Stablecoin net flows, trading volumes, and funding rates are now core benchmarks for crypto market intelligence. Net flows signal capital positioning, volumes validate execution strength, and funding rates reveal leverage dynamics. Together, they provide a precise snapshot of liquidity, sentiment, and momentum, indispensable for traders and institutions navigating market direction.

This combined perspective is known as the Stablecoin Signal Framework. By reading these three metrics in harmony, market participants can anticipate shifts earlier, manage risk more effectively, and sharpen their trading strategies.

1.Understanding the Core Metrics

1.1 Net Flows: The Capital Pulse

Stablecoin net flows measure how much dollar-backed liquidity is entering or exiting exchanges within a given timeframe. These movements are powerful because they often precede trading activity:

- Inflows typically mean fresh capital is being mobilized and prepared for deployment.

- Outflows suggest capital is leaving exchanges, signaling de-risking, profit taking, or moves into self-custody or DeFi protocols.

Traders treat net flows as a capital radar. When inflows spike sharply across multiple exchanges, it often marks the preparation stage for significant price action. Conversely, when outflows dominate, risk appetite is shrinking, and volatility may subside.

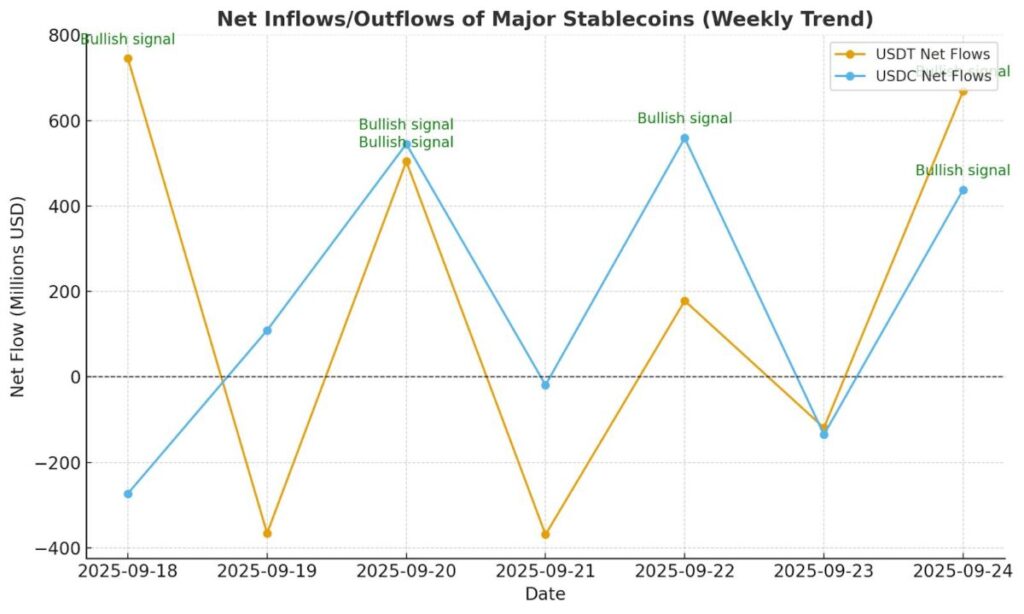

Here’s the line chart showing weekly net inflows and outflows of USDT and USDC, with annotations marking bullish and bearish signals

1.2 Trading Volumes: Execution in Action

While net flows show intent, trading volumes confirm execution. They measure the level of actual trading activity on spot and derivative markets.

- Rising volume with inflows → confirms capital is being deployed in trades, often fueling short-term rallies or sharp sell offs.

- Inflows without volume → suggests funds are being staged, not yet deployed. This “silent buildup” can precede explosive volatility once execution begins.

Volume also helps separate market noise from conviction. A price move with weak volume is less reliable than one supported by surging execution.

1.4 Funding Rates: The Leverage Barometer

Perpetual futures are among the most traded instruments in crypto, and funding rates determine the cost of holding long or short positions.

- Positive funding rates → longs pay shorts. This usually signals bullish positioning and leverage stacking.

- Negative funding rates → shorts pay longs. This points to defensive positioning, hedging, or bearish sentiment.

Funding rates are critical because they often move before prices react, making them a leading sentiment indicator. Monitoring divergence (e.g., BTC funding rising while ETH funding falls) can also uncover rotation trends.

1.5 Interpreting Signals Together

The Stablecoin Signal Framework is most powerful when metrics are layered, not isolated. Different combinations create different interpretations:

- Inflows + rising volume + positive funding → Strong bullish conviction. Fresh capital is flowing in, execution is active, and leverage favors longs. Breakouts are highly probable.

- Inflows + flat volume → Capital staging. Money is on exchanges but not yet deployed. Once volumes pick up, price action can turn explosive.

- Outflows + declining volume + negative funding → De-risking phase. Traders are pulling capital, activity is fading, and sentiment is bearish. Expect pullbacks or range bound conditions.

This layered interpretation transforms scattered data points into a coherent narrative of what the market is preparing to do.

2.Practical Application for Traders

How can traders apply the framework on MEXC and other exchanges?

- Start with net flows: Watch stablecoin movements into/out of major exchanges daily. Spikes often foreshadow activity.

- Confirm with volume: Pair flow data with actual trading activity. Inflows without matching volume = staging; inflows with strong volume = execution.

- Layer funding rates: Assess whether leverage is aligning with flows and volume. Divergences flag caution.

2.1 Example Workflow

- BTC sees a $500M stablecoin inflow.

- Spot and derivative volumes rise 30% on MEXC.

- Funding turns increasingly positive.

Interpretation: Bullish alignment → market may be preparing for a breakout. A trader could position with measured longs or scale into spot, while keeping stop-losses in place in case of reversal.

2.2 Risk Management Tips

- If funding becomes excessively positive, consider trimming exposure liquidations can reverse trends quickly.

- If inflows surge but volume lags, consider waiting; premature entries risk capital before conviction builds.

- Use alerts and tiered orders to react quickly to shifts.

3.Institutional and Macro Implications

The Stablecoin Signal Framework isn’t just a retail tool institutions rely on it as well.

- Market makers track flows to manage liquidity provisioning.

- Hedge funds watch funding rates to detect over leveraged positioning.

- Cross border firms monitor stablecoin flows as substitutes for dollar movement in regions facing FX stress.

On the macro scale, stablecoin flows often mirror global dollar liquidity. When liquidity tightens globally, stablecoin supply contracts and outflows rise. During expansionary periods, inflows surge, signaling heightened appetite for risk assets.

This broader context makes the framework valuable for aligning crypto trading with global financial cycles.

4.Limitations and Considerations

Despite its power, the framework has caveats:

- Custodial transfers (e.g., between wallets of the same institution) may distort net flow data.

- Volume spikes may sometimes reflect arbitrage or bot activity rather than genuine sentiment.

- Funding data is exchange-specific and can diverge; cross-venue checks are necessary.

The solution is not to rely on any single number but to contextualize across metrics, venues, and timeframes.

5.Conclusion

The Stablecoin Signal Framework is more than a buzzword. By combining net flows, trading volumes, and funding rates, traders can construct a real-time picture of market positioning and sentiment.

- Net flows show where money is moving.

- Volumes confirm whether that money is active or idle.

- Funding rates reveal how leverage is shaping bias.

Together, they transform noise into a clear signal. For traders, this framework enables better timing, sharper risk management, and a strategic edge. For institutions, it links crypto market dynamics with global capital flows. When all three metrics align, conviction is high. When they diverge, caution is essential. Mastering this framework is no longer optional, it’s the new standard for reading the market’s heartbeat.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!