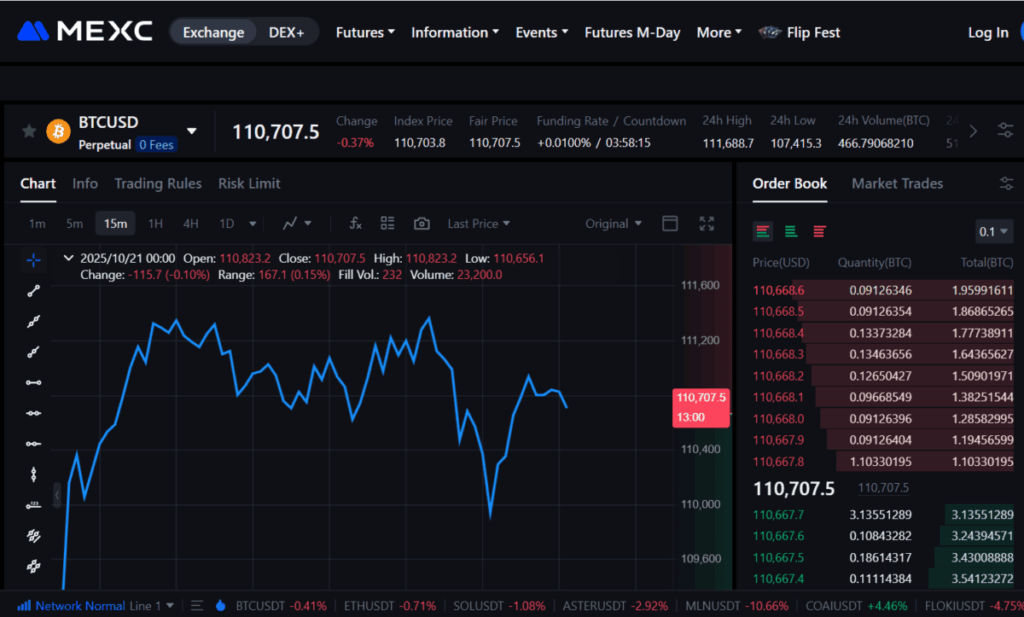

Bitcoin (BTC) returned to a growth phase over the weekend, and on Monday it climbed above 110,000 USDT on the MEXC exchange.

On Friday, October 17, the BTC rate fell to 103,524 USDT. At this point, the RSI relative strength index fell below 15, which indicated an oversold asset.

Bitcoin quickly reached a local bottom and after a short consolidation began to restore lost positions.

He was supported by sharks and whales holding more than 10 BTC. These cohorts of investors after taking profits returned to accumulating crypto. The day before, the leading digital currency jumped to $111,660, but in the evening adjusted to $110,694.

- Nevertheless, BTC is still trading above the psychological mark of $110,000, it is guided by many retail traders who panicked selling in mid-October.

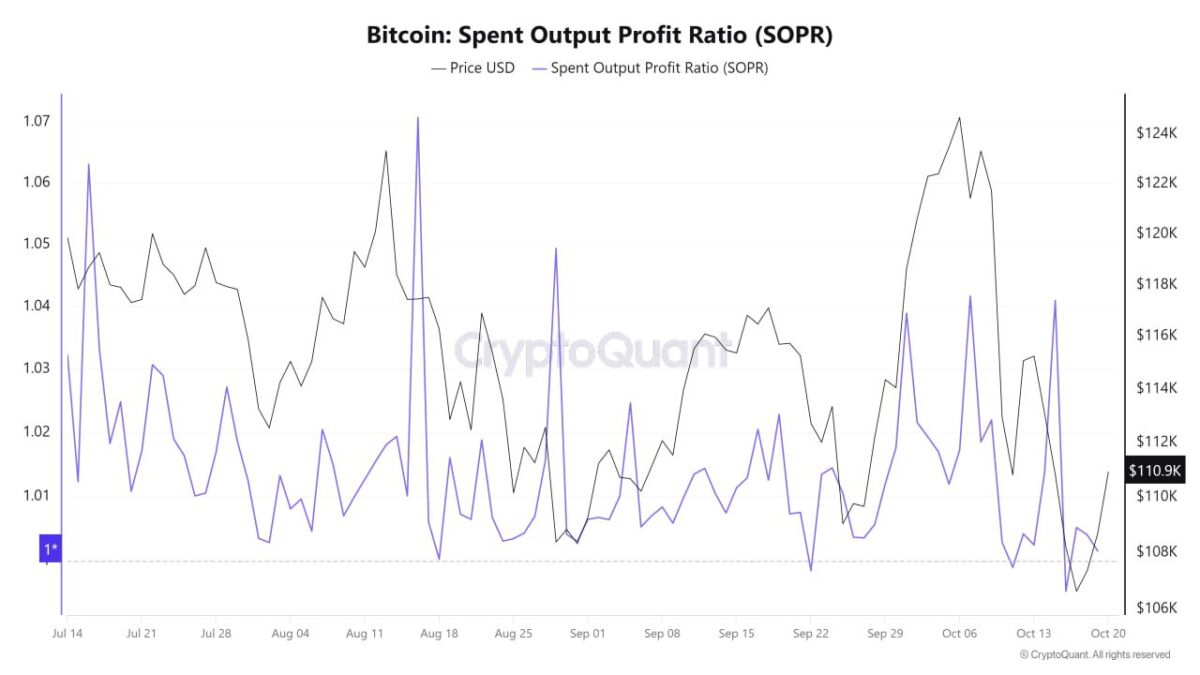

The SOPR index fell below 1 last week, which indicated that most transactions selling BTC were unprofitable.

At the weekend, the indicator rose again above 1, and most traders began to sell coins again with a profit (according to CryptoQuant).

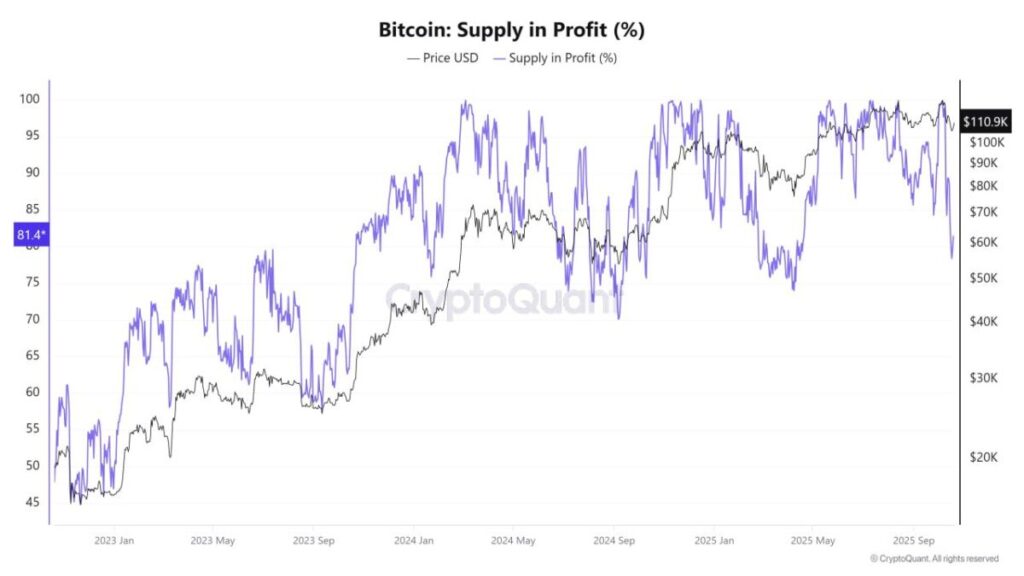

Most BTC addresses have returned to the yield zone

The jump of bitcoin above $110,000 at the beginning of this week improved the financial positions of many investors. The share of profitable supply in the BTC network is approaching 81.5%.

That is, the majority of crypto holders receive income, whereas a few days ago the share of profitable supply fell to 78%.

In this situation, panic sold BTC, first of all, those traders who purchased coins at prices above $105,000.

October 12, open interest in futures dropped to $31.4 billion (according to Coinalyze).

But over the weekend, speculators began to return to the market, which led to increased interest to $34.82 billion.

The funding rate for perpetual swaps on the MEXC platform MEXC on Monday rose sharply, and the turnover of futures in dollar terms increased to $52.976 million

- In the first half of October, negative sentiments increased on social networks. Telegram, Reddit, X and 4Chat users expected bitcoin to fall below $100,000.

According to analysts, the dominance of pessimism in social networks accelerated the achievement of the local bottom, as a result of aggressive sales, investors left the market, who were afraid of the return of a bearish trend.

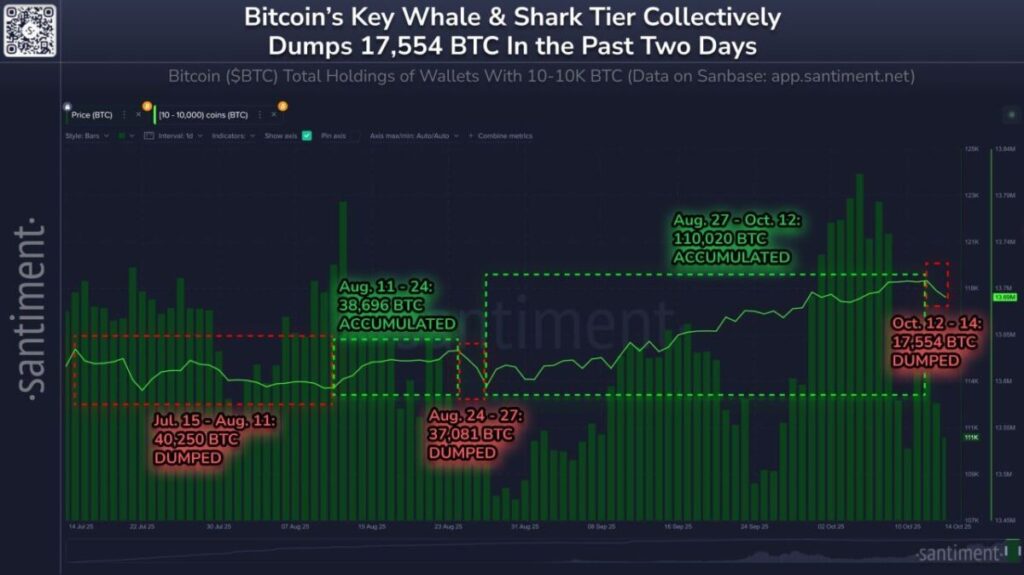

Whales and sharks recorded profits and resumed purchases

MEXC Research team recalls that retail traders can focus on the behavior of large and medium-sized investors. So-called whales and sharks have a strong influence on the value of digital currency.

- The collapse of bitcoin in October was the result of a large-scale reset arranged by addresses with a balance of 10 to 10,000 coins.

According to Santiment, sharks and whales on October 12-14 sold a total of 17,544 BTC. Now these cohorts of investors hold more than 68% of the bitcoin market turnover.

When whales and sharks sell, the price tends to fall. Conversely, if large addresses resume purchases, then the value of the digital currency begins to rise.

In 2025, there were several similar periods when the BTC rate decreased as a result of sales arranged by whales and sharks. For example, from July 14 to August 11, they dropped 40,250 coins, and from August 24 to August 27, the sales volume was 37,081 BTC. At these moments, the crypto retreated in the spot market.

But when whales and sharks started shopping, the BTC rate began to strengthen again. In general, since January, addresses with a balance of up to 10 to 10,000 BTC purchased 318,610 coins.

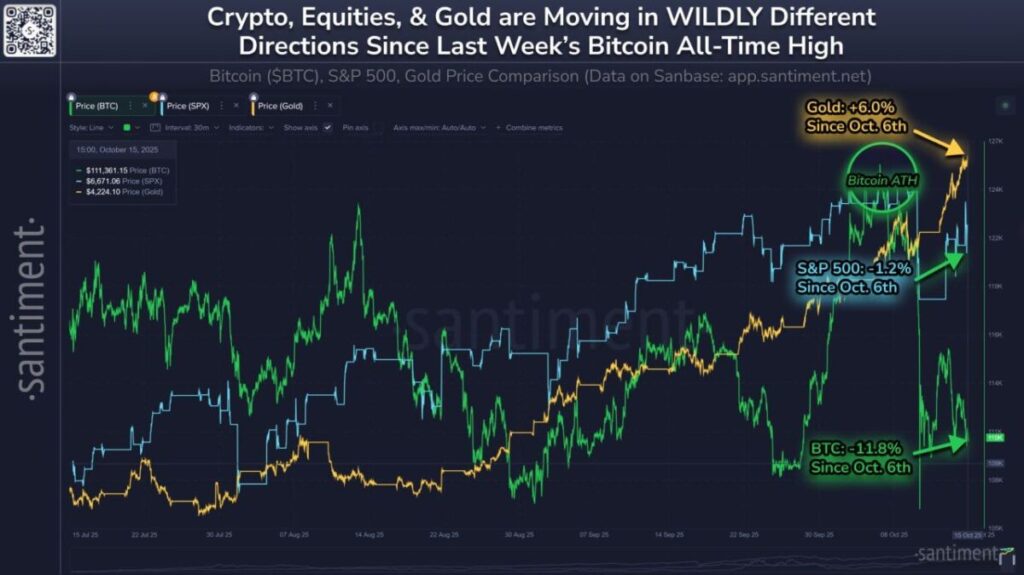

Stock markets and cryptocurrencies painfully reacted to the statement of US President Donald Trump about his intention to increase tariffs for China. However, against the background of the retreat of BTC and the S & P 500 index, a troy ounce of gold, on the contrary, updated the historical maximum.

- Crypto is still heavily influenced by the behavior of investors in the US stock market.

- The correlation between bitcoin and IT stocks intensifies during periods of global tension, the next stage of which we are now witnessing.

Disclaimer: This information is not investment, tax, legal, financial, accounting, advisory or any other related services advice, nor is it advice to buy, sell or hold any assets. MEXC Training provides information for reference purposes only and is not investment advice. Please ensure that you fully understand all risks and exercise caution when investing. The platform is not responsible for users’ investment decisions.

Join MEXC and Get up to $10,000 Bonus!