Ringkasan :

YieldBasis (YB) hadir dengan misi yang ambisius: mengubah cara likuiditas dikelola di dunia DeFi. Protokol ini memungkinkan pengguna untuk menyediakan aset seperti BTC atau ETH ke dalam kolam likuiditas sambil tetap mendapatkan imbal hasil stabil yang bahkan dengan risiko impermanent loss yang jauh lebih kecil atau bahkan nol.

Melalui mekanisme leverage, auto-rebalancing, dan tokenisasi posisi likuiditas, YieldBasis menawarkan pendekatan baru dalam menghasilkan yield yang efisien dan berkelanjutan.

1.Background: The Problem with Traditional AMMs

Dalam model AMM (Automated Market Maker) tradisional, penyedia likuiditas (LP) sering menghadapi masalah klasik: impermanent loss. Ketika harga pasangan aset bergerak tidak seimbang, nilai portofolio LP cenderung menurun akibat rebalancing otomatis dalam pool. Banyak protokol mencoba menutupi hal ini dengan reward tinggi.

YieldBasis mencoba memecahkan masalah ini dengan cara yang berbeda. Melalui kolam likuiditas berleverage dan mekanisme rebalancing otomatis, protokol ini menggabungkan pendapatan biaya transaksi dengan peluang yield tambahan untuk menekan dampak impermanent loss secara signifikan.

Bagaimana YieldBasis Bekerja

YieldBasis is a DeFi protocol reportedly co-founded by one of Curve’s creators (Michael Egorov and others). Its goal is straightforward: enable BTC and ETH holders to provide liquidity with minimal impermanent loss and enhanced returns.

YieldBasis adalah protokol DeFi yang kabarnya turut dikembangkan oleh salah satu kreator Curve (Michael Egorov dan timnya). Tujuannya sederhana: memberi kesempatan bagi pemegang BTC dan ETH untuk menjadi LP tanpa takut kehilangan nilai aset saat harga berfluktuasi.

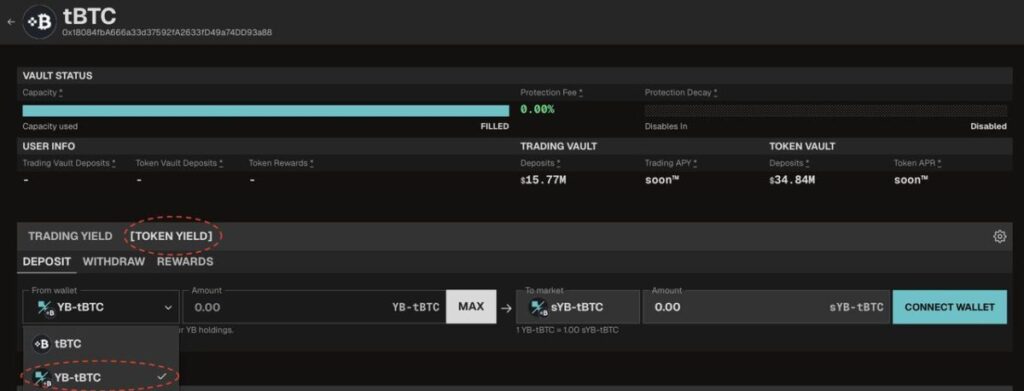

Setiap posisi LP di-tokenisasi menjadi aset seperti ybBTC atau ybETH, yang memiliki leverage hingga 2× dan dilindungi sistem auto-rebalancing agar eksposur harga tetap optimal terhadap aset utama.

Artinya, kamu tidak hanya mendapatkan biaya transaksi, tetapi juga bisa men-stake posisi tersebut untuk memperoleh reward tambahan dalam bentuk YB token dan hak suara dalam governance protokol.

Singkatnya, YieldBasis adalah “leveraged liquidity protocol dengan mitigasi impermanent loss”, yang menggunakan crvUSD sebagai modal pinjaman dengan rasio over-collateralization sebesar 200%, menjaga posisi leverage tetap aman dan stabil.

Perbedaan YieldBasis dan YB

Untuk memahami ekosistem ini lebih jelas:

- YB adalah token asli dari protokol tersebut, yang berfungsi untuk governance, reward, dan pembagian pendapatan.

- YieldBasis adalah nama protokol dan sistemnya — mencakup mekanisme, kolam likuiditas, serta arsitektur ekosistem.

Masalah yang Diselesaikan oleh YieldBasis

Sebelum hadirnya YieldBasis, model AMM tradisional masih memiliki banyak kelemahan. Berikut empat hal utama yang diatasi oleh protokol ini:

- Impermanent Loss:

Alih-alih rebalancing pasif yang membuat portofolio kalah dibanding hanya hold satu aset, YieldBasis menggunakan leverage dan rebalancing dinamis agar nilai portofolio tetap seimbang meski market volatil. - Efisiensi Modal Rendah:

Likuiditas idle di market sepi volume tidak menghasilkan banyak pendapatan. Desain leverage dan tokenisasi LP di YieldBasis memastikan modal bekerja maksimal setiap waktu. - Likuiditas yang Terfragmentasi:

BTC dan ETH sering tersebar di berbagai protokol DeFi. YieldBasis bertujuan menjadi gerbang utama likuiditas aset blue-chip dalam ekosistem DeFi. - Minimnya Partisipasi Governance:

Banyak protokol memisahkan LP dari hak suara. YieldBasis mengintegrasikan model YB/veYB, menyatukan LP, pemegang token, dan partisipan governance dalam satu sistem insentif terpadu.

Mekanisme Inti YieldBasis

Sebelum terjun ke teknis trading atau staking, penting memahami bagaimana protokol ini menjaga keseimbangan antara yield tinggi dan risiko rendah.

Leverage & Auto-Rebalancing Pools:

YieldBasis menggunakan pinjaman crvUSD untuk menciptakan posisi likuiditas berleverage 2×. Sistem ini “meluruskan” kurva √p khas AMM, secara teori menghapus efek impermanent loss. Protokol juga memantau kesehatan pool dan melakukan rebalancing otomatis agar harga tetap sinkron dengan kondisi market.

Tokenisasi Likuiditas (ybBTC / ybETH):

Saat pengguna mendepositkan BTC atau ETH, protokol mencetak token ybBTC atau ybETH sebagai bukti kepemilikan posisi LP berleverage. Token ini bisa distake untuk mendapatkan YB rewards atau digunakan di protokol DeFi lain yang kompatibel.

Fee, Reward, dan Governance:

Sebagian biaya transaksi dialokasikan ke cadangan protokol dan pool reward. Pemegang YB mendapat hak pembagian pendapatan serta suara dalam governance yang termasuk penyesuaian parameter, jadwal reward, hingga pembaruan strategi.

Sinergi dengan Ekosistem Curve:

Karena berbasis crvUSD, YieldBasis memiliki hubungan teknis dan strategis erat dengan ekosistem Curve. Hal ini berpotensi memengaruhi arah Curve DAO governance dan menarik arus likuiditas baru dari pengguna Curve yang sudah ada.

Mitigasi Impermanent Loss:

Berdasarkan hasil backtest, YieldBasis mampu memberikan APY rata-rata 20,5%, bahkan di periode volatilitas rendah masih di kisaran 9%. Ini menunjukkan stabilitas yield yang jarang ditemukan pada model LP tradisional.

Tokenomics YB

Token Overview:

- Nama Token: Yield Basis (YB)

- Initial Supply: 700.000.000 YB

- Maximum Supply: 1.000.000.000 YB

cta:Trade YB on MEXC:https://www.mexc.com/price/YB

Kegunaan dan Utilitas Token YB:

- Rewards: Diberikan kepada penyedia likuiditas, staker, dan partisipan aktif.

- Governance: Pemegang YB (atau veYB yang terkunci) memiliki hak suara untuk mengatur proposal dan parameter protokol, mengikuti model veCRV dari Curve.

- Revenue Sharing: Sebagian pendapatan protokol dibagikan kepada pemegang YB/veYB.

- Ekspansi Ekosistem: Dialokasikan untuk kemitraan, insentif developer, dan program komunitas.

Dengan struktur ini, YB menjadi “tulang punggung ekonomi dan tata kelola” bagi seluruh peserta dalam ekosistem YieldBasis.

Posisi YieldBasis di Market

YieldBasis memposisikan diri sebagai “protokol likuiditas berleverage dengan optimasi impermanent loss. Pendekatan uniknya yaitu menggabungkan leverage, auto-rebalancing, dan tokenisasi LP dan membedakannya dari AMM klasik seperti Uniswap atau Curve.

Kompetitor potensial:

- AMM Tradisional (Uniswap, Curve): Menyediakan return pasif namun tanpa mitigasi impermanent loss.

- Protokol Pinjaman (Aave, Compound): Fokus pada leverage tapi tidak mengoptimalkan likuiditas.

YieldBasis menjembatani kedua dunia ini, menghadirkan yield berleverage untuk likuiditas BTC/ETH dengan risiko yang lebih terukur.

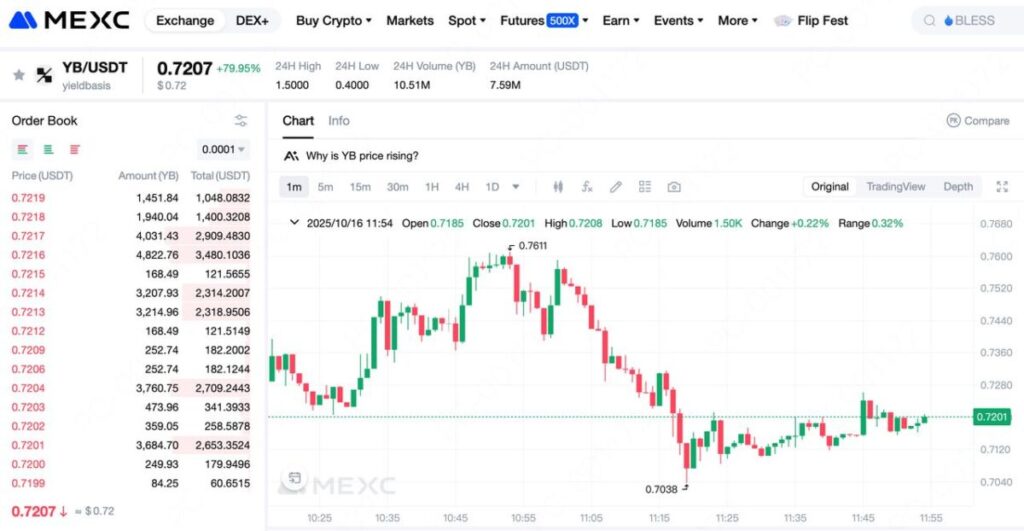

Cara Membeli YB di MEXC

Sebagai platform global dengan likuiditas mendalam, MEXC kini resmi memperdagangkan YB, lengkap dengan biaya rendah dan eksekusi cepat.

- Masuk ke aplikasi atau situs resmi MEXC.

- Ketik “YB” di kolom pencarian pasar.

- Pilih pasangan spot YB/USDT, lalu masukkan jumlah dan harga order yang kamu inginkan.

Kesimpulan

YieldBasis adalah salah satu inovasi paling menarik dalam dunia DeFi tahun ini. Dengan menggabungkan leverage, auto-rebalancing, dan tokenisasi posisi likuiditas, protokol ini berpotensi merevolusi cara penyedia likuiditas mendapatkan imbal hasil.

Melalui token YB, seluruh peserta mulai dari LP hingga pemegang token dapat terlibat langsung dalam sistem insentif yang berkelanjutan. Hasilnya, ekosistem yang lebih efisien, transparan, dan selaras antara pengguna dan protokol.

Join MEXC and Get up to $10,000 Bonus!

Sign Up