The cryptocurrency market outlook for 2026 is undergoing a fundamental transformation. Coinbase Institutional just released a comprehensive 70-page report called "2026 Crypto Market Outlook" by their research leaders David …

India has achieved a historic milestone by ranking #1 in the 2025 Global Crypto Adoption Index for the third consecutive year. With 119 million active users, the world's largest …

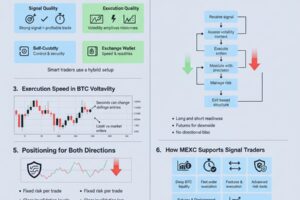

Crypto signals promise clarity in a market defined by uncertainty. A precise entry level. A clear invalidation point. A projected target. For many traders, especially those navigating Bitcoin’s volatility, …

Bitcoin volatility has returned to the center of market conversations, but for traders, this is not a warning sign. It is a signal.

After more than a decade of predictable patterns, Bitcoin has officially closed 2025 in the red. This marks the first time in history that a post-halving year has ended …

After 11 years as New Zealand's crypto stalwart, Kiwi-Coin ceased operations on January 1, 2026; marking the end of an era for independent, locally-owned exchanges and highlighting a banking …

For years, blockchain's greatest strength has been its greatest weakness for institutional adoption. Ethereum's radical transparency means every transaction, every balance, every strategic move is visible on a public …

Searching for the Marina Protocol today’s answer? You’re in the right place. The Marina Protocol daily quiz is one of the easiest ways to learn while earning. By answering …

Looking for the Spur Protocol today’s quiz answer? You’re in the right place. Each correct answer in the SpurPro app earns you $SPUR tokens instantly – no gas fees, …

Looking for the correct Xenea Wallet Daily Quiz Answer for January 4, 2026? You’re in the right place. The quiz is one of the simplest ways to earn free …