Executive Summary: Breaking the Fee Barrier to Unlock Scaled Liquidity

In 2025, MEXC significantly lowered trading barriers through its Zero-Fee strategy, cementing its leadership as the gateway to the industry’s lowest costs and widest asset selection.

The strategy employed a dual approach—balancing broad market coverage with sharp strategic focus across priority segments.

In the Spot market, MEXC embedded its Zero-Fee conviction across 3,026 trading pairs, delivering comprehensive coverage from mainstream to long-tail assets. In the Futures market, the strategy concentrated on 203 high-demand pairs to precisely capture periods of heightened market volatility.

By directly converting platform revenue into user value, the initiative saved 3.44 million users a total of 1.1 billion USDT in fees. The average user saved 320 USDT, with the top single-user saving reaching a remarkable 9 million USDT. This approach not only reduced entry barriers for retail investors but also maximized capital efficiency for whales.

Futures Market Deep Dive

Top 10 Zero-Fee Futures Trading Volumes: Mainstream Assets Dominate, Emerging Narratives Surge

During MEXC’s Zero-Fee strategy, the Top 10 Futures Trading Volumes revealed a distinct tiered landscape: core blue-chip assets maintained a commanding lead, while emerging public chains and narratives gained rapid traction, alongside sustained activity in classic Meme coins. This distribution perfectly reflects the platform’s ability to capture current capital flows and satisfy diverse trading appetites.

- BTCUSDT and ETHUSDT acted as undisputed market leaders. Together, they accounted for 70% of the Top 10 total volume, cementing their unshakeable status as the core of the market.

- SOLUSDT secured the third spot, firmly establishing itself as the third major trading asset.

- SUIUSDT, as a standout for emerging public chains, ranked fourth. It significantly outperformed many established assets, demonstrating robust growth momentum.

- DOGEUSDT, “The Genesis of Meme Coins,” ranked fifth, highlighting its enduring market consensus across both bull and bear cycles.

The latter half of the list displayed clear diversification:

- Established public chains like BNBUSDT, XRPUSDT, and ADAUSDT continued to demonstrate strong capital attraction.

- New-narrative assets performed notably well, with Perp DEX representative ASTERUSDT and privacy coin ZECUSDT ranking ninth and tenth, respectively.

The Zero-Fee strategy proved to be a powerful catalyst for high-volatility and new-narrative assets, effectively fueling capital inflows into trending sectors and high-frequency opportunities.

Overall, the Top 10 rankings are anchored by mainstream chains, while emerging hotspots continue to fuel momentum. This structure aligns perfectly with the current “dual-track” market pattern. Through the Zero-Fee strategy, MEXC not only significantly boosted overall platform volume but also successfully amplified activity across multiple sectors, satisfying both the demand for mainstream allocation and the appetite for new narrative speculation.

Top 10 Zero-Fee Futures by Growth: Driving Liquidity in USDC Pairs, New and Established Assets Rally

Among the Top 10 futures trading pairs by growth rate, 9 were USDC-denominated pairs.

- BNBUSDC led the pack with a staggering 110-fold (11,074%) surge.

- SUIUSDC followed with an 83-fold increase.

- Major assets like JUPUSDC (42x), ADAUSDC (28x), and SOLUSDC (23x) also secured spots in the top five.

This underscores how the Zero-Fee strategy effectively unlocked liquidity for popular tokens and USDC pairs, establishing a distinct competitive edge in market depth for the platform. Furthermore, the initiative reignited trading interest in established assets. The presence of ADA, AVAX, LINK, HBAR, and CRV in the top ten highlights a broad resurgence across legacy Layer 1s, Oracles, and DeFi blue chip projects.

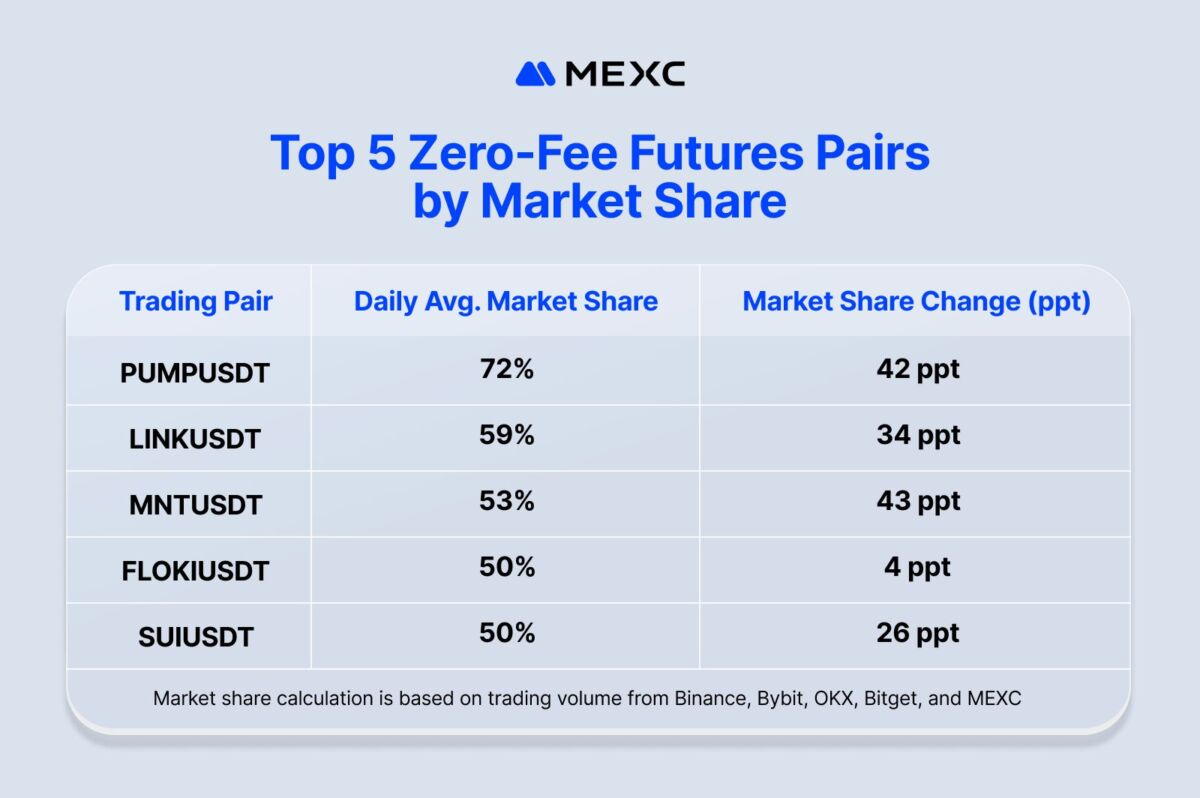

Zero-Fee Market Share Dynamics: Emerging Assets Surge, Core Advantages Solidify

MEXC’s Zero-Fee strategy successfully bootstrapped emerging assets, driving a rapid increase in their market share. Simultaneously, it consolidated the dominance of core blue-chip assets, deepening the platform’s liquidity moat.

During the Zero-Fee period, market dominance for top assets remained robust:

- PUMPUSDT peaked at 72% market share.

- LINKUSDT reached 59%, MNTUSDT53%, with SUI and FLOKI both hitting 50%.

- Mainstream assets like SOL (43%), the Meme OG DOGE (42%), and DeFi blue-chip UNI (41%) all sustained shares above 40%.

This demonstrates that Zero-Fee is not merely a short-term marketing tactic, but a strategic cornerstone for building long-term liquidity advantages.

Regarding market share growth:

- MNTUSDT led the charge with a net increase of 43%.

- PUMP, the flagship of the Meme Coins narrative, followed closely with a 42% increase.

- Established asset LINKUSDT also saw a 34% share surge.

This demonstrates that Zero-Fee is more than a tactic. It reduces cost friction for high-frequency trading, becoming a key driver for bootstrapping new tokens. Acting as a powerful “liquidity lever,” it enables new assets to scale rapidly while unlocking the trading potential of mature assets for a phase of renewed growth.

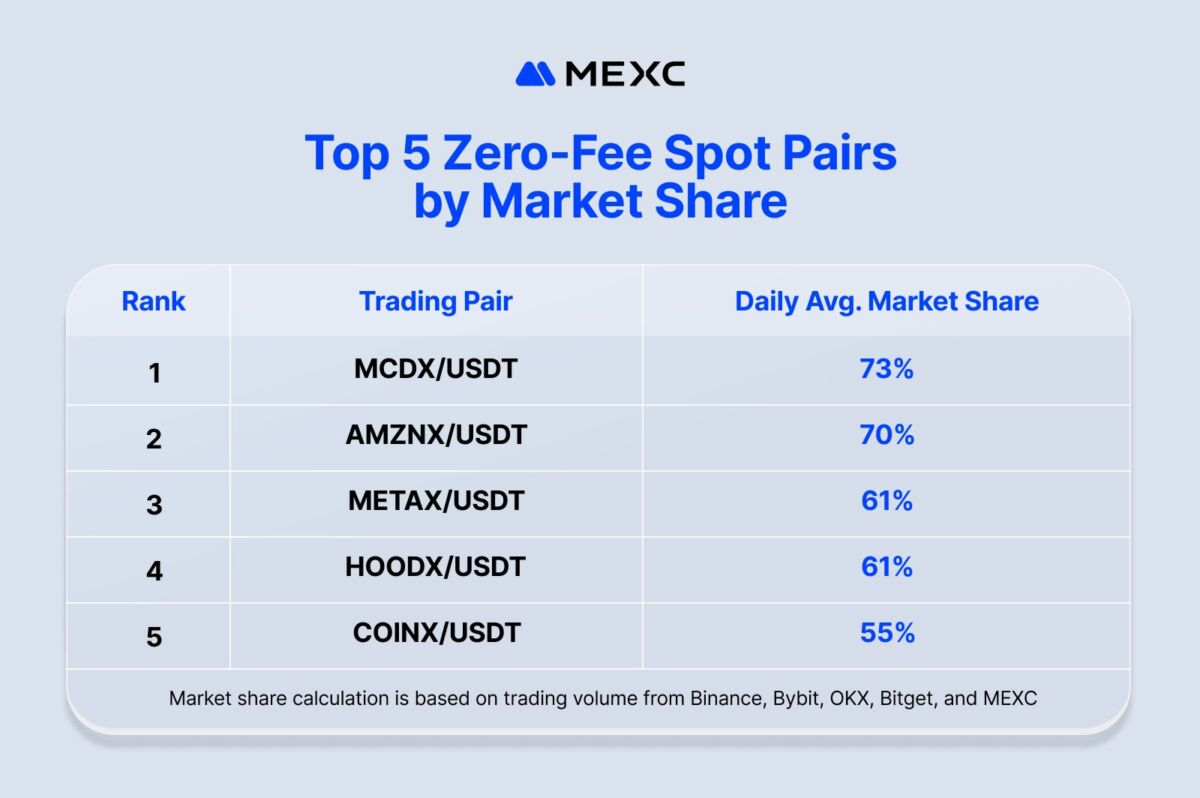

Spot Market Deep Dive

MEXC’s Zero-Fee strategy successfully capitalized on the year’s defining narrative: Tokenized US Stocks, a type of Real World Asset (RWA), effectively capturing surging trading demand.

- MCDX/USDT (McDonald’s) dominated the sector with a 73% daily average market share.

- AMZNX/USDT (Amazon) and METAX/USDT (Meta) followed with 70% and 61% respectively, satisfying user demand for FAANG assets.

- HOODX/USDT (Robinhood) and COINX/USDT (Coinbase) reached 61% and 55%. The presence of these two crypto-friendly brokerage stocks in the top five highlights the strong crossover interest between crypto users and the US equity market.

The Zero-Fee strategy aligned perfectly with users’ diversified investment needs, significantly boosting activity in non-crypto native assets. Since December 22, 2025, MEXC has fully expanded the Zero-Fee strategy to cover all Spot Trading pairs. This move further lowered barriers to entry, delivering a more efficient and accessible trading experience for all users.

Conclusion

In 2025, MEXC leveraged the Zero-Fee strategy, not only validating the robust vitality of the ‘Low Cost, High Liquidity’ flywheel but also laying a solid market foundation for the platform.

By consolidating liquidity in mainstream assets and capitalizing on emerging narratives, MEXC has built a competitive moat centered on optimal trading experience. Moving forward, MEXC remains committed to a “User First” philosophy, deeply integrating Zero-Fee strategy with product innovation. MEXC aims to build the premier crypto gateway defined by “MEXCmize, Zero-Fee, Infinite Opportunities,” empowering global users to capture market opportunities and maximize asset value.

Join MEXC and Get up to $10,000 Bonus!

Sign Up