FUN token (FUN) is a cryptocurrency built on the Ethereum and Polygon blockchains, specifically designed as a fast, transparent, and truly fair transactional solution for iGaming ecosystems and players. …

Artificial Intelligence (AI) is no longer a future concept, it is a present-day force reshaping industries across the globe. While much of the spotlight often falls on the United …

Latin America is rapidly becoming one of the most important regions in the global stablecoin economy. In 2026, stablecoins are no longer viewed as experimental crypto assets across the …

For the Argentine trader or investor, cryptocurrency represents a dual proposition: a formidable hedge against persistent domestic inflation and peso depreciation, and a gateway to the frontier of global …

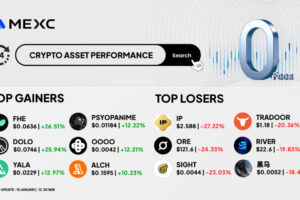

Pergerakan pasar kripto di MEXC kembali menunjukkan volatilitas tinggi dalam 24 jam terakhir. Sejumlah aset mencatat lonjakan tajam dan masuk daftar Top Gainers, sementara beberapa token lain mengalami koreksi …

Key Takeaway: The Price-to-Earnings (P/E) ratio measures how much investors pay for each dollar of earnings. It helps traders identify undervalued gems for Spot holding or overvalued stocks suitable …

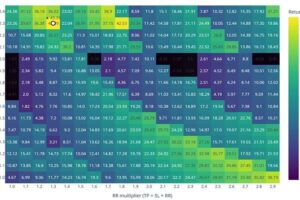

In the high-volatility world of cryptocurrency trading, understanding where the “smart money” is looking is the key to profitability. The Liquidation Heatmap is an advanced visualization tool that gives …

Understanding Capital Gains Tax (CGT) is essential for maximizing your investment returns. Whether you are selling stocks, real estate, or cryptocurrency, the timing of your sale and your income …

Key Takeaways Understanding a company’s financial position is the first step toward intelligent investing and effective management. The balance sheet provides a comprehensive snapshot of what a company owns, …

Key Takeaways: Private equity sounds complex, but it’s really about investing in businesses that are not listed on the stock market so they can grow, transform, and eventually be …