The cryptocurrency market entered September 2025 with cautious optimism after months of regulatory debates, institutional adoption signals, and fresh retail participation. But beneath the surface, malicious actors were preparing one of the most damaging months in recent memory. According to blockchain security firm CertiK, crypto investors and projects collectively lost more than $155.9 million in September alone to hacks, scams, and exploits.

This staggering figure is not just a number but it represents broken trust, drained liquidity, and heightened fears about whether the crypto ecosystem is maturing fast enough to withstand increasingly sophisticated attacks. For exchanges, developers, and investors alike, the report serves as a wake-up call: security is not a secondary concern in Web3 but it is the foundation of survival.

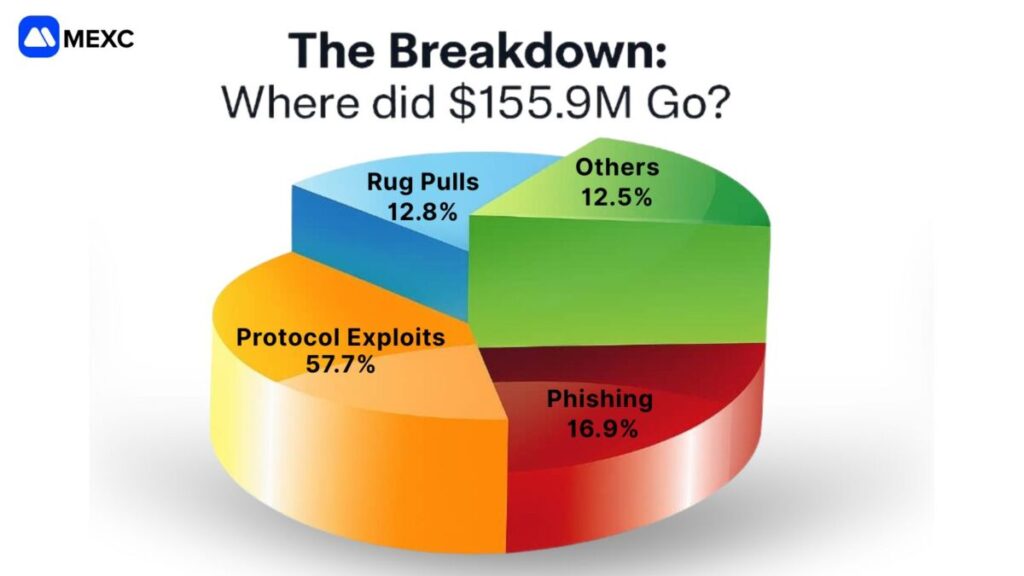

1.The Breakdown: Where Did $155.9M Go?

CertiK’s September report paints a grim picture:

Phishing Attacks: $26.4 million lost

Protocol Exploits & Vulnerabilities: Over $90 million

Rug Pulls & Exit Scams: $20 million

Other Scams (fake airdrops, social engineering): Balance of the total

Phishing, the oldest trick in the cyber playbook which accounted for a surprisingly high share of the damage. Despite countless warnings, malicious links, impersonation accounts, and wallet-draining apps continue to deceive both retail and semi-professional investors.

Protocol exploits, however, remain the most damaging. Attackers target weaknesses in smart contracts, bridges, and Decentralized Finance (DeFi) protocols. Even established projects with millions in Total Value Locked (TVL) were not immune.

2.Major Incidents in September

To understand the human and financial toll behind the numbers, it’s worth revisiting some of the month’s largest and most publicized attacks:

Cross-Chain Bridge Breach

A major cross-chain bridge connecting Ethereum to a layer-2 solution was drained of nearly $30 million after an attacker exploited a flaw in its verification logic. This event once again highlighted bridges as one of the most vulnerable components of the crypto ecosystem.

DeFi Lending Protocol Exploit

A well-known DeFi lending platform lost over $20 million when attackers manipulated oracle price feeds. Despite audits and bug bounty programs, the incident underscored that DeFi protocols remain highly exposed to manipulation.

High-Profile Phishing Scam

Several influencers reported their followers being lured into connecting wallets to fake “staking platforms” that promised double rewards. Over $10 million vanished through this coordinated campaign.

Rug Pull of a Promising Token

A newly launched memecoin, which gained traction on social media, disappeared overnight when its developers drained liquidity pools and abandoned the project. Losses were estimated at $8 million.

Each of these stories reflects different weaknesses — human psychology, coding errors, or governance loopholes — but together they show the multi-front battle crypto security is facing.

3.Industry Reactions: Security Under the Spotlight

The $155.9M figure sparked widespread debate in the industry.

- Security firms called for mandatory smart contract audits before token listings.

- Exchanges reiterated their commitment to stronger due diligence on new listings and proactive wallet monitoring.

- Developers voiced frustration that audits alone cannot stop exploits, therefore, ongoing monitoring and quick patching are equally critical.

- Investors pushed for better education and awareness campaigns to recognize phishing and rug pulls.

At the institutional level, regulators are likely to use the report as further justification for tighter controls on DeFi and centralized exchanges. The narrative that “crypto is unsafe” gains traction every time such figures are published, therefore, shaping regulatory agendas in the U.S, UK, EU, and emerging markets.

4.The Market Impact

Interestingly, while the security breaches shook confidence, their immediate impact on token prices was less dramatic than expected. Bitcoin and Ethereum continued to trade within established ranges, while some DeFi governance tokens dipped temporarily before recovering.

This suggests two key things:

- Investors are becoming desensitized to hacks, seeing them as unfortunate but inevitable in crypto.

- Exchanges and protocols are absorbing shocks faster, restoring operations, and compensating users in some cases.

Yet beneath the market resilience lies a deeper problem because each hack slowly erodes long-term trust. Institutional investors, who weigh risk heavily, may hesitate before allocating billions into systems perceived as vulnerable.

5.Comparing September to Previous Months

To put the $155.9M into perspective:

August 2025: $320M in losses, largely due to one major cross-chain exploit.

July 2025: $240M in losses, spread across several large DeFi incidents.

September 2024 (one year ago): $330M in damages, highlighted by a single exploit.

Thus, while September 2025 was not the worst month in history, it was significant because of the sheer number of smaller incidents rather than one catastrophic breach. This trend shows attackers are diversifying targets, testing multiple vectors, and succeeding at scale.

6.Why Are Hacks Still So Frequent?

Several factors explain why the industry continues to bleed funds:

- Code Complexity: Smart contracts are unforgiving; one overlooked bug can mean millions lost.

- Rapid Innovation: Protocols rush to market, sometimes sacrificing rigorous security testing.

- Cross-Chain Vulnerabilities: Bridges remain a high-value target with weak defenses.

- Low User Awareness: Phishing and social engineering thrive because many retail users are still new.

- Regulatory Arbitrage: Projects launch in less strict jurisdictions, evading oversight.

7.How Exchanges Like MEXC Are Responding

Exchanges remain the most visible gateways into crypto and therefore the most trusted by retail investors. MEXC, alongside other top exchanges, has responded with:

- Multi-layer defense by combining cold-hot wallet separation, multi-signature approvals, real-time risk monitoring, enhanced KYC/AML checks, regular security audits, user tools like 2FA and withdrawal whitelists.

- Real-time monitoring of wallet flows to detect exploit patterns.

- Insurance funds to cover user losses in rare cases.

- Strict listing standards requiring audits and background checks on new tokens.

- Education campaigns warning users about phishing links and scams.

By proactively investing in advanced security, MEXC continues to set itself apart in an industry where safety has become the ultimate competitive advantage.

8.Regulatory Lens: Global Watchdogs Take Notice

The Financial Action Task Force (FATF) has been pressuring countries to strengthen anti-money laundering (AML) and fraud detection in crypto. Recent reports suggest regulators want powers to freeze crypto assets linked to suspicious activity.

Meanwhile:

- The U.S. SEC continues to scrutinize DeFi protocols.

- The UK FCA is increasing pressure on unregistered exchanges.

- The EU MiCA framework now requires stricter licensing for service providers.

- Nigeria is introducing fines and new licensing regimes to curb fraud.

The $155.9M September losses will likely fuel further crackdowns.

9.Building a Safer Future: Solutions in Progress

The crypto community is not standing still. Several promising initiatives are emerging such as;

- Formal Verification Tools: Mathematical proof of smart contract safety.

- Decentralized Insurance Protocols: Covering user losses from exploits.

- Bug Bounty Programs: Incentivizing ethical hackers to report flaws.

- User Education Platforms: Teaching safe wallet practices.

- AI-Driven Threat Detection: Monitoring unusual activity in real time.

As these solutions mature, they may reduce the frequency and scale of attacks.

10.Conclusion: A Crisis or an Opportunity?

The $155.9 million lost in September 2025 is both alarming and instructive. It reminds the industry that crypto is still evolving,it is also a frontier with immense opportunity but real dangers.

For investors, it is a call to exercise vigilance. For developers, it is a push to prioritize security over speed. For exchanges like MEXC, it is an opportunity to build trust through transparent security practices. And for regulators, it strengthens the case for global cooperation on digital asset oversight.

Whether history remembers September 2025 as just another bad month or as a turning point will depend on how the industry acts now. One thing is certain: in crypto, security is not optional but it is destiny.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up