Summary

In the recent crypto market, Plasma (XPL) has undoubtedly emerged as one of the hottest new projects. On the one hand, it introduces a groundbreaking model of zero-fee stablecoin payments, breaking through the long-standing cost and efficiency barriers faced by traditional blockchains. On the other hand, the recent contract spike incident has thrown it into the spotlight. Driven by both technological innovation and market volatility, XPL has not only become a trending topic among investors but also a case study closely watched by industry analysts.

TL;DR

- Plasma (XPL) is a Layer 1 blockchain built for stablecoin payments, featuring zero-fee USDT transfers, sub-second finality, and Bitcoin-anchored security.

- Plasma One, its flagship app, combines payments, deposits, and cashback, while the native token XPL powers security, incentives, governance, and fee settlement.

- The Aster exchange contract spike incident highlighted exchange-level risk issues but ended with full USDT compensation for affected users.

- MEXC listed XPL in its Innovation Zone with instant swap and zero trading fees, boosting accessibility but also underscoring higher volatility risks.

1.What Is Plasma (XPL )?

Plasma is a Layer 1 blockchain purpose-built for stablecoin payments. Its standout features include:

- Zero-fee USDT transfers: Users can send stablecoins to Plasma without paying additional gas fees.

- Sub-second finality: Unlike Ethereum, which requires multiple confirmations, Plasma achieves near-instant transaction finality.

- Bitcoin-anchored security: The chain regularly checkpoints its state onto the Bitcoin network, ensuring immutability and tamper-proof history.

On the application layer, Plasma has launched Plasma One, a financial super-app combining payments, deposits, and cashback. Users can not only earn yield by depositing stablecoins but also receive cashback rewards through spending. The team’s ambitious roadmap aims to expand coverage to over 150 countries and regions.

The native token, XPL , powers the ecosystem by securing the network, incentivizing validators, enabling governance voting, and serving as the ultimate settlement medium for fees. With XPL, the Plasma economy forms a sustainable cycle of incentives and utility.

2. Plasma (XPL )Mechanism & Architecture

2.1 Consensus Layer: PlasmaBFT + PoS

Plasma employs PlasmaBFT, an enhanced variant of the Fast HotStuff Byzantine Fault Tolerance protocol. It enables high throughput and finalizes transactions in just seconds.

- Validators must stake XPL to participate in block production. Malicious behavior results in slashing.

- Regular users can earn rewards by delegating their XPL stake without running their own node.

2.2 Execution Layer: EVM Compatibility + Stablecoin Optimization

Plasma is fully EVM-compatible, allowing developers to seamlessly port Ethereum-based dApps and smart contracts. At the same time, it optimizes the network for stablecoin transfers by offering a zero-fee user experience. Stablecoins or selected tokens can be used to cover gas costs, with the protocol automatically settling fees in XPL.

2.3 Stablecoin Support & Cross-Chain Bridge

At its core, Plasma is designed to serve stablecoin liquidity. Users can bridge assets like USDT and USDC into Plasma via a cross-chain vault, enabling frictionless payments, lending, and trading within the ecosystem. Once stablecoins are on Plasma, they circulate seamlessly—free from high gas costs that plague other chains.

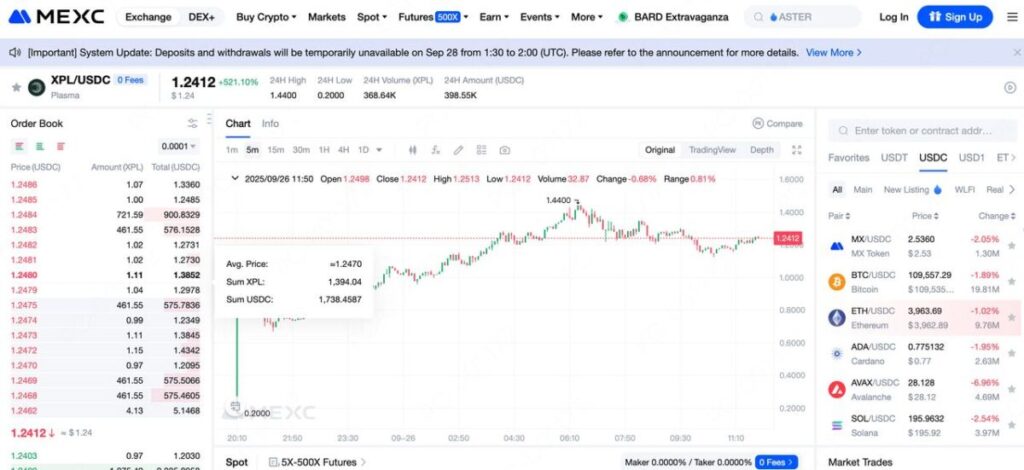

3.The Aster Contract Spike Incident: Mismanagement, Price Surge & Compensation

Just as XPL was gaining traction, a major incident occurred on September 26, when the Aster exchange’s XPL perpetual contracts experienced an extreme anomaly. Prices spiked suddenly to $4, while other trading platforms remained stable.

Analysis showed that this was not the result of a hack or vulnerability but rather a serious operational failure in Aster’s pricing and risk-control mechanisms. In response, Aster promptly issued a statement confirming that all affected users had been fully compensated in USDT, with funds directly credited back to their accounts.

While this compensation restored some confidence in the short term, the incident highlighted the fragility of exchange-level risk management. For XPL, it became a real-world stress test of its ecosystem’s ability to handle crises. If similar structural flaws persist, further disruptions may follow.

4. MEXC List Plasma (XPL) in Innovation Zone With Convert Feature

As XPL’s popularity surged, its exchange presence drew further attention. On September 25, 2025, MEXC announced the official listing of XPL in its Innovation Zone.

The listing included spot trading pairs and an instant swap feature, allowing seamless conversion between XPL and stablecoins (USDT, USDC) with zero slippage. To attract liquidity and trading volume, MEXC also offered zero trading fees for both XPL/USDT and XPL/USDC pairs during the launch phase.

This move not only boosted market accessibility but also provided early-stage price discovery. However, Innovation Zone assets are known for their higher volatility and risks, which investors should carefully consider.

5.Conclusion

The rapid rise of Plasma (XPL) reflects both investor enthusiasm for zero-fee stablecoin chains and the speculative dynamics that often fuel emerging crypto projects. Its advanced technical stack, compelling product design, and early exchange support position it as a promising financial infrastructure play.

At the same time, the Aster contract spike serves as a stark reminder that new projects come with inherent risks. While XPL’s short-term price action will likely remain driven by liquidity and sentiment, its long-term value will depend on the ecosystem’s ability to deliver real-world adoption, maintain robust mechanisms, and earn lasting market trust.

For investors, Plasma represents an emerging Layer 1 worth watching. But caution, patience, and a long-term perspective remain essential.

Join MEXC and Get up to $10,000 Bonus!

Sign Up