in BTC should increase whale and shark wallets holding more than 10 coins.

On social networks at the beginning of this week, the number of posts with calls to buy cryptocurrency increased. Users of Telegram, Reddit, X and 4Chat expected a reduction in the Fed discount rate, so communities were dominated by positive sentiments.

Calls to buy right now have been addressed to retail traders in order to support bitcoin.

- The subsequent profit fixing was inevitable, since usually in optimistic periods the asset reaches a local peak. After that, some large and medium-sized investors dump the accumulated coins in order to make quick money, the MEXC Research team notes.

Bears will try to keep bitcoin below $114,000

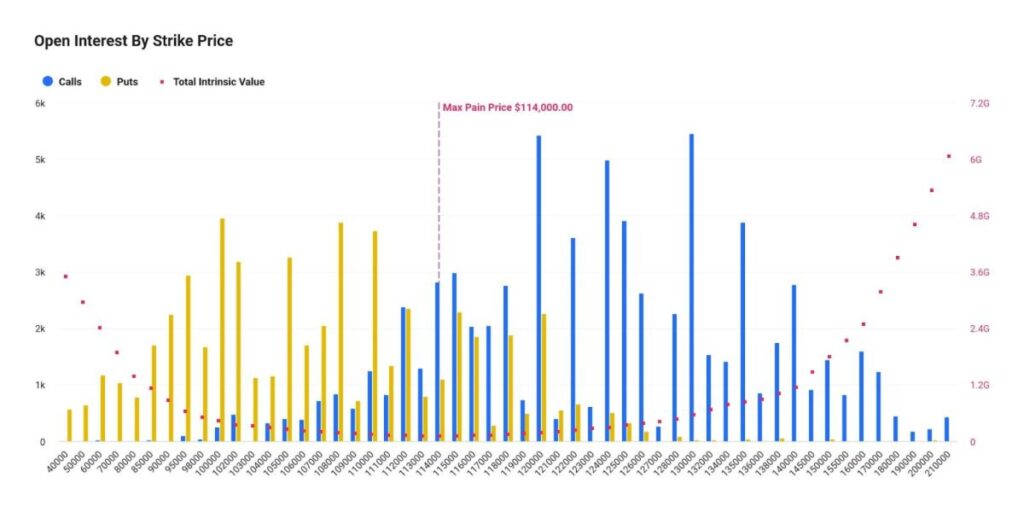

Volatility in the cryptocurrency market is aggravated not only in connection with the decision of the Fed to reduce the discount rate, but also in connection with the approaching expansion of October options for bitcoin.

This coming Friday, contracts worth $14.42 billion will expire.

- Expedition of 127,000 BTC options is expected on the morning of October 31. The maximum pain threshold is set at $114,000 with a Put / Call contract ratio of 0.76.

Before options expire, turbulence usually turbulence returns not only to the spot market, but also to the crypto derivatives market.

The rate on perpetual swaps on MEXC on the eve went into into the negative zone amid the retreat of bitcoin.

Traders doubt that in the coming days the largest cryptocurrency will be able to resume expansion and achieve good results. Investors put on a gradual narrowing of the volume of trading as the asset enters the consolidation phase.

The same sentiment prevails in the options market. The return of support leveled the risks of falling below $109,000, but the bullish trend has not yet been able to become dominant.

- Another deterrent is the US-China trade talks, which are due to take place this week. Bears in the next 24 hours will try to maintain their leading position and keep BTC below $114,000.

- Bulls, by contrast, are interested in the coin bouncing above this psychological mark. In most Call options with expiration in October, strikes range from $120,000 to $130,000.

It is unlikely that the price of BTC will soar to this level in a day, so these contracts will be canceled on October 31.

Disclaimer: This information is not investment, tax, legal, financial, accounting, advisory or any other related services advice, nor is it advice to buy, sell or hold any assets. MEXC Training provides information for reference purposes only and is not investment advice. Please ensure that you fully understand all risks and exercise caution when investing. The platform is not responsible for users’ investment decisions.

Join MEXC and Get up to $10,000 Bonus!