In the realm of digital finance, stablecoins serve as the quiet backbone of crypto markets anchoring value, powering remittances, and underpinning decentralized finance.

At the heart of this ecosystem stand two heavyweights: Tether (USDT) and USD Coin (USDC). One reigns by sheer liquidity and reach, while the other ascends on pillars of regulatory clarity and institutional trust. Their ongoing duel reflects not just shifts in market share, but the broader evolution of crypto’s march toward maturity.

1.Market Dominance: The Numbers

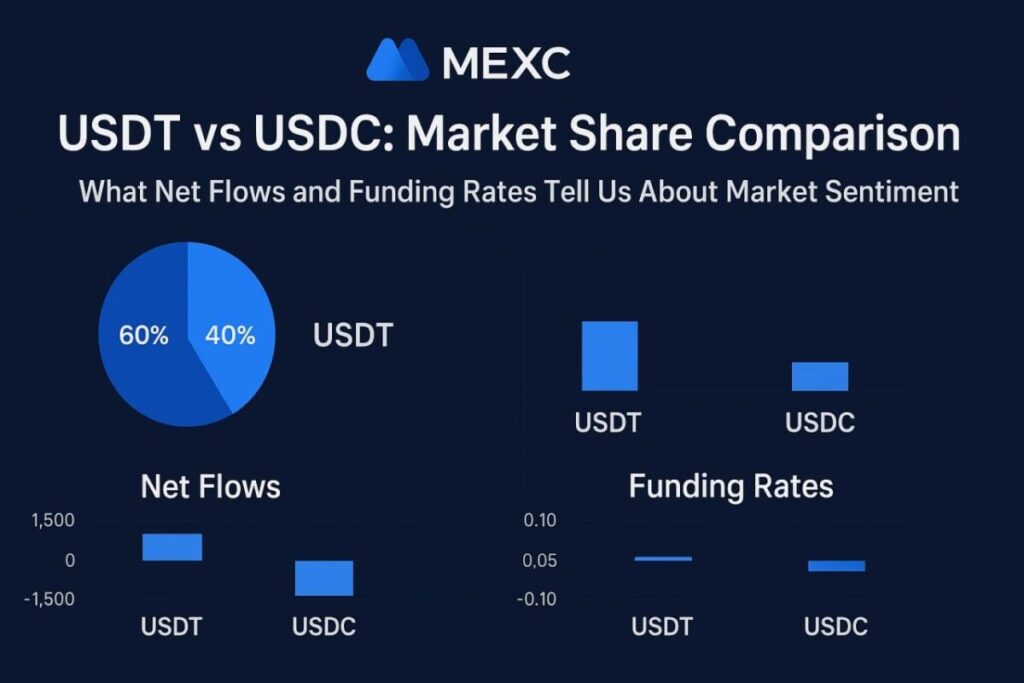

As of early to mid 2025, USDT and USDC jointly account for 85–90% of the stablecoin market.

A Phoenix Group report covering mid‑May 2025 pegged total stablecoin market cap at $246.5 billion, with USDT at $151 billion (62.4%) and USDC at $60.6 billion (≈24.6%)

February 2025 data reaffirmed this, showing USDT at 64% and USDC at 24.5%, totaling around 88.5%

Nansen data from April 2025 placed USDT at 66% and USDC at 28%

By August 2025, USDT’s share dipped to 60%, with USDC rising to 30%, and new entrants like Ethena’s USDe reaching 4.3%

2.Growth Dynamics: Trends in Motion

The rivalry grows sharper as USDC accelerates its gains:

USDC’s market share doubled, climbing from around 20% to 25.5%, while USDT dropped from ≈73.5% to 65.4% between early 2024 and February 2025

In April 2025, USDC hit a new market‑cap record of $62.1 billion, capturing 26% of the market share and 18% of volume on centralized exchanges

Stablecoin transfers exceeded $35 trillion annually, surpassing Visa by double USDT remained the largest by supply, while USDC grew robustly

3.Underlying Forces: Regulation, Transparency & Strategy

What fuels USDC’s rise, and what holds USDT’s lead intact?

Regulatory Alignment & Institutional Trust

USDC’s growth is rooted in its regulated structure—audited reserves, legal clarity, and big‑name supporters like Coinbase and Circle’s public listing, which bolster confidence.

USDT: Liquidity Muscle vs. Transparency Concerns

USDT’s massive reach and deep liquidity especially in Asia, Latin America, and the Middle East keep it dominant. Yet, recurring criticism over opaque reserves and the absence of regular audits continues to cloud its reputation.

Treasury Market Power

Remarkably, by Q1 2025, USDT held about $98.5 billion in U.S. Treasury bills, representing 1.6% of all outstanding T‑bills making it one of the largest non‑sovereign buyers. This massive demand effectively reduces short‑term yields, reflecting the intersection of crypto liquidity and traditional finance.

Ecosystem Footprints: On‑Chain and Chain Activity

The flux of USDT and USDC varies markedly across blockchains and applications:

On the Tron network, USDT commands an astounding 98.5% of stablecoin supply, reinforcing its dominance in that ecosystem.

Ethereum handles the lion’s share of stablecoin volume. In February 2025, Ethereum facilitated $67 billion in USDT and $35 billion in USDC transfers. Total monthly stablecoin volume on the chain approached $850 billion, driven by these two tokens.

Solana and other chains like Base have become pivotal for USDC’s growth enabling cross‑chain expansion and adoption.

4.Emerging Players & Market Diversification

While the USDT/USDC duopoly holds firm, new stablecoins are emerging:

USDe, launched by Ethena Labs in December 2024, already holds 4–4.3% market share, a significant foothold for a newcomer.

Smaller yet noteworthy relative players include DAI, and others like USDO and USDY, indicating growing diversity.

5.The Road Ahead: What to Expect

The stablecoin landscape ahead is shaped by several trends:

USDT: Resilient Yet

Pressured

USDT’s unmatched liquidity and widespread utility reinforce its position. However, regulatory scrutiny and transparency demands may progressively narrow its advantage.

USDC: Compliance as Currency

USDC’s structural integrity positions it well to seize market share especially among institutions and regulated use cases. Its IPO success and legislative tailwinds suggest it may close the gap further or even overtake USDT by the early 2030s

Regulatory Catalysts

Legislation such as the GENIUS Act and global regulation under frameworks like MiCA favor USDC’s ascendancy.

Innovation and Diversification

New stablecoins like USDe, and trends toward asset‑backed models, are expanding user choice and functionality.

6.Conclusion

USDT: A liquidity titan, deeply embedded in crypto trading and payments, with undeniable financial weight yet facing growing regulatory pressure.

USDC: The compliant contender, powered by transparency, oversight, and institutional backing, steadily narrowing the gap.

Stablecoin Evolution: The duopoly remains powerful, but diversification, regulation, and innovation propel an ever changing arena.

In the digital‑dollar duel of 2025, USDT remains on top but USDC’s rise signals a shifting balance. Watch how regulation, ecosystem expansion, and institutional demand reshape the stablecoin summit in years to come.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up