As the crypto market searches for a fresh narrative, an old theme is quietly making a strong return — privacy coins. These digital assets, once a dominant force during the 2017–2018 cycle, are now back in the spotlight as investors rediscover the importance of financial privacy in an increasingly regulated world.

1.Global Regulatory Crackdowns From East to West

Privacy coins are regaining attention amid intensifying financial surveillance from both the U.S. and Asia.

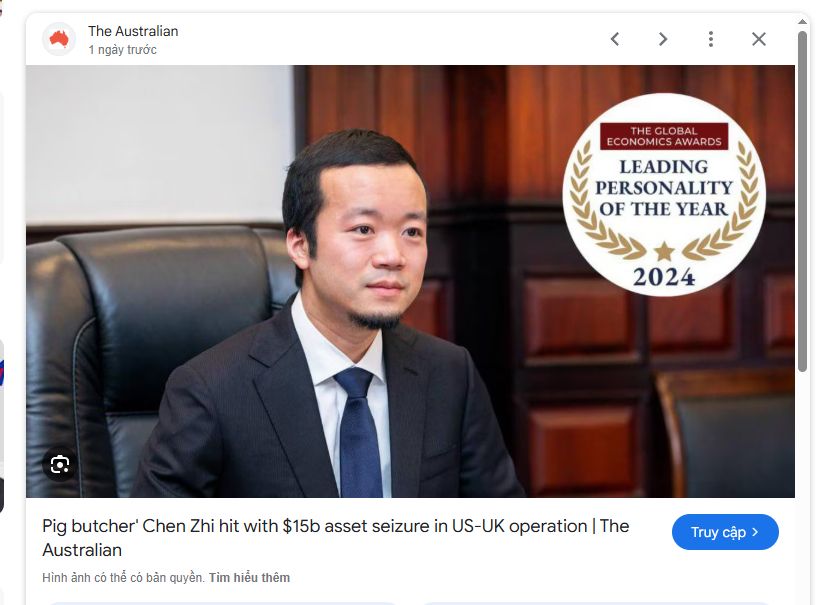

In the U.S., the Department of Justice (DOJ) recently executed the largest crypto seizure in history, confiscating 127,271 BTC tied to criminal charges against Chen Zhi, founder of Prince Group in Cambodia. Chen, who holds both British and Cambodian citizenship, faces accusations of money laundering and wire fraud.

The U.S. has classified Prince Group as a transnational criminal organization, allegedly running large-scale “pig butchering” scams — fraudulent romance schemes designed to steal victims’ money and crypto assets.

Blockchain analytics firm Elliptic traced the confiscated Bitcoin to a 2020 theft involving LuBian, a mining company operating across China and Iran. However, how this BTC ended up in the U.S. custody remains unclear — whether Chen, LuBian, or a third party was behind the theft is still an open question.

Meanwhile in Japan, the Financial Services Agency (FSA) is drafting a framework to prevent insider trading in crypto markets, according to Nikkei Asia. The Securities and Exchange Surveillance Commission (SESC) will gain new authority to investigate and sanction individuals or organizations violating crypto regulations.

By late 2025, Japan aims to revise its Financial Instruments and Exchange Act to strengthen market transparency and enforcement.

As both the U.S. and Japan tighten oversight, whales and early crypto adopters may increasingly turn to privacy-focused assets such as Monero (XMR) and Zcash (ZEC) to safeguard financial privacy against growing regulatory scrutiny.

2.Zcash Leading the Privacy Coin Revival

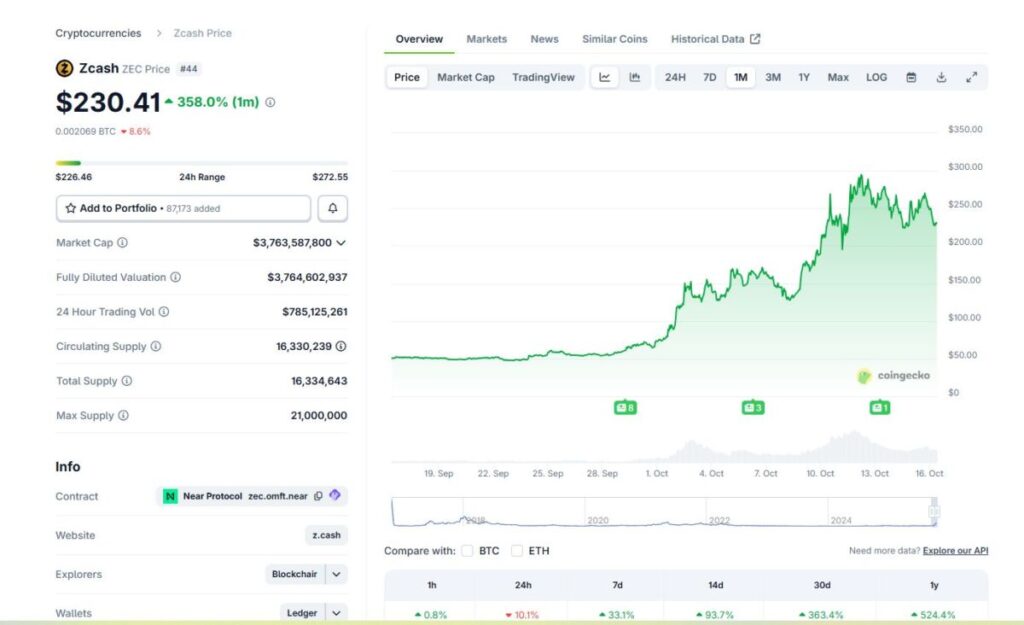

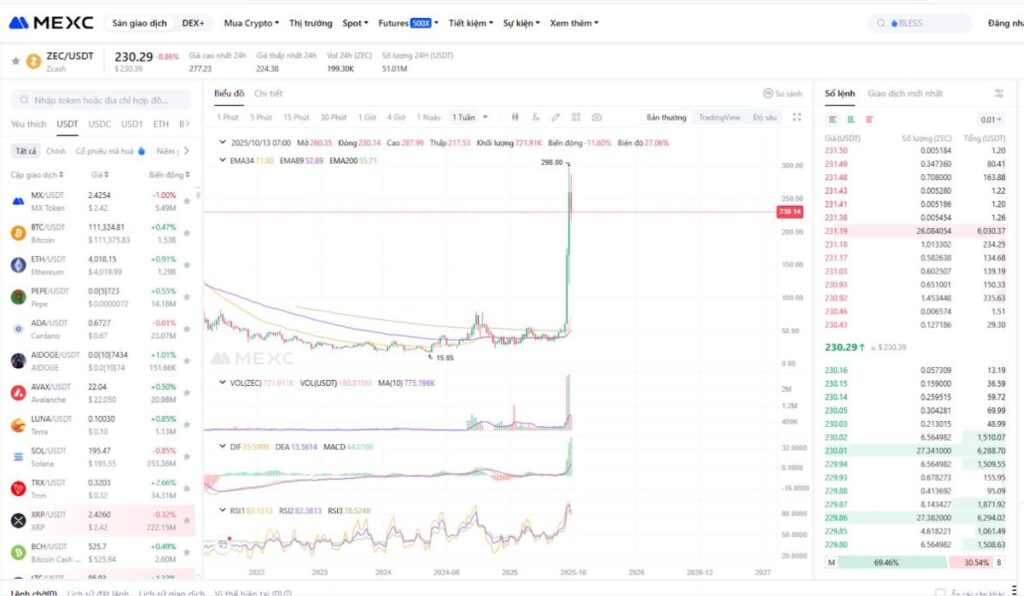

After years of dormancy, Zcash (ZEC) — a Bitcoin fork enhanced with zero-knowledge proof technology — has suddenly surged back into the spotlight, gaining nearly 240% in a month and hitting $290, its highest level since April 2022.

At the time of writing, ZEC trades around $260, up 30% in the past 24 hours. However, it still sits 95% below its 2016 all-time high of $3,200, leading many analysts to frame the move as a recovery phase rather than a new bull cycle.

The rally has been amplified by key crypto influencers reigniting discussion around Zcash on social media.

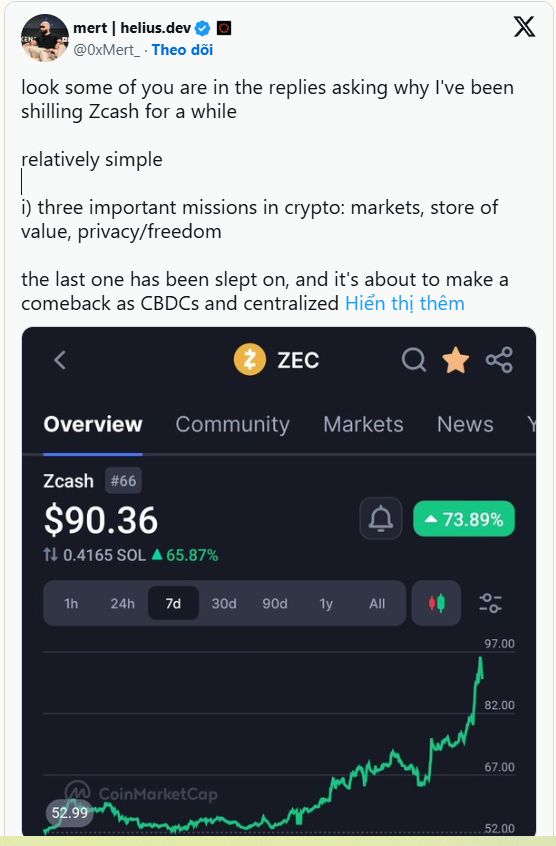

It started in early October when Mert Mumtaz, CEO of Helius Labs and a long-time ZEC supporter, posted a thread highlighting privacy as one of crypto’s “three core missions” — alongside markets and value storage. He argued that privacy has been neglected for too long but will soon resurface as a major theme amid the rise of CBDCs and increasing government surveillance.

Mert also noted that while Monero’s market cap had reached $5B, Zcash remained under $700M, despite stronger privacy design and scalability. He suggested ZEC was severely undervalued, predicting it could reach $1,000. His thread also showed a sharp rise in the number of shielded transactions on Zcash, signaling growing network activity.

Following Mert’s post, other major voices joined in:

- Chris Burniske of Placeholder VC shared a detailed Zcash report, noting its structural and narrative alignment with Bitcoin.

- Naval Ravikant, a respected tech investor, called Zcash “insurance against Bitcoin,” implying it complements BTC’s digital gold status by adding the missing privacy layer.

- Arthur Hayes, former BitMEX CEO, jumped into the conversation, publicly praising ZEC’s momentum and calling it a “strong buy for those with steel nerves.” He even hosted a mini giveaway of 10 ZEC for the funniest comment — a clear “shill move” that further fueled FOMO across crypto Twitter.

According to Messari, Zcash recorded a 1,000% surge in weekly interest on X (Twitter), ranking first in social growth among all crypto assets — a testament to its viral comeback.

3.Other Privacy Coins to Watch

For those who missed Zcash’s explosive run, several other privacy-focused tokens may ride the same narrative wave:

Verge (XVG) The Core v7.13.0 update (August 2025) deeply integrates Tor/I2P, improving IP obfuscation and transaction anonymity. XVG is now a top pick for cross-chain privacy payments (supports EVM, BSC, Polygon via Bridgers).

DASH In August 2025, DASH partnered with NymVPN (endorsed by Edward Snowden) to enable anonymous VPN payments through its PrivateSend mixing feature and a 5-hop metadata-resistant mixnet.

RAIL (Railgun) In May 2025, the Ethereum Foundation integrated Railgun into the Kohaku SDK, enabling MetaMask and OKX wallets to shield ERC-20, NFT, and DeFi transactions natively via zk-SNARKs. Railgun’s shielded TVL has surpassed $100M, with $3.5B in private volume. Notably, Vitalik Buterin used Railgun in June 2025 to transfer $2.6M in ETH/USDC — seen as a quiet endorsement of privacy pools, a concept he co-authored in 2023.

Tornado Cash (TORN) In January 2025, a U.S. court overturned the OFAC ban, ruling that immutable smart contracts cannot be sanctioned as “property.” This decision effectively reinstated Tornado Cash as a legitimate privacy tool on Ethereum. Vitalik has since called for clemency for founders Roman Storm and Alexey Pertsev. All of the above privacy coins have been listed on the MEXC exchange.

4. Favorable Macro Tailwinds

ZEC’s rally and the broader privacy coin revival aren’t just driven by internal fundamentals — global macro uncertainty is playing a massive role.

The escalating U.S.–China trade conflict has revived fears of a new tech decoupling era, with tighter restrictions on cross-border capital, chip exports, and blockchain infrastructure. This geopolitical tension has amplified concerns over financial surveillance and data control, pushing investors toward censorship-resistant assets.

As capital seeks off-grid alternatives, privacy coins are emerging as digital safe havens — offering protection from both market volatility and government overreach.

In a world where AI, data, and finance are converging under tighter state oversight, on-chain privacy is no longer a niche — it’s becoming the last line of defense for personal sovereignty in the digital age.

Disclaimer: This content does not constitute investment, tax, legal, financial, or accounting advice. MEXC provides this information for educational purposes only. Always DYOR, understand the risks, and invest responsibly.

Join MEXC and Get up to $10,000 Bonus!