The non-ferrous metals sector has emerged as the undisputed champion of early 2026, delivering extraordinary returns that have far outpaced all other major asset classes. From copper and aluminum …

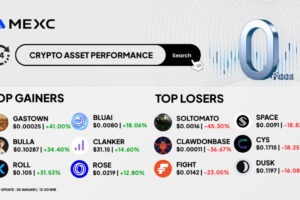

Top Gainers & Top Losers Kripto di MEXC (30 Januari 2026)

The floor is falling out from under the cryptocurrency market. Bitcoin (BTC) plummeted to a fresh 2026 low early Friday, trading near $83,380, as a terrifying technical formation known …

Over the past decade, cryptocurrencies have evolved from fringe technological experiments into globally traded financial assets. Yet despite their growing market capitalization and adoption, digital assets have remained difficult …

For much of the past decade, blockchain technology has been narrowly associated with cryptocurrencies, trading platforms, and speculative markets. This framing, while understandable given Bitcoin’s historical role as blockchain’s …

When people talk about finance, they often focus on returns, interest rates, yields, profits, or price movements. But in reality, finance is built first on control, trust, and risk …

The cryptocurrency market faced a brutal reality check early Friday as Bitcoin (BTC) plunged below the critical $85,000 support level, triggering a cascading liquidation event that has wiped out …

Stablecoins, particularly USDTandUSDC are increasingly viewed not just as trading tools, but as financial infrastructure. Governments, regulators, and major corporations are now assessing how stablecoins affect capital flows, market …

XRP has retreated sharply in early Friday trading, sliding 6.2% to $1.89 as a “perfect storm” of macroeconomic uncertainty and legislative gridlock dampens investor appetite. After a bullish start …

While headlines often focus on price swings in New York or regulatory debates in Brussels, a more profound and sustained crypto revolution is unfolding thousands of miles away. Latin America …