Key Highlights

- Sustainability Over Hype: Projects that prioritize fundamentals like security, scalability, and governance often outlast those built only on hype.

- Community Matters: Long-term projects cultivate strong communities with active participation rather than speculative crowds.

- Utility Drives Adoption: Protocols with real-world applications (e.g., DeFi, payments, stablecoins) create lasting value.

- Adaptability: The ability to pivot and scale with user needs is a hallmark of enduring Web3 protocols.

- Case Studies: Ethereum (smart contracts), Uniswap (DeFi liquidity), and meme tokens (Dogecoin, Shiba Inu) provide contrasting lessons.

1.Understanding the Divide: Fads vs. Substance

Web3 has seen waves of innovation, from meme tokens with viral hype to foundational protocols powering decentralized finance. While hype can bring temporary attention and sharp price spikes, sustainable growth depends on delivering continuous utility and cultivating trust.

2.Case Studies in Web3 Growth

2.1 Case Study 1: Ethereum (ETH)

Ethereum’s 2015 launch reshaped blockchain forever. By introducing smart contracts, it transformed blockchain from a financial ledger into a platform for decentralized applications.

Approach: Ethereum raised ~$18 million in its ICO, focusing not on short-term price speculation but on cultivating a developer community.

Impact: Today, Ethereum powers 3,000+ dApps and dominates DeFi with $50B+ in TVL at its peak. Its ecosystem supports NFTs, DAOs, and Layer-2 networks.

Lesson: Real innovation, paired with strong timing, can sustain growth long after the initial hype.

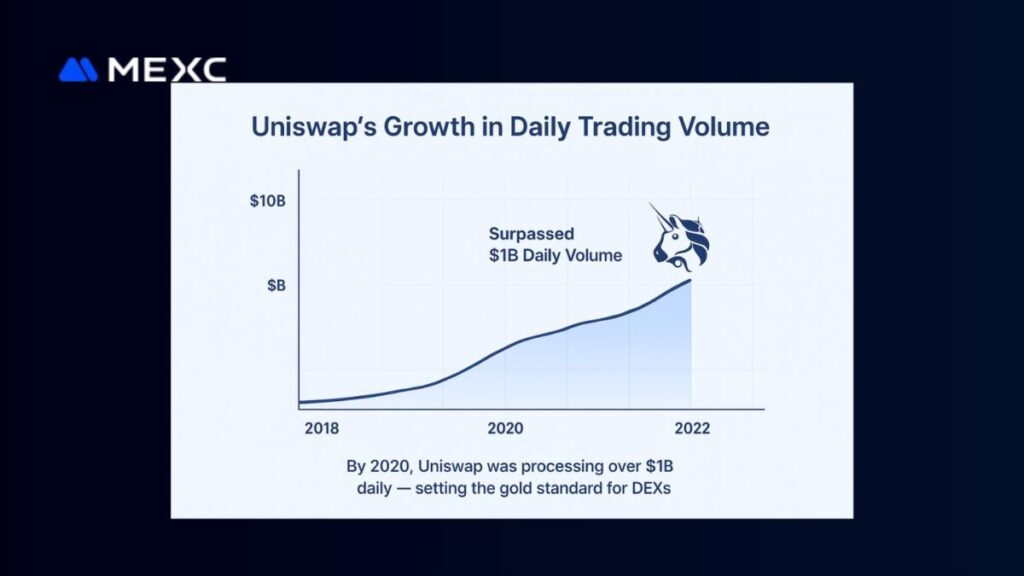

2.2 Uniswap: Building Liquidity for DeFi

Uniswap revolutionized decentralized trading when it launched in 2018 with the Automated Market Maker (AMM) model.

- Approach: Instead of relying on traditional order books, Uniswap created liquidity pools open to anyone. This allowed instant token swaps, democratized liquidity provision, and solved the liquidity problem haunting early DEXs.

- Impact: By 2020, Uniswap reached $1B in daily trading volume, rivaling centralized exchanges. The UNI token further empowered community governance.

- Lesson: Simplicity and accessibility can drive mass adoption and set industry standards.

2.3 Meme Tokens (Dogecoin, Shiba Inu, PEPE): Hype vs. Community

Not all hype-driven projects vanish immediately. Meme tokens like Dogecoin and Shiba Inu show the power of community-driven growth.

- Approach: With little technical innovation, these tokens built their value around culture, humor, and loyal communities.

- Impact: Dogecoin hit a market cap of $80B+ in 2021, while Shiba Inu grew into a multi-billion-dollar ecosystem. Yet, both face questions of long-term sustainability.

- Lesson: Community can keep a project alive, but without evolving utility, longevity remains uncertain.

Figure 4: A meme-style graphic showing hype-driven growth vs. utility-driven growth.

Suggested sites:

- Dogecoin Official

- Shiba Token

2.4. Case Study 4: Solana (SOL)

Solana positioned itself as the “Ethereum killer” in 2020 by offering 65,000 TPS and ultra-low fees.

- Approach: Solana’s narrative centered around scalability, making it attractive for NFTs, GameFi, and DeFi.

- Impact: Total NFT sales on Solana surpassed $5B, but repeated network outages raised concerns about stability.

- Lesson: Speed attracts adoption, but resilience ensures retention.

3.Core Principles of Long-Term Web3 Projects

3.1 Governance and Transparency

Protocols with decentralized governance, like DAOs, foster user trust and engagement.

3.2 Utility Beyond Speculation

Whether payments, cross-border settlements, or DeFi integrations, utility ensures relevance beyond short-term price cycles.

3.3 Resilience and Adaptability

Projects that adjust to regulations, market shifts, and technological challenges sustain growth.

4.Lessons for Builders and Investors

- Builders: Focus on solving real problems, not just token launches.

- Investors: Evaluate governance, community activity, and actual adoption before entering.

- Communities: Support ecosystems that bring tangible impact, not just viral memes.

5.Conclusion

The Web3 space rewards vision and execution over temporary noise. Ethereum and Uniswap show how solving real problems fosters resilience, while meme tokens reveal both the strength and fragility of community-driven hype. For the industry to mature, projects must move beyond speculative cycles toward building tools and systems that matter.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up