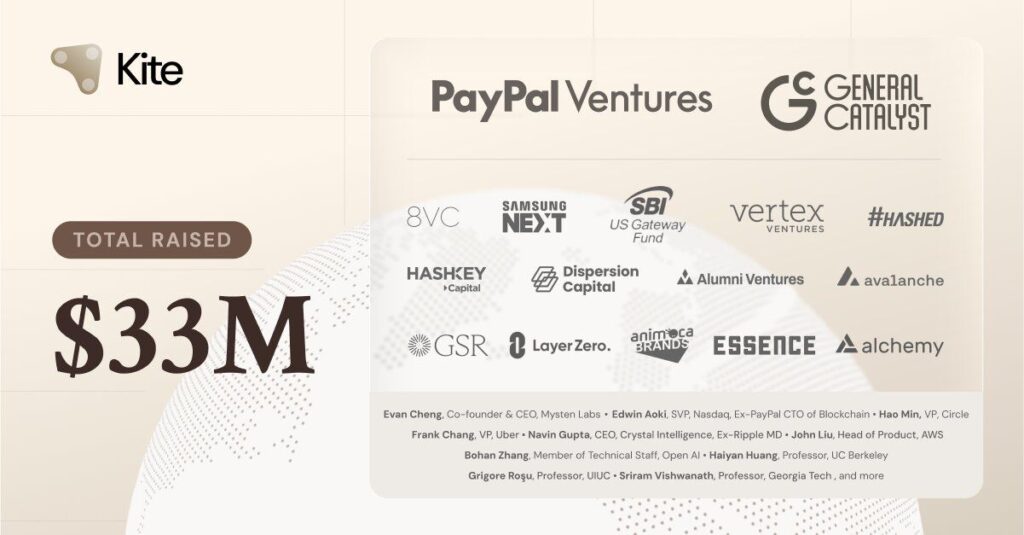

In September 2025, Kite AI announced an $18 million Series A funding round led by PayPal Ventures and General Catalyst, bringing total funding to $33 million. The round included participation from Samsung Next, 8VC, Alumni Ventures, and other prominent investors. Then, in October 2025, Coinbase Ventures joined with an additional investment, further validating Kite’s vision of becoming the foundational payment infrastructure for autonomous AI agents.

This isn’t just another AI startup raising venture capital. Kite is building something fundamentally different: a blockchain-based Layer-1 network specifically designed to enable AI agents to transact with each other autonomously, using stablecoins for millisecond-level settlement at near-zero cost. With venture capital firm a16z projecting the AI agent economy could reach $30 trillion by 2030, Kite is positioning itself as the payment rails that make this future possible.

1.What Is KITE AI and Why Does It Matter?

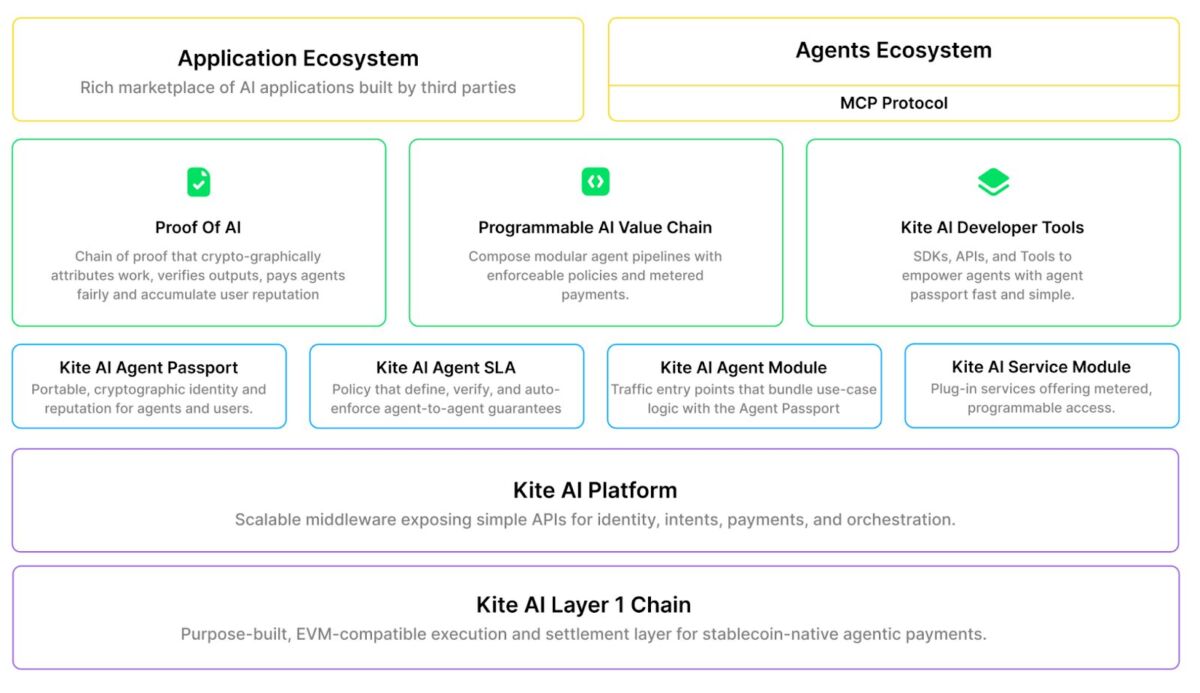

KITE AI (formerly known as Zettablock) is building what it calls the “agentic web”—an internet where AI agents conduct transactions, negotiate services, and operate independently without human intervention. The company’s flagship product, Kite AIR (Agent Identity Resolution), provides three critical components that autonomous agents need to function:

1.1 Agent Passport (Verifiable Identity)

Every AI agent needs a unique, cryptographic identity to prove who it is and establish trust. Kite’s Agent Passport gives each agent a verifiable digital identity with programmable governance rules—think of it as a driver’s license and credit limit combined, but for AI.

1.2 Agent App Store (Service Discovery)

AI agents need to discover and access services like APIs, data feeds, and commerce tools. Kite’s Agent App Store functions as a marketplace where agents can find, pay for, and use services autonomously. Any merchant on Shopify or PayPal can opt in and become discoverable to AI shopping agents.

1.3 Stablecoin Payment Rails (Instant Settlement)

Traditional payment systems break down when AI agents try to conduct high-frequency, low-value transactions. Credit cards have latency, high fees, and chargeback fraud risk. Kite solves this by enabling stablecoin-based payments that settle in milliseconds with transaction fees under one cent.

2.The Problem KITE Solves: Why Current Systems Can’t Handle AI Agents

To understand why Kite raised $18M from PayPal and General Catalyst, you need to understand the friction AI agents face when trying to transact today.

2.1 Problem 1: Payment Systems Are Built for Humans, Not Machines

Imagine an AI shopping agent that browses 1,000 products per second, compares prices across 50 stores, and makes micro-purchases totaling $0.10 each. Traditional payment systems would charge $0.30 per transaction in credit card fees, consume 3-5 seconds per payment, and require human approval at multiple steps. This makes AI-to-AI commerce economically unviable.

2.2 Problem 2: Identity and Trust Are Fragmented

How do you prove an AI agent is authorized to spend money on your behalf? How does a merchant know an AI isn’t fraudulent? Current systems rely on usernames, passwords, and centralized authentication—all designed for human users, not autonomous software.

2.3 Problem 3: Micropayments Are Economically Broken

AI agents will conduct millions of tiny transactions—paying $0.001 for an API call, $0.05 for a data query, $0.10 for a product comparison. Traditional payment networks can’t process micropayments profitably. The infrastructure cost exceeds the transaction value.

Kite’s Solution:

By building a blockchain specifically designed for AI agents, Kite solves all three problems:

- Stablecoin payments: Near-zero fees, millisecond settlement, no chargebacks

- Cryptographic identity: Each agent has a verifiable public key and programmable permissions

- Smart contract governance: “Code-as-law” execution ensures transactions follow predefined rules automatically

3.Why PayPal Ventures and General Catalyst Led the Round

PayPal and General Catalyst aren’t typical crypto investors—they’re institutional giants with strategic reasons for backing Kite.

3.1 PayPal’s Interest: The Future of Commerce

Alan Du, Partner at PayPal Ventures, described Kite as “the first real infrastructure that is purpose-built for the agentic economy.” PayPal processes billions in payments annually but recognizes that AI-driven commerce requires fundamentally different infrastructure. By investing in Kite, PayPal positions itself at the center of AI-to-AI payments rather than being disrupted by them.

Moreover, Kite is already integrated with PayPal’s merchant network. Any PayPal merchant can opt into Kite’s Agent App Store, making their products discoverable to AI shopping agents. Purchases are settled on-chain using stablecoins, with full traceability and programmable permissions. This isn’t theoretical—it’s live infrastructure today.

3.2 General Catalyst’s Thesis: Building the Machine-to-Machine Economy

Marc Bhargava, Managing Director at General Catalyst, stated: “Kite is doing the foundational work we believe will define how agents operate tomorrow. They are building the rails for the machine-to-machine economy.”

General Catalyst has backed transformative companies like Airbnb, Stripe, Snap, and Gusto. Their investment in Kite signals conviction that AI agents will become the dominant interface for digital commerce—and whoever builds the payment infrastructure owns a critical chokepoint in a $30 trillion market.

3.3 Samsung, Coinbase, and Others Join

Beyond PayPal and General Catalyst, Kite’s investor roster includes:

- Samsung Next: Strategic interest in AI-enabled hardware and IoT devices

- Coinbase Ventures: Integration with x402 payment protocol (more on this below)

- 8VC, Hashed, HashKey, Avalanche Foundation, LayerZero, Animoca Brands: Deep crypto-native expertise

This combination of traditional finance (PayPal), venture capital (General Catalyst), corporate tech (Samsung), and crypto infrastructure (Coinbase, Avalanche, LayerZero) creates a powerful network effect that can accelerate Kite’s adoption across multiple ecosystems.

4.Kite’s Integration with Coinbase x402 Protocol

In October 2025, Kite announced Coinbase Ventures’ investment and deep integration with Coinbase’s x402 Agent Payment Standard—the same protocol that drove explosive growth in x402 tokens like PING, PayAI, and others.

4.1 What is x402?

x402 is an open payment protocol enabling instant USDC payments via HTTP 402 status codes. It allows AI agents to pay for APIs, data, and services automatically through standardized web requests. Coinbase and Cloudflare developed x402 collaboratively, and it’s becoming the de facto standard for AI-to-AI payments.

Kite as the Primary Execution Layer:

Kite positioned itself as one of the first Layer-1 blockchains to natively implement x402-compatible payment primitives. This means AI agents using x402 can settle payments directly on Kite’s blockchain, benefiting from:

- Sub-cent transaction fees

- Millisecond finality

- Full programmability and governance controls

- Native stablecoin integration

By integrating deeply with x402 at the chain level—not just as an application—Kite becomes the default settlement layer for a protocol that a16z projects could underpin a $30 trillion AI economy.

5.Real-World Use Cases: What Kite Enables Today

Kite isn’t vaporware. The platform is live and already integrated with Shopify and PayPal, enabling real use cases:

5.1 Use Case 1: AI Shopping Agents

Imagine asking ChatGPT: “Find me the best wireless headphones under $100 with noise cancellation, compare prices across 10 stores, and buy the best option.”

Today, ChatGPT would provide links and you’d complete the purchase manually. With Kite, the AI agent autonomously:

- Queries multiple Shopify stores via Kite Agent App Store

- Compares prices and reviews

- Executes the purchase using stablecoin payment settled on-chain

- Confirms delivery—all without human intervention

5.2 Use Case 2: Agent-to-Agent API Payments

A data analysis AI needs to call a weather API 10,000 times to complete a forecast model. Instead of requiring a human to approve each API call or set up billing, the AI agent:

- Discovers the weather API in Kite Agent App Store

- Pays $0.001 per API call using stablecoins

- Receives data instantly

- Reconciles payments automatically at machine speed

5.3 Use Case 3: High-Frequency Trading Agents

Trading AI agents need to execute thousands of micro-trades per second, settling payments with counterparties instantly. Kite’s millisecond-level settlement and sub-cent fees make this economically viable, whereas traditional payment networks would add 3-5 seconds latency and $0.30+ fees per trade.

5.4 Use Case 4: Agent-to-Agent Subscriptions and Metered Billing

AI agents can subscribe to services, pay by usage, or negotiate dynamic pricing—all without human intervention. A content creation AI might pay a stock photo API $0.05 per image used, with billing reconciled automatically every hour.

6.The Technology: How Kite’s Blockchain Works

Kite built a custom Layer-1 blockchain optimized for AI agent transactions. Key technical features include:

6.1 EVM Compatibility

Kite is fully compatible with Ethereum Virtual Machine (EVM), meaning developers can deploy Ethereum smart contracts on Kite without code changes. This lowers the barrier to adoption and taps into Ethereum’s massive developer ecosystem.

6.2 Proof of Attributed Intelligence (PoAI) Consensus

Kite uses a novel consensus mechanism called Proof of Attributed Intelligence, which transparently attributes and rewards contributions from AI models and data providers. This aligns incentives across the network and ensures fair compensation.

6.3 State Channels for Off-Chain Micropayments

For extremely high-frequency transactions, Kite uses state channels—off-chain payment channels that enable near-instant finality and drastically reduce on-chain transaction costs. Only final settlement is recorded on-chain.

6.4 Programmable Permissions and Governance

Each AI agent operates under smart contract-enforced rules. Spending limits, authorized merchants, and transaction types are all programmable, ensuring agents can’t exceed their permissions.

7.Market Opportunity: Why the $30 Trillion Projection Matters

Venture capital firm a16z projects the AI agent economy could reach $30 trillion by 2030. To contextualize this:

- Global GDP is approximately $100 trillion

- The entire cryptocurrency market cap is ~$3.8 trillion

- E-commerce represents ~$6 trillion globally

If AI agents capture even 10% of this projected market ($3 trillion), payment infrastructure providers like Kite could capture billions in transaction fees and ecosystem value. The comparison: Visa and Mastercard process ~$14 trillion annually and generate ~$40 billion in revenue. If Kite becomes “Visa for AI agents,” the addressable market is enormous.

8.Risks and Challenges: What Could Go Wrong

Despite strong backing and compelling technology, Kite faces several risks:

8.1 Risk 1: Adoption Uncertainty

AI agents conducting autonomous transactions remain experimental. Mainstream adoption depends on regulatory clarity, consumer trust, and technological maturity—all uncertain.

8.2 Risk 2: Competition

Multiple projects are building AI payment infrastructure. x402 protocol itself is open-source, meaning competitors can integrate it. Kite must differentiate through superior execution and network effects.

8.3 Risk 3: Regulatory Hurdles

Autonomous AI agents making financial decisions raise complex regulatory questions. If regulators restrict AI-to-AI commerce or impose strict compliance requirements, it could slow adoption.

8.4 Risk 4: Technical Execution

Building a secure, scalable blockchain is hard. Bugs, exploits, or performance issues could damage trust and adoption. Kite’s team has deep experience (Databricks, Uber, UC Berkeley), but execution risk remains.

9.How to Position Around KITE: Strategic Considerations

For Investors:

Kite is not publicly tradeable yet (no token announced as of November 2025). However, investors can:

- Monitor for future token launch announcements

- Invest in x402 ecosystem tokens (PING, PayAI) that benefit from Kite’s growth

- Track Kite’s partnerships and integrations as indicators of traction

For Developers:

Kite’s EVM compatibility makes it easy to build on the platform. Developers interested in AI-driven commerce can explore Kite’s documentation and Agent App Store API.

For Traders:

Position in x402 ecosystem tokens, which benefit from Kite’s role as a primary settlement layer. As Kite adoption grows, x402 protocol usage increases, driving value to x402 tokens.

10.The Bottom Line: Infrastructure for the Agentic Future

Kite’s $18M raise from PayPal, General Catalyst, Coinbase, and Samsung isn’t just about capital—it’s validation that the AI agent economy is real and payment infrastructure is the critical bottleneck. With live integrations, institutional backing, and technical differentiation, Kite is positioning itself as the foundational payment layer for a future where AI agents transact autonomously at scale.

Whether that future arrives in 2026, 2030, or beyond remains uncertain. But if AI agents do become the dominant interface for digital commerce, whoever owns the payment rails will capture extraordinary value. Kite is betting it can be that infrastructure, and some of the world’s smartest investors are betting with them.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!